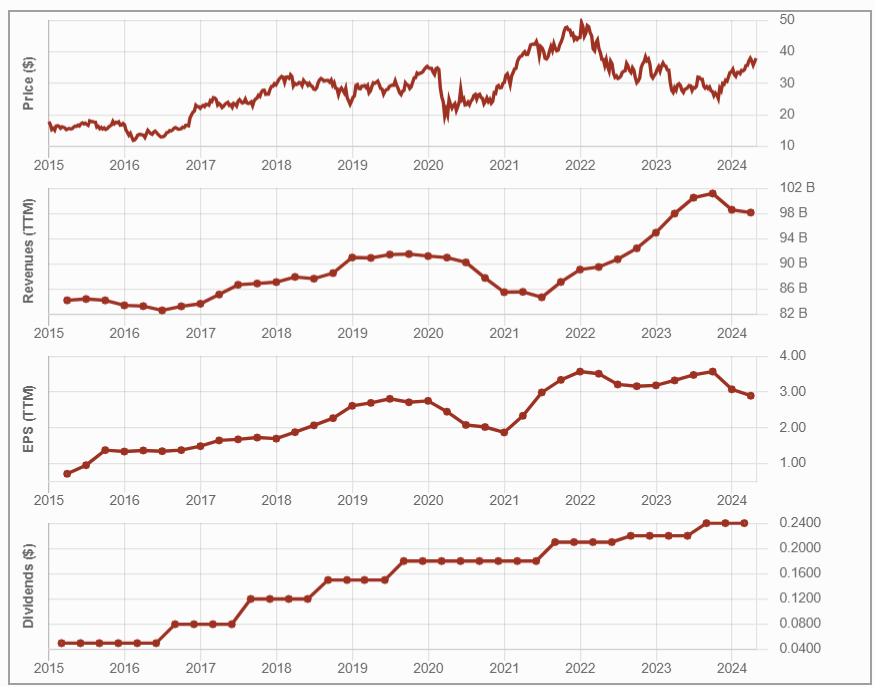

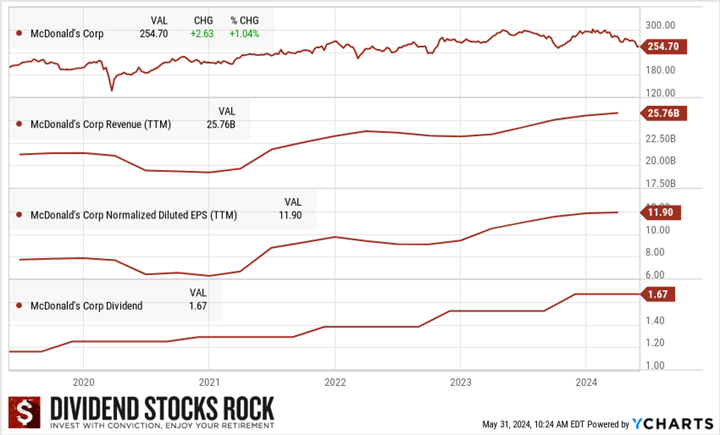

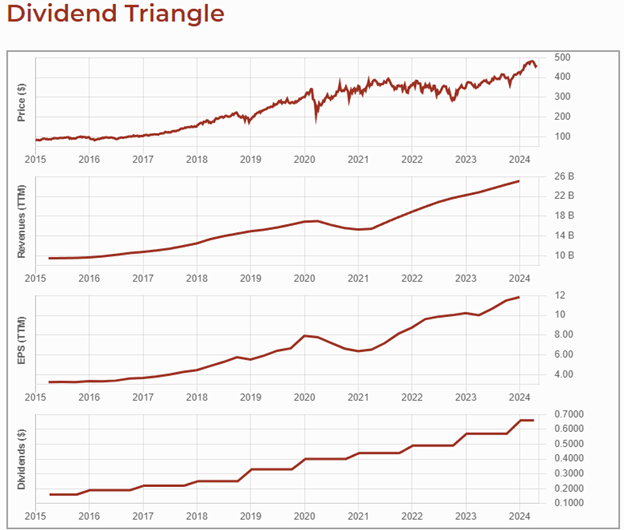

New on my buy list for June 2024 is McDonald’s (MCD). It matches my investment strategy perfectly, including a strong dividend triangle showing robust growth trends for revenue, earnings, and dividends. I see MCD as a core holding. Missed our stock pick for May? Read all about it here.

Build a robust portfolio that generates income for life. Download our guide now!

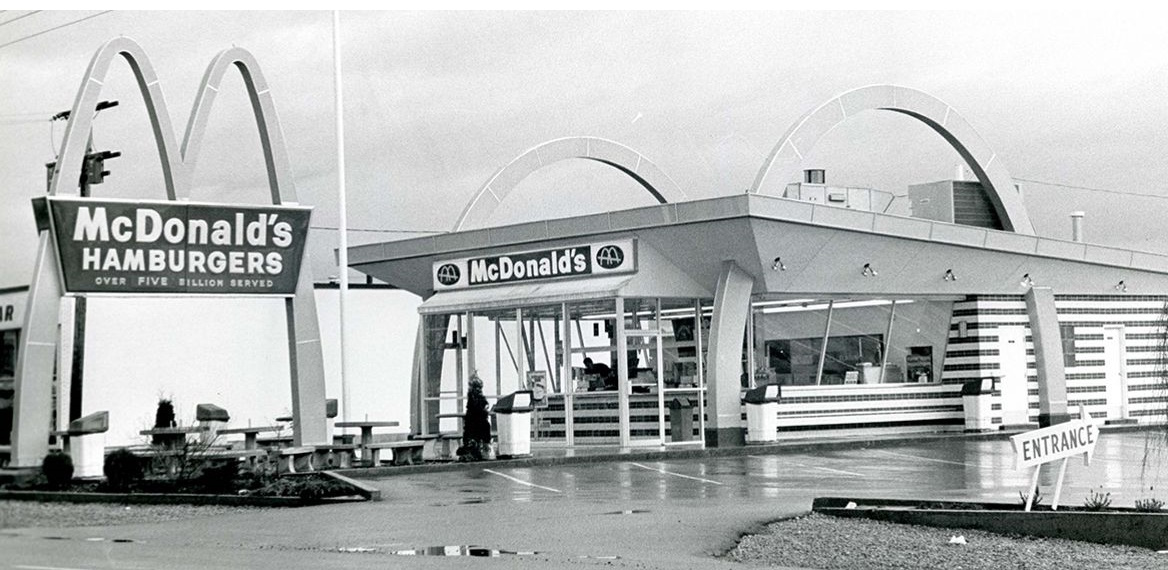

McDonald’s Business Model

McDonald’s is a food service retailer with over 40,000 locations in over 100 countries. The Company’s segment includes United States, International Operated Markets, and International Developmental Licensed Markets & Corporate.

The International Operated Markets segment operates and franchises restaurants, in markets including Australia, Canada, France, Germany, Italy, Poland, Spain, and the United Kingdom. This segment is over 89% franchised.

The International Developmental Licensed Markets & Corporate segment consists of developmental licensee and affiliate markets in the McDonald’s system. This segment is about 98% franchised. Its menu features hamburgers and cheeseburgers, the Big Mac, the Quarter Pounder with Cheese, the Filet-O-Fish, and several chicken sandwiches like the McChicken, McCrispy and McSpicy.

Approximately 95% of McDonald’s restaurants worldwide are owned and operated by independent local business owners.

MCD Investment Thesis

After seeking ways to generate additional growth for many years, and failing on many attempts, MCD’s CEO finally found a way to succeed. Through a major re-franchising of over 4,000 locations, MCD was able to improve its business model. It increased its earnings, reduced volatility, and won the market’s favor once again.

MCD enjoys strong brand recognition and is the world’s largest fast-food retailer. MCD is attentive to its customers and has made many changes to its menu over the years, adding all-day breakfast and healthier options. Their loyalty program has reached over 50 million customers in top operating markets. The company opened 2000 new restaurants in 2023.

McDonald’s puts a lot of effort into its “Accelerating the Arches 2.0” plan built around four D’s: delivery, digital, drive-through, and development. With more drive-throughs and remodeled restaurants, McDonald’s is well-positioned to take advantage of evolving digital ordering habits. Finally, recent initiatives in mobile ordering and delivery could bode well for continued growth in digital traction, along with consumers trading down from more costly alternatives.

For 2024, MCD expects to open about 2,100 restaurants globally, resulting in a 1,600 net restaurant growth for the year. MCD also expects a free cash flow conversion rate of around 90%. Operating margin is expected to land in the mid-to-high 40% range.

MCD Last Quarter and Recent Activities

McDonald’s reported an “okay” first quarter 2024 with revenue up 5%, but EPS only up by 3%. Revenue growth was driven by solid performance across the U.S. and International Operated Markets (IOM) segments, despite challenging macroeconomic conditions. The continued impact of the war in the Middle East more than offset positive comparable sales in Japan, Latin America, and Europe. Comparable sales in the U.S., up 2.5%, benefited from average check growth driven by strategic menu price increases. The company expects continued moderation in top-line growth due to consumer pressures and a challenging economic landscape.

Potential Risks for McDonald’s

The reduced purchasing power and potential loss of disposable income from customers could bring some choppy quarters. Franchisees are seeking support and MCD will require additional liquidity to provide for its restaurants as the economy stabilizes. Some franchisees may not survive further economic slowdowns, and MCD will continue to face labor shortages and wage inflation, especially in the US.

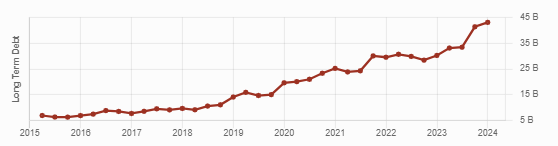

All fast-food chains compete for the same customers’ dollars. MCD’s debt has decreased but is still significant at $39B with more investments coming. While we await interest cuts, MCD should make a concerted effort to pay down debts.

Build a robust portfolio that generates income for life. Download our guide now!

MCD Dividend Growth Perspective

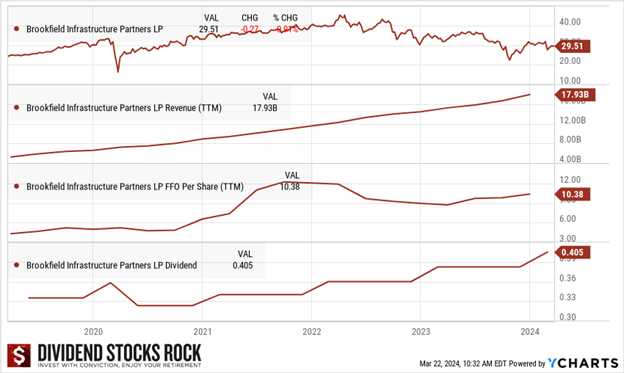

MCD has increased its dividend every year since 1977. The company has grown both its cash flow from operations and free cash flow over the past 10 years. Through its re-franchising process, the restaurant chain improved its earnings and shows a payout ratio that is well under control.

The company enjoys financial flexibility, but the dividend growth policy could slow down as the company’s payout ratio continues to rise. In 2020 the dividend increase was only 3%, followed by a more generous 6.98% in 2021. Thanks to stronger numbers, MCD increased its payout by 10% in 2022 and by another 10% in 2023!

Final Thoughts on McDonald’s

There are many compelling reasons to see McDonald’s (MCD) as a good investment. Its global brand recognition and presence in over 100 countries, ensures a steady revenue stream. Its business model, combining company-owned and franchised restaurants, provides stability and growth potential, and transfers some of the risk to franchisees.

McDonald’s resilience through economic cycles, adaptation to consumer preferences, and embrace of technology, such as digital ordering and delivery services, enhance its appeal. Additionally, its strong dividend history and commitment to returning value to shareholders make it an attractive choice for long-term investors seeking both growth and income.

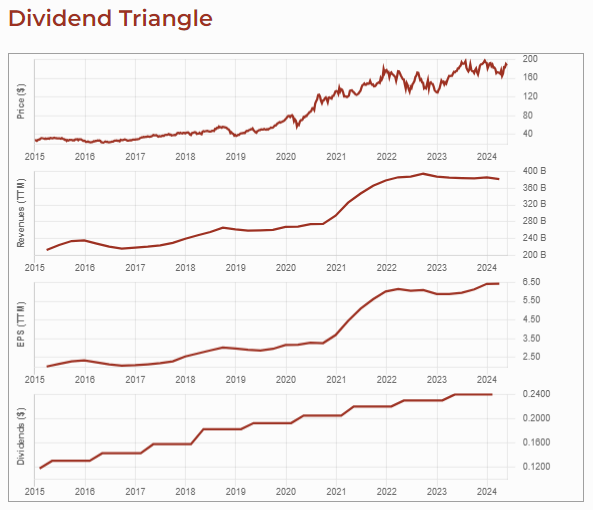

Microsoft’s suite of products (Windows OS, Office) is deeply embedded in individual and corporate workflows. Imagine a corporation wanting to move away from Microsoft products…the training, the lost productivity during and after the switch, and employee resistance to change are all costly!

Microsoft’s suite of products (Windows OS, Office) is deeply embedded in individual and corporate workflows. Imagine a corporation wanting to move away from Microsoft products…the training, the lost productivity during and after the switch, and employee resistance to change are all costly!

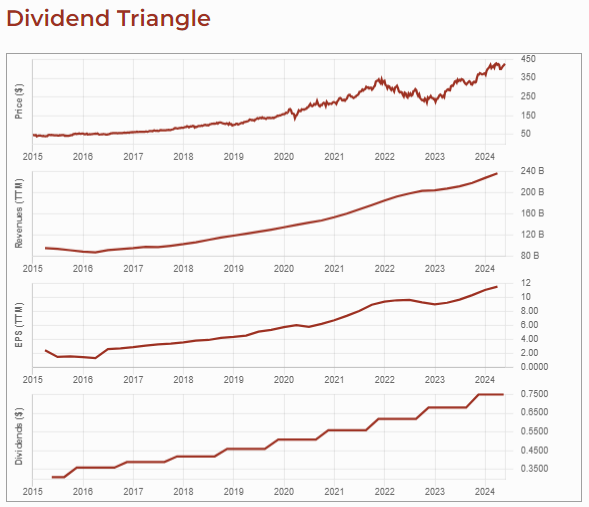

This ensures NNN has a higher occupancy rate than the industry standard, currently above 99%! While the brick-and-mortar retail store environment is rapidly shifting toward online businesses, NNN is one of the retail REITs that won’t be affected.

This ensures NNN has a higher occupancy rate than the industry standard, currently above 99%! While the brick-and-mortar retail store environment is rapidly shifting toward online businesses, NNN is one of the retail REITs that won’t be affected.

NNN made sure to stay away from businesses that would suffer the most from online competition; books, consumer electronics, and office supplies each represent less than 2% of its business, and NNN has virtually no apparel-oriented tenants. The risk of oversupply of retail real estate is becoming less likely since new developments should slow down in this high-interest rate environment. Expect more conservative FFO growth moving forward.

NNN made sure to stay away from businesses that would suffer the most from online competition; books, consumer electronics, and office supplies each represent less than 2% of its business, and NNN has virtually no apparel-oriented tenants. The risk of oversupply of retail real estate is becoming less likely since new developments should slow down in this high-interest rate environment. Expect more conservative FFO growth moving forward.

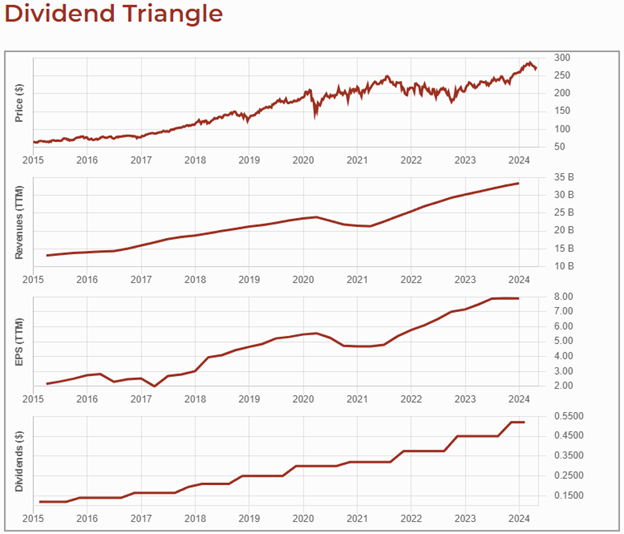

BIP provided extra information on its debt structure in its Q4 2023 presentation in February 2024. BIP has a credit rating of S&P 500 BBB+ with an average debt term maturity of 7 years. The company has $2.8B in liquidity and only 5% of Brookfield Infrastructure’s debt is up for renewal over the next 12 months.

BIP provided extra information on its debt structure in its Q4 2023 presentation in February 2024. BIP has a credit rating of S&P 500 BBB+ with an average debt term maturity of 7 years. The company has $2.8B in liquidity and only 5% of Brookfield Infrastructure’s debt is up for renewal over the next 12 months.