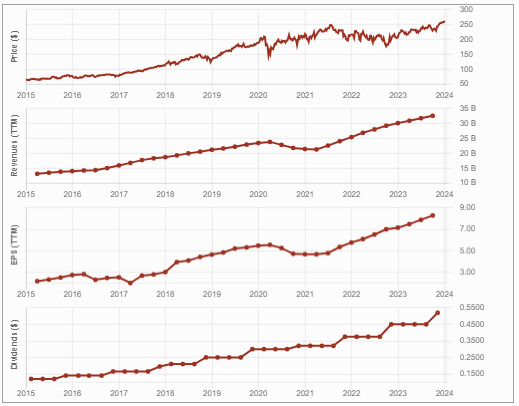

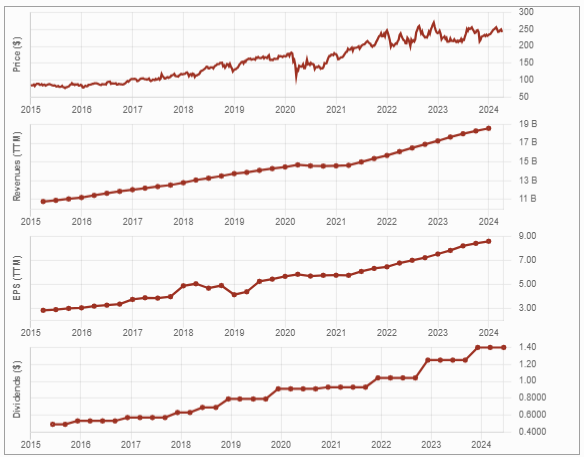

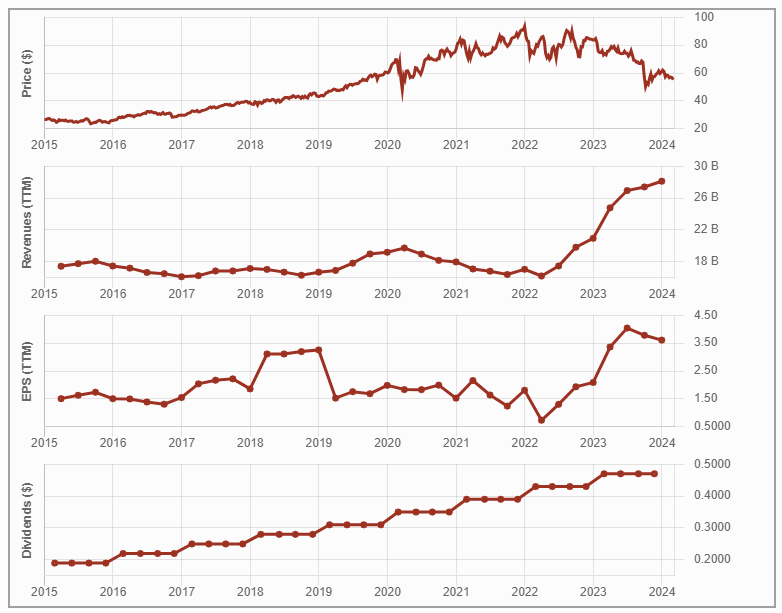

A new buy list stock for March 2024 is Automatic Data Processing (ADP). I added ADP to my buy list because of its marvelous dividend triangle; everything goes up quarter after quarter, yet the stock price isn’t following the pace. I see an interesting entry point. While you’ll have to accept paying a P/E above 25 for this “deal”, the stock is trading well below its 5-year P/E average of 31.27.

Get great stock ideas from our Rock Stars list! It’s updated monthly.

Automatic Data Processing (ADP) Business Model

Automatic Data Processing, Inc. (ADP) is a global technology company. It provides cloud-based human capital management (HCM) solutions that unite HR, payroll, talent, time, and tax and benefits administration. Its segments include:

- Employer Services, which serves clients ranging from single-employee small businesses to large enterprises employing tens of thousands of employees around the world. Its technology-based HCM solutions, including its cloud-based platforms, and human resource outsourcing (HRO) solutions, offer Payroll Services, Benefits Administration, Talent Management, HR Management, Workforce Management, Compliance Services, Insurance Services, and Retirement Services.

- Professional Employer Organization (PEO), called ADP TotalSource, provides clients with employment administration outsourcing solutions. ADP serves over one million clients in 140 countries and territories.

ADP Investment Thesis

Automatic Data Processing is the largest US-based payroll provider. It enjoys strong cross-selling opportunities from its 990,000 customers and multiple HR-related products. As customers use a wider assortment of ADP services, it becomes more difficult and expensive for them to switch to competitors’ services. ADP’s customer lifetime is estimated to exceed 10 years. Each time a new employee is hired by ADP’s customers, ADP profits.

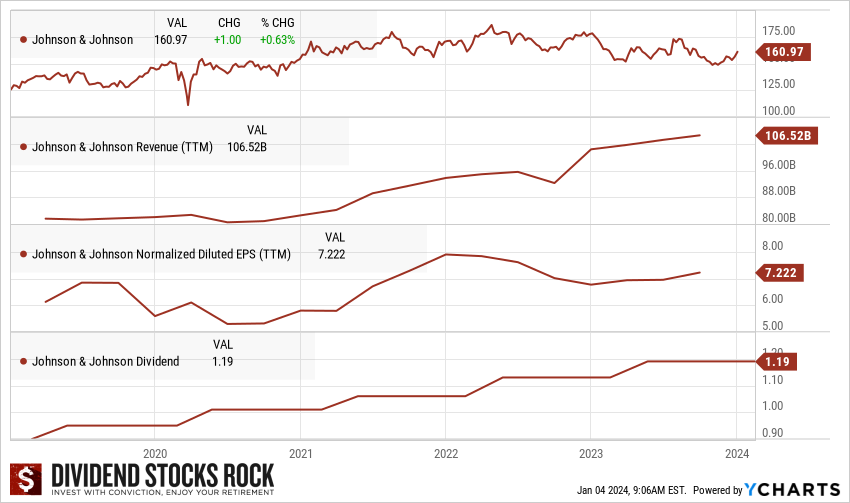

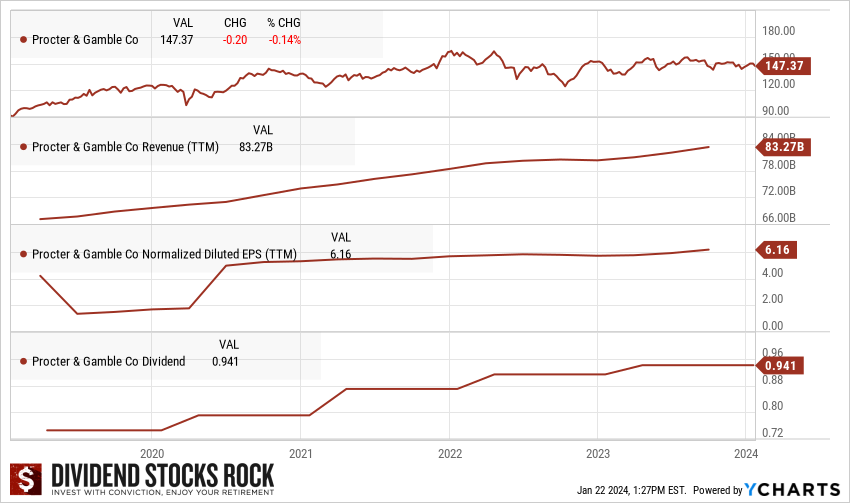

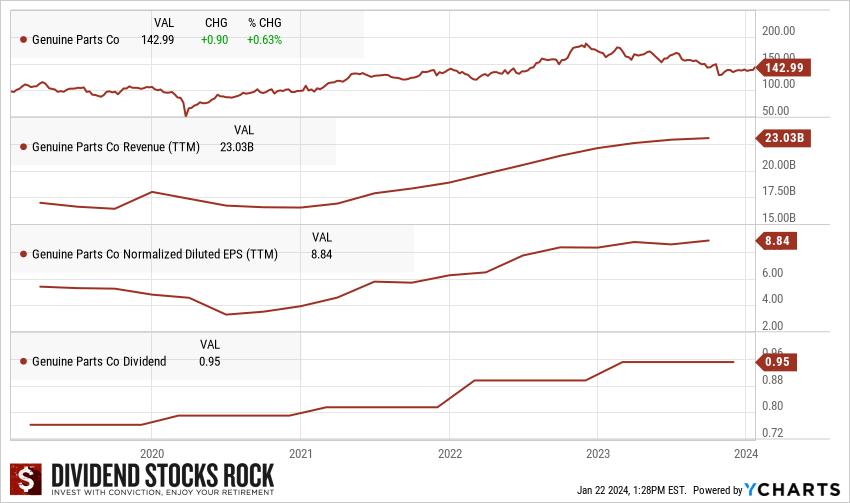

ADP exhibits an impressive dividend growth history, with 48 consecutive years with an increase (since 1975). Tight labor markets have worked in ADP’s favor, leading to improved financial performance, with a rebound in new bookings and pays-per-control. ADP’s recent efforts to increase investment in existing platforms and sales capacity should help boost growth. Unfortunately, there’s a high price to pay for a quality stock.

ADP Last Quarter and Recent Activities

ADP reported another quarter of record bookings and strong retention resulting in revenue and earnings growth. Revenue was up 6% and EPS 9%, beating analysts’ expectations. Employer Services revenue grew by 8% and PEO Services revenue by 3%. Management reaffirmed its guidance for 2024: revenue growth to be between 6% and 7% and adjusted EPS should be up by 10% to 12%.

See the monster growth of this month’s Canadian buy list stock pick.

Potential Risks for Automatic Data Processing

While many labor regulations enabled ADP to win customers and increase both its revenues and earnings, much of the benefit from these has long been realized. ADP is highly dependent on the U.S. workforce. Since ADP earns its revenue based on the number of paychecks it processes, a recession harms its business, even if it manages to keep all its customers.

With the increasing number of cloud-based and software-as-a-service (SAAS) providers, the traditional pay services becoming commodified by new competitors, and midsize businesses looking to pay less to issue salary payments, customers might move towards less costly solutions.

The stock seems to be overvalued based on the DDM calculations and the forward PE (27) valuation method. There is a price to pay for quality…

Want more stock ideas? Get out Rock Stars list…updated monthly.

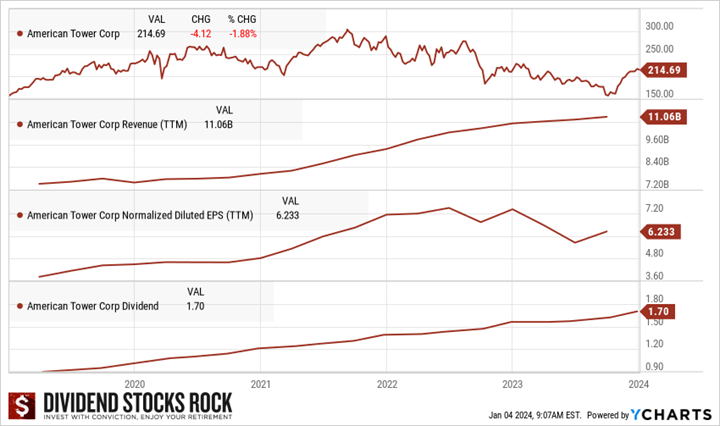

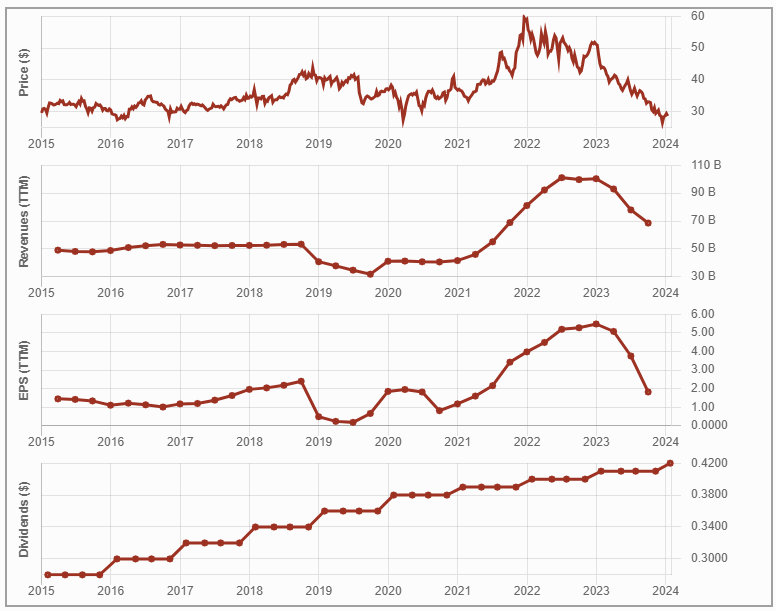

ADP Dividend Growth Perspective

ADP increased its dividend payout every year since 1975. The company maintained a strong dividend growth policy over the past 5 years, which we can expect to continue going forward. The stock isn’t cheap, but management does all it can to offer a yield of approximately 2%.

ADP provides a good combination of dividend growth and decent yield. Both payout and cash payout ratios are under control. In 2021, ADP increased its dividend by an impressive 12%! Management did it again with a 20% increase in 2022. The dividend triangle is becoming increasingly stronger with another generous dividend increase in 2023 of 12%!

Final Thoughts on ADP

Despite pretty resilient economies in North America, potential economic headwinds could put a damper on things. That being said, ADP could still be a very good play for growth in the industrial sector.

FPL segment is a rate-regulated electric utility that generates, transmits, distributes, and sells electricity in Florida. It has approximately 33,276 megawatts (MW) of net generating capacity, approximately 90,000 circuit miles of transmission and distribution lines, and 883 substations.

FPL segment is a rate-regulated electric utility that generates, transmits, distributes, and sells electricity in Florida. It has approximately 33,276 megawatts (MW) of net generating capacity, approximately 90,000 circuit miles of transmission and distribution lines, and 883 substations.

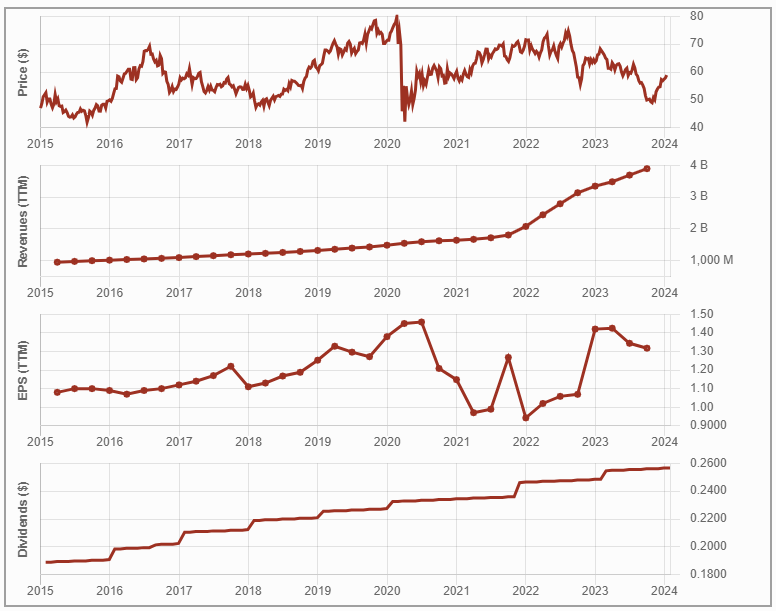

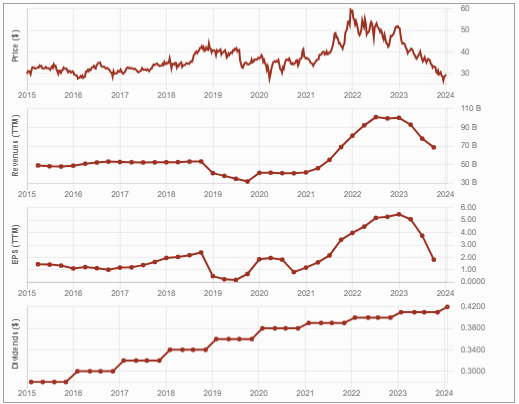

A holding company, American Tower Corporation runs a real estate investment trust (REIT) that owns, operates, and develops multitenant communications real estate. It has property segments for the U.S. & Canada, Asia-Pacific, Africa, Europe, and Latin America, as well as segments for Data Centers and Services. Its primary business is leasing space on multitenant communications sites to wireless service providers, radio and television broadcast companies, wireless data providers, government agencies and municipalities and tenants in other industries.

A holding company, American Tower Corporation runs a real estate investment trust (REIT) that owns, operates, and develops multitenant communications real estate. It has property segments for the U.S. & Canada, Asia-Pacific, Africa, Europe, and Latin America, as well as segments for Data Centers and Services. Its primary business is leasing space on multitenant communications sites to wireless service providers, radio and television broadcast companies, wireless data providers, government agencies and municipalities and tenants in other industries. The CoreSite acquisition was a bit surprising since it’s outside AMT’s core business. Still, it’s an interesting growth vector to pursue as demand remains robust for data centers. In April, AMT saw accelerated organic growth in tenant billings and another record quarter of new business signed at CoreSite.

The CoreSite acquisition was a bit surprising since it’s outside AMT’s core business. Still, it’s an interesting growth vector to pursue as demand remains robust for data centers. In April, AMT saw accelerated organic growth in tenant billings and another record quarter of new business signed at CoreSite.