Are you about to retire and you are worried about losing money in this crazy market? The best retirement stocks often rhyme with a good yield and price stability. Unfortunately, the stock market is highly volatile and could crush even the best retirement stocks. You shouldn’t be losing money at retirement. You should be receiving income from the best retirement companies.

When building a solid retirement portfolio, retirees or soon-to-be retirees are seek steady income and value stability. Some retirees will balance the scale more towards income and will tend to pick high-yielding stocks, which might bring some inherent risk. At Dividend Stocks Rock (DSR) we tend to favor companies with a 4-5% dividend yield and decent dividend growth that at least beats inflation. In some rare instances, you will find retirement stocks with more than 6% dividend growth rate that will not only keep up with inflation, but increase your paycheck every year.

In this section, we will give you a sneak peek of some of the companies we analyze at DSR and how they fit our retirement model portfolios. These companies are some of the best quality players in their markets. They show not only a strong dividend growth track record but a great potential to maintain that generosity with shareholders.

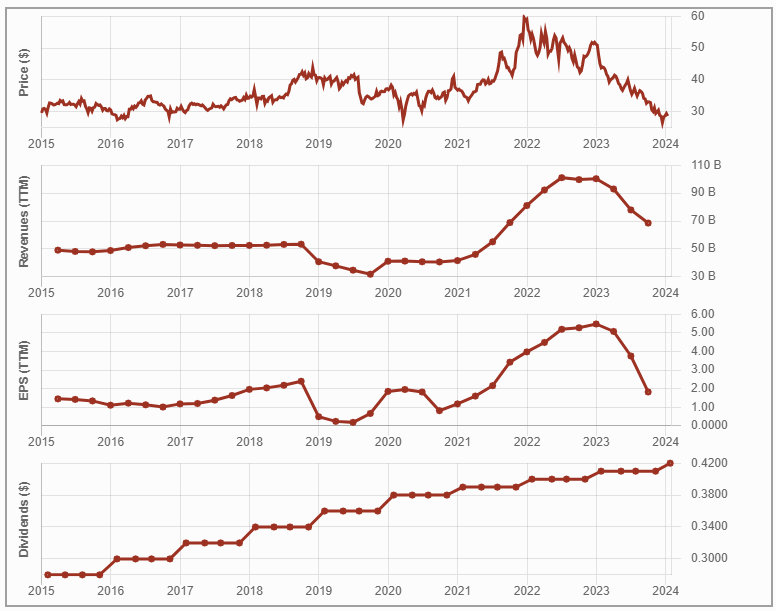

Pfizer

- Market Cap: $155B

- Yield: 6.12%

- Revenue growth (5yr, annualized): 13.81%

- EPS growth rate (5yr, annualized): 9.22%

- Dividend growth rate (5yr, annualized): 4.56%

Pfizer Inc. is a research-based biopharmaceutical company that develops, manufactures, markets, sells and distributes biopharmaceutical products around the world. It operates through two segments: Biopharma and PC1. Biopharma is engaged in the science-based biopharmaceutical business. PC1 is its global contract development and manufacturing organization and supplier of specialty active pharmaceutical ingredients. The Company’s primary care products include Eliquis, Nurtec ODT/Vydura and the Premarin family; the Prevnar family, Nimenrix, FSME/IMMUN-TicoVac and Trumenba; Comirnaty, and Paxlovid. It has specialty care products that include Xeljanz, Enbrel (outside the United States and Canada), the Vyndaqel family, Sulperazon, Medrol, Zavicefta, Zithromax, etc. Its oncology products include Ibrance, Xtandi, Inlyta, Retacrit, Lorbrena and Braftovi.

Why we like it

PFE faces a heavy patent expiration cycle, but has built an impressive lineup of new drugs. The 2019 acquisition of Array (ARRY), a $11.4B deal, adds several solid marketed drugs with a focus on oncology and rare diseases. Thanks to its size and scale, PFE can develop and produce drugs more cheaply than many of its competitors. We see ongoing growth catalysts from a number of different areas, including cardiology, immunology, and oncology. PFE divested its off-patent division at the end of 2020 (it became Viatris) to drive additional cash flow toward drug development and potential acquisition. That’s what they did in 2023 with the announcement of the acquisition of cancer-focused big pharma Seagen for $43B. Pfizer believes Seagen could contribute more than $10B in revenues by 2030, with potential significant growth beyond 2030. The transaction is expected to close at the end of this year or in early 2024.

Pfizer has not been getting a lot of love from the market since sales of Covid-related products have dwindled and the announcement of the Seagen acquisition. The stock price has been falling ever since. This well-established company with 13 consecutive years of dividend increases, has a 5-year average dividend yield of 4%. With the stock price decline, the yield has climbed to over 6%! A good stock for a retirement portfolio pretty much all the time, and a particularly interesting play in the healthcare industry now, considering Pfizer’s historic business model and drug pipeline.

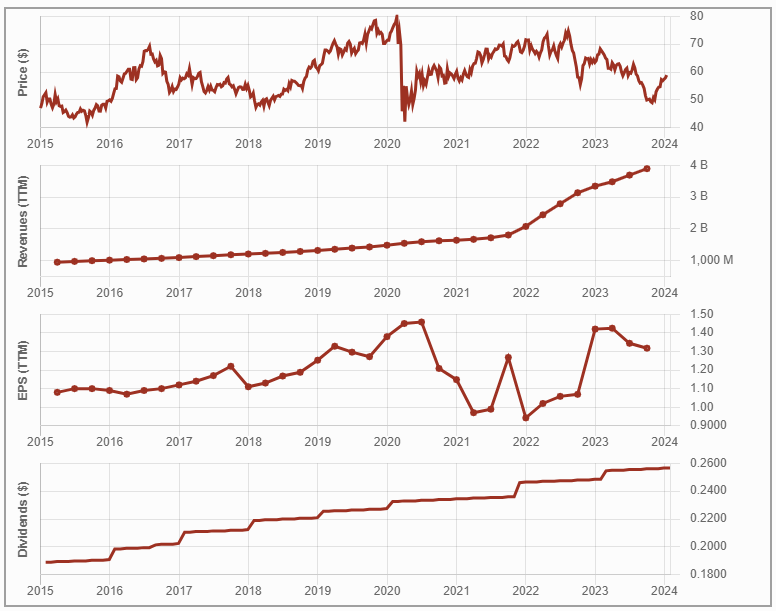

Realty Income (O)

- Market Cap: $46B

- Yield: 5.55%

- Revenue growth (5yr, annualized): 22.43%

- EPS growth rate (5yr, annualized): 5.24%

- Dividend growth rate (5yr, annualized): 3.19%

Realty Income Corporation is a real estate investment trust. The Company is acquiring and managing single-unit freestanding commercial properties under a long-term net lease agreement with its commercial clients. The Company owns and operates a diversified portfolio of over 13,250 commercial properties. The Company’s properties are leased to over 1,300 clients who operate in approximately 85 separate industries throughout all 50 states, as well as Puerto Rico, the United Kingdom, Spain, Italy, and Ireland. Its properties are leased to retail and industrial clients with a service, non-discretionary and/or low-price-point component to their business. The Company’s property types include retail, gaming, industrial, and other types, such as agriculture and office. The Company’s top five industries include grocery stores, convenience stores, dollar stores, drug stores and home improvement.

Why we like it

After another year of revenue growth that also saw another dividend increase, Realty Income is remains one of the best retirement stocks. The largest net lease REIT in the US, O is highly diversified and enjoys a regular stream of cash flow (about 50%) from investment-grade customers. As most of its leases are for terms of 15 years, O enjoys predictable, recurring income year after year. The company deserves to stay in a dividend income investor’s portfolio, not only because it has paid dividends for almost five decades, but also because it has a steady cash flow stream from diversified properties and quality tenants, maintaining high occupancy levels that have never dropped below 96% (98.8% at the end of Q3 2023).

O should be insulated from retail/brick-and-mortar concerns as most of their tenants are non-discretionary or service oriented. We also think O’s resiliency to a slowdown in consumer spending (possible given current high inflation, rising interest rates, and geopolitical risks) is underestimated by investors. You can consider Realty Income a deluxe bond; you might not get much capital appreciation, but steady dividend income.

Dodge market crashes with these Retirement Stocks

I compile a list of stocks expected to do better than the market for Dividend Stocks Rock members each year. This year, I’ve reviewed the 11 sectors for them and included top picks for each. I’ve decided to share three of them with you: Consumer Discretionary, Financial Services, and Industrials.

You can download 6 of my top 24 for 2024 right here:

Leave a Reply