Summary

Procter and Gamble (PG) is a worldwide consumer products company, and one of the largest companies in the world. The company has grown its dividend for 55 consecutive years.

-Revenue Growth: 8.2%

-Income Growth: 13%

-Cash Flow Growth: 13%

-Dividend Growth: 11%

-Dividend Yield: 3.25%

Overall, I find PG to be fairly valued at the current price. The company has long-term goals that should provide shareholders with substantial long-term rates of return, but the current price leaves little margin of safety.

Overview

Founded in 1837, Procter and Gamble (symbol: PG) is now one of the largest companies in the world. They sell their products in over 180 countries and currently have a market capitalization of $180 billion.

Business Segments

PG is divided into three business units:

Beauty and Grooming

In this unit, PG holds brands such as Gillette, Olay, Pantene, Head and Shoulders, and more. Beauty and Grooming accounts for 34% of total 2010 company sales.

Health and Well-being

In this unit, PG holds brands such as Always, Crest, Oral B, Scope, Tampax, Pepto Bismol, Iams, and more. Health and Well-being accounts for 18% of total 2010 company sales.

Household Care

In this unit, PG holds brands such as Tide, Swiffer, Puffs, Pampers, Mr. Clean, Downy, Febreeze, Gain, Duracell, Dawn, Downy, Bounty, Bounce, and more. Household Care accounts for 48% of total 2010 company sales.

Geographic Distribution of Total Company Sales

North America: 42%

Western Europe: 21%

Asia: 15%

Eastern Europe, Africa, Middle East: 13%

Latin America: 9%

Revenue, Income, Cash Flow, and Metrics

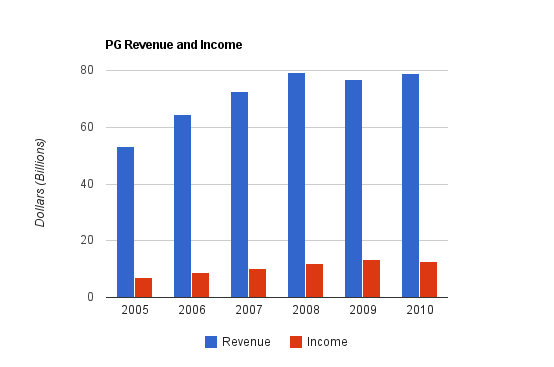

Procter and Gamble has been adept at growing despite its massive size, but the numbers during the last few years have been flat due to economic difficulties and period of divestitures and streamlining.

Revenue Growth

| Year | Revenue |

|---|---|

| 2010 | $78.938 billion |

| 2009 | $76.694 billion |

| 2008 | $79.257 billion |

| 2007 | $72.441 billion |

| 2006 | $64.416 billion |

| 2005 | $53.210 billion |

This represents an average annual revenue growth rate of about 8.2% over the last five years. This is strong growth for a large company.

Income Growth

| Year | Total Income | Income from Cont. Op. |

|---|---|---|

| 2010 | $12.736 billion | $10.946 billion |

| 2009 | $13.436 billion | $10.680 billion |

| 2008 | $12.075 billion | $11.291 billion |

| 2007 | $10.340 billion | $9.662 billion |

| 2006 | $8.684 billion | $8.187 billion |

| 2005 | $6.923 billion | $6.384 billion |

Procter and Gambles has had lackluster revenue and income growth since 2008, and the company has been divesting targeted segments, and streamlining the whole operation. Over the whole five-year period, company grew total earnings by 13% compounded annually, and income from continuing operations by 11.3% compounded annually.

EPS from continuing operations was $2.48 in 2005 and $3.70 in 2010, which leads to a compounded annual growth rate of 8%. The total diluted EPS growth rate was 10%.

Operating Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2010 | $16.072 billion |

| 2009 | $14.919 billion |

| 2008 | $15.008 billion |

| 2007 | $13.435 billion |

| 2006 | $11.375 billion |

| 2005 | $8.722 billion |

During this period, PG has grown operating cash flow by an average of 13% annually.

Metrics

Price to Earnings: 17

Price to Book: 3

Return on Equity: 18%

Dividends

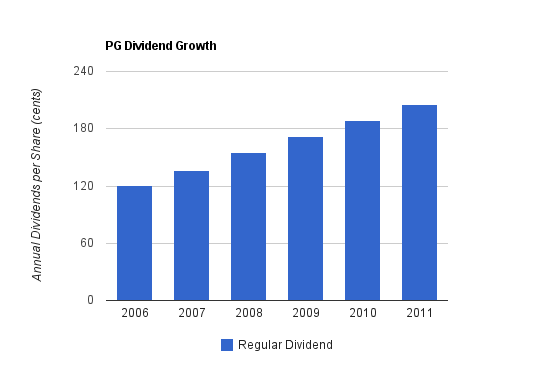

Procter and Gamble stock currently has a dividend yield of about 3.25%. This is fairly high compared to its average dividend yield over the past five years. The company has been paying a dividend for 120 consecutive years and has increased its annual dividend for the past 55 consecutive years. Numbers like this are worthwhile to take a minute to dwell on.

The current yield is around 3.25% based on a stock price of a little under $65. The most recent quarterly dividend increase was nearly 9%, and the payout ratio is approximately 55%.

Dividend Growth

| Year | Dividend | Yield |

|---|---|---|

| 2011 | $2.0568* | 3.15% |

| 2010 | $1.8854 | 3.00% |

| 2009 | $1.72 | 3.30% |

| 2008 | $1.55 | 2.30% |

| 2007 | $1.36 | 2.10% |

| 2006 | $1.21 | 2.00% |

During this five-year period, PG has grown its dividend by about 11% annually on average. (*Assumes the quarterly dividend payment will continue throughout 2011, as per usual.)

In addition to paying dividends, the company repurchases billions of dollars worth of shares each year, and issues a comparably small value of shares, resulting in a fairly substantial annual net share repurchase. The company has repurchased over $6 billion worth of company stock in each of the past three years, compared to spending between $5 billion and $6 billion on dividends. PG returned $11.5 billion to shareholders in 2010 with dividends and repurchases, which is more than 6% of the market capitalization of the company. Repurchasing shares fuels EPS growth and dividend growth, but at the current PG stock valuation, the return on investment is not spectacular for this spent cash.

Balance Sheet

The company has a LT Debt/Equity ratio of 0.35 and a Total Debt/Equity ratio of 0.49. These numbers are strong. Goodwill, however, consists of 88% of total shareholder equity. This number is higher than I’d like to see, but because PG is a brand management company, accumulating strong brands and occasionally selling them, I believe that a substantial portion of the goodwill is fair. The interest coverage ratio is over 18, which is extremely high. Overall, PG has a moderately strong balance sheet.

Investment Thesis

Procter and Gamble offers investors consistency, robustness, diversification, safety, income, growth, and more. PG is known for its strong dedication to developing leaders within its organization and thinking years ahead when it comes to planning.

The company’s products are diverse, useful, and rather easy to understand. This isn’t a company that can go out of business due to a technological shift, as their products are widespread and fairly simple. The size of the company gives it safety and strength.

At it’s core, Procter and Gamble is a brand management company. Their products are often the best around, but their brands just as important. The company owns 23 billion-dollar brands and 20 half-billion-dollar brands.

Developing markets are playing a larger and larger role in the growth of the company, accounting for 29% of sales in 2007 and 32% of sales in 2009. The company has over 4.2 billion customers, and targets 5 billion by 2015.

PG identifies their five major strengths as follows:

Consumer and Market Research

PG does more market research than any other company in the world. According to the 2009 annual report, the company conducts over 15,000 research studies per year.

Innovation

PG continually develops new brands and new products within existing brands.

Brand-Building

The majority of PG brands hold #1 or #2 spots in their categories.

Go-To-Market Capabilities

PG is a logistics powerhouse, using its large size to be an efficient and fast supplier of its products.

Scale

PG is among the largest of companies in the world, and leverages its size to gain efficiency in most of what it does.

Risks

Like any company, PG does have some risk. They are resilient, but not immune, to recessions. Tough times lead people to buy cheaper products. They face currency risk due to their global operations, and are vulnerable to changes in commodity costs. The company has some very large competitors, and their size makes it difficult to grow at a large rate or to be flexible.

Conclusion and Valuation

The company’s long-term goal is to have a organic sales growth that exceeds market growth by 1-2%, and to have high single digit or low double digit EPS growth. This level of growth coupled with a 3% dividend, if the goals are met, should result in substantial long-term shareholder returns.

I think PG stock is fairly priced at the current price of around $65. The P/E is at around 17, long-term growth prospects appear to be solid, the dividend is moderately sized, growing, and safe, debt levels are low, the company always has a long-term outlook, the products are fairly easy to understand and most investors probably use some of them quite often, and the company has a worldwide reach. The price doesn’t give much of a margin of safety, though. I’d prefer to pick up shares closer to $60. Overall, I consider the stock a solid “hold” right now. If the total market continues falling as it has for several weeks, value investors may find opportune times to buy at a price that provides some margin of safety.

Full Disclosure: I own shares of PG.

You can see my full list of individual holdings here.

Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

I’d agree with your hold sentiment. Great stock, a dip might be a good time to buy.

solid analysis. I like that P&G are divesting some non-core business like Pringles. In this way they are optimizing their business and are not acting as imperial builders.

Matt,

Your site is certainly one of my top 10s. I’ll bet you have a full-time job, but I’d enjoy reading a post from you every day, if possible!

I picked up PG for under $54 a share a few years back. Wish I had bought more…

I wish I had a few grand in my RRSP, I’d be a buyer. This guy is on my long-term buy list.

How long have you held PG and what was your entry point?

PG reminds of GE when Jack Welch took over, trying to be (or stay) # 1 and #2 in most lines of business or don’t be in them at all.

Great stuff Matt!