Realty Income Corp. (O) is a Real Estate Investment Trust (REIT) that purchases established retail real estate sites and holds long-term contracts with tenants. Rent collected goes mainly toward distributions to shareholders.

-Seven Year Revenue Growth Rate: 13.6%

-Seven Year FFO/Share Growth Rate: 3.2%

-Seven Year Dividend Growth Rate: 3.9%

-Current Dividend Yield: 4.14%

-Balance Sheet Strength: Stable, Conservative

Realty Income continues to deliver, but the comparatively high valuation has pushed the dividend yield to rather low levels, which reduces the expected long-term rate of return.

Overview

Realty Income Corp. (NYSE: O) is a Real Estate Investment Trust (REIT) that maintains a portfolio of over 3,500 properties in 49 states that are leased to over 200 tenants. The business is rather lean, with a nearly $10 billion market capitalization and under 100 employees.

They focus on acquiring and maintaining properties that already have long-term leases contracted for tenants that they believe operate in healthy industries that absolutely require property for their day-to-day operations. (In comparison, that is, to tenants that may be able to shift some of their business towards the internet, or businesses where their property is a smaller focus of their operations.) Most of their contracts are structured so that the tenant, rather than Realty Income, is responsible for paying property taxes, maintaining the interior, exterior, and land of the property, and for insurance. Realty Income also occasionally trims its portfolio by selling properties that no longer align with their goals.

The ten largest tenants for Realty Income are:

Fed-Ex

L.A. Fitness

Family Dollar

AMC Theatres

Diageo

BJ’s Wholesale

Walgreens

Northern Tier Energy

Super America

Regal Cinema

Over three-quarters of the rental income comes from tenants in Retail, while the remaining quarter is split among Distribution, Office, Agriculture, Manufacturing, and Industrial properties. Currently, over 97% of the properties are occupied.

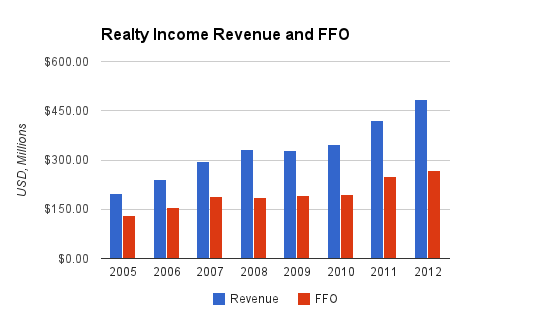

Revenue

(Chart Source: DividendMonk.com)

Revenue growth over this period has been a significant 13.6% per year on average, and Funds from Operations have grown at 10.9% per year on average over the same period.

As will be shown by the next chart, much of this growth is fueled by issuing new shares, which dilutes the numbers on a per-share basis. Over the course of this charting period from 2005 to 2012, the REIT went from 83.7 million shares outstanding to 133.4 million shares outstanding. Because the REIT pays out most of its incoming funds as dividends, there is only a modest amount that can be reinvested to grow the property portfolio. Therefore, most of the property acquisitions are paid for by issuing new shares.

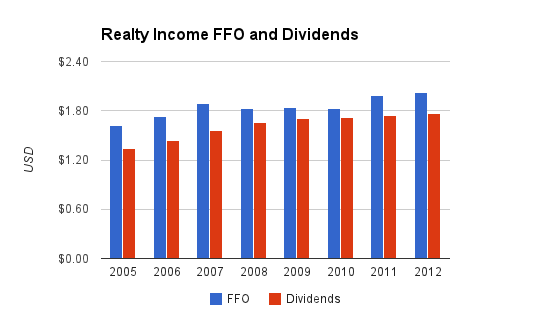

Funds From Operations and Dividends

(Chart Source: DividendMonk.com)

This chart depicts growth on a per-share basis. FFO per share grew by an average of 3.2% per year over this period, while the dividend grew by an average of 3.9%.

The current dividend yield is 4.14%, and Realty Income pays out 85-95% of its FFO as dividends. Realty Income pays out its dividend on a monthly basis.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 4.14% |

| 2012 | 5.0% |

| 2011 | 5.0% |

| 2010 | 6.3% |

| 2009 | 7.4% |

| 2008 | 5.8% |

| 2007 | 5.3% |

| 2006 | 6.2% |

| 2005 | 4.9% |

As can be seen, Realty Income’s yield is at a low point compared to the recent historical average. The valuation has been pushed higher, resulting in a lower yield.

Balance Sheet

Realty Income maintains an investment grade BBB+ credit rating.

As of the most recent quarter, the REIT has $8.76 billion in assets, $3.62 billion in liabilities, and therefore $5.14 billion in shareholder equity.

Investment Thesis

The thing that stands out about Realty Income is its dedication to shareholders. They brand themselves as “The Monthly Dividend Company”, and the bulk of their website is an atypically user-friendly dedication to educating potential shareholders about their business.

The first thing you may notice if you read their annual report is that the depictions are mostly of shareholders, whereas most annual reports by companies focus on their customers. When you look through the colorful annual reports of most businesses, you’ll generally see depictions of their customers, products, and operations. Indeed, Realty Income does depict some of their properties in their report. But at the forefront of their report are pictures depicting shareholders. There are five pages worth of various pictures of the demographic that they view as their shareholders: typically upper middle class, middle-aged or retired, and generally enjoying life. How a company chooses to market itself, including to its own shareholders, is an expression of that organization’s culture.

Realty Income’s role in a portfolio, over the 4+ decades of operation, has generally been to provide solid current income that keeps up with inflation. Payments come monthly rather than quarterly, and as a REIT the payout ratio is rather high, resulting in a decent current yield of 4+% (though historically higher than that). From a diverse and stable set of properties with long-term contracts, Realty Income seeks to provide good retirement income.

American Realty Capital Trust Acquisition

In the first quarter of 2013, Realty Income completed their acquisition of ARCT for $3.2 billion. This adds 515 properties, leased by 69 tenants in 44 states, to Realty Income’s portfolio, and has resulted in an unusually large dividend increase for the REIT of nearly 25%.

The acquisition also increased the overall occupancy rate of Realty Income, and increased the percentage of investment grade tenants. Currently, about two-thirds of Realty Income’s tenants are investment-grade businesses.

Real Estate Investment Trusts Vs. Directly-Owned Real Estate

Owning property is one of the oldest forms of wealth and investment. Of course, real estate can be owned actively with direct property, or passively through publicly traded REITs.

Owning direct real estate can result in a rate of return that exceeds the historical average of the stock market. Individual real estate markets are generally less efficient than stock markets, less liquid, and require more direct time and attention. When operated skillfully with the proper application of leverage, consistent double-digit returns are possible in many markets. The downside is that, as a hands-on approach, it requires a degree of real estate skill and of course time.

In comparison, owning shares in a REIT is a passive activity, but the returns will generally be lower. The reason for the lower returns is that as an investor, you’re paying a premium for the complete convenience. The book value of Realty Income is less than half of the current market capitalization. If, as a direct real estate investor, you owned shares of Realty Income at direct book value, your dividend yield would be doubled to nearly 10%, with dividend growth that generally keeps up with inflation. You’d be looking at low double-digit returns, which historically is better than the S&P 500.

As a publicly traded entity, the liquidity and passivity of the investment results in a fair price that is higher than book value, and therefore lower returns. Historically this REIT has still outperformed the market, but during most of that period, the valuation was lower and the yield was higher than it currently is.

Risks

Realty Income’s performance comes from the team’s ability to acquire and maintain a highly occupied property portfolio. General economic weakness can decrease their occupancy rates as their tenants struggle.

None of Realty Income’s tenants account for more than 10% of overall rental income, but the top six tenants each account for over 3% of rental income each. Of this, their largest tenant Fed-Ex accounts for 5.5% of rental income.

Conclusion and Valuation

Overall, Realty Income is clearly a well-run operation that has historically served investors well. The nature of property inherently gives them somewhat of an economic moat, and the conservative balance sheet and diversified property portfolio give shareholders some protection against loss. The REIT’s strong focus on shareholders and monthly high-yield dividend can be very attractive to those that seek current income.

The question, though, is whether Realty Income is trading at an attractive valuation. Assuming a constant valuation and dividend payout ratio, long-term returns are approximately equal to sum of dividend yield and dividend growth. For Realty Income, that sum is about 8%.

So, based on the Dividend Discount Model, investors looking for an 8% long-term rate of return, can pay up to $49 for shares of Realty Income, assuming that a 4% dividend growth rate occurs. If only a 3.5% long-term dividend growth rate is expected, this fair value drops to $43 instead.

If investors are looking for 9% annual returns over the long-term, and are expecting 4% dividend growth per year, then the fair value drops to $39.

Therefore, at $52/share, Realty Income is set to deliver shareholders a rate of return in the high 7% range, which is lower than the historical market rate of return, but comparatively solid for those seeking current income. Because the REIT is trading at a historically high valuation with a correspondingly low dividend yield, caution is advised.

Full Disclosure: As of this writing, I have no position in O.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I think Realty Income will always be overvalued because of its dividend history and reliability. Unlike many other companies their motto is to pay monthly dividend to bring income to shareholders and investors know it, so they want to buy this stock.

I am personally willing to pay around 40 – 42 a share for this stock as of today, so I am not investing in it (but I hold it in my portfolio). I am waiting for some correction waiting the price drop closer to my buy target. And it will happen one day as soon as those people out there start panicking once again and pouring the bath water away with the baby. Then I will start buying again.

Historically, Realty Income has usually been attractively valued. It has only been in the last few years that it has become so expensive and with a lower yield. So I wouldn’t particularly agree that it will always be overvalued.

That being said, if there is a longer-term change in what people desire from the stock market (as in, more interest in consistent dividend growth), then valuations of those types of stocks may rise on a longer or permanent basis, and Realty Income could indeed be overvalued for the foreseeable future. In general, REITs and utilities have not been particularly attractively valued as industries in my opinion over the last few years.

This REIT is overvalued. I would consider adding to it on dips below $42. My last addition was in the low $30’s, and I thought it was close to being overvalued back then. The FFO growth from ARCT acquisition was helpful, but I doubt O can grow by more than 4%-5%/year over the next decade.

Realty Income has never been valued as highly as other premier REITs because they invest in properties with tenants that are typically low or non investment grade. Of course, we know that credit quality is subjective and I’ve felt that this credit mispricing has given value investors an edge. The management of this company is top notch, they are very selective about location and they have higher credit quality tenants/locations then what the market has typically priced.

Until now. I don’t know if this huge move up is simply euphoria or the market waking up to the quality of this company. I’m hoping that idiot instincts of Wall Street will kick in at some point to get us better pricing on this stock.

Reality Income is one of my largest holdings as the moment. Gotta love a monthly dividend! However I agree with some of the other commentors that it’s a bit too high right now for me to make any more additions.