This article has been written by Olivier Gélinas for Dividend Monk.

Summary

- Renewable energy’s growth potential is booming

- EPS increases as revenue misses estimates, risk is still in the air

- Confident management with promising goals

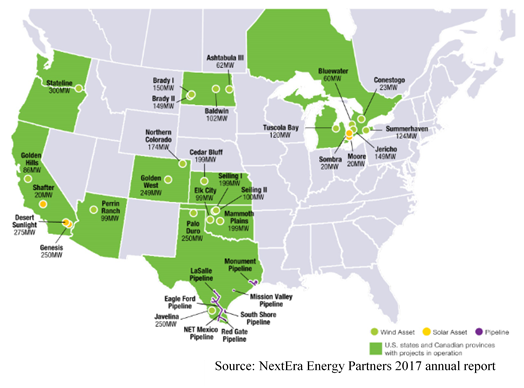

Renewable energies are the next big thing in terms of propelling our world. With those energies being mostly solar, wind or natural gas, this is exactly where NextEra Energy operates. The company made a huge acquisition back in 2015, when their portfolio bought seven plants’ natural gas pipelines in Texas. Today, the management sees opportunities in renewable energies as North America slowly shifts towards new energy sources. But taking ownership of new projects is costly and risky. Investors need to be aware that even if the energy industry shows potential, it might still be too shaky to be sustainable!

Understanding the Business

NextEra Energy Partners (NEP) is a limited partnership, formed by NextEra Energy (NEE). Its main goal is to acquire, manage and own assets in the renewable energy sector. Solar and wind are the most popular, but the company does also own natural gas plants in Texas. One of the main goals of NEP is to take advantage of the North American trend toward renewable energy and include clean energy projects in its portfolio.

NEP derives approximately 47% of its consolidated revenue from 3 contracts: Pacific Gas and Electric Company, Mex Gas Supply S.L. and the IESO. The company does not have employees, per se. It relies on NEE employees to oversee the ongoing operations, since the company acts like their GP.

Growth Vectors

NEP is part of the utility sector. Utilities are known for their stable business model. As most of their income is regulated; this makes for predictable cash flow. Which, in turn, equals safe dividend. You can get the complete list of utility dividend stocks with comprehensive metrics here.

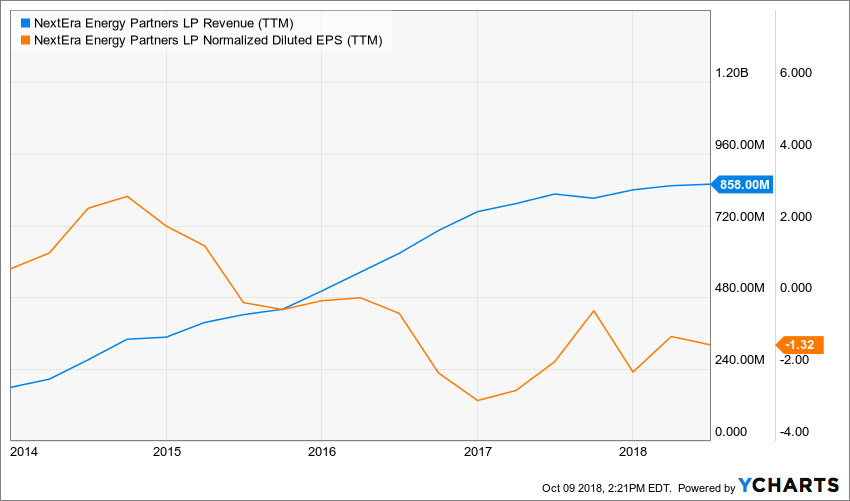

Source: Ycharts

NEP is building growth year over year. The fact that the company operates in promising alternative energy sources such as wind and solar is a huge upside. Renewable energy in today’s market is a key driver not only for growth, but for plain sustainability. Management’s guidance in that matter estimates a growth rate between 12% and 15% through 2023. With technology developing rapidly and production costs dropping drastically, NEP does seem to have everything it needs to reach this goal.

Another growth factor to be on the lookout for is management’s ability to oversee currently owned plants. At the recent sale of their Canadian based assets located in Ontario, management unlocked a decent CAD $740M (USD $573M), to be reinjected into the company’s operations. NEP’s position on this recent sale was to get the ability to invest in higher-yielding assets in the US, which could happen later this year or early 2019.

Latest quarter in a flash

On July 25th, the company reported the following results:

- Non-GAAP EPS of $1.43, beating estimates by $0.90.

- Revenue of $225M, missing estimates by $44.75M

- Dividend of $0.4375/share, a 4% jump since last quarter

The chairman and CEO, Jim Robo, added a few words:

“NextEra Energy Partners continued to build upon the strong start to 2018 with significant year-over-year growth in both adjusted EBITDA and CAFD, reflecting new asset additions and the outstanding performance of the portfolio,”

Dividend Growth Perspective

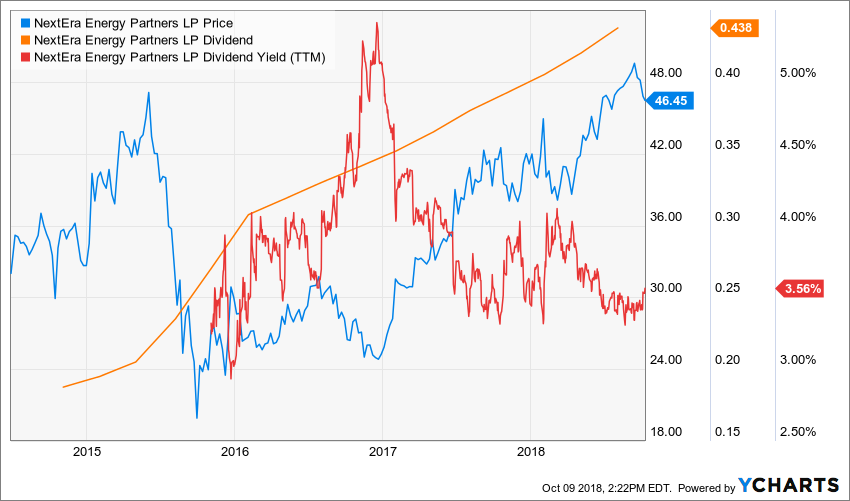

Since 2016, NEP has increased its annual dividend. Investors can count on a $1.75 dividend for the current year. As the company expands their operations, I really believe the company should have more available free cash flows for the upcoming financial years.

Source: Ycharts

Seeing how the renewables are soaring through markets, I wouldn’t be surprised to see a sustained increase in dividend output. An income-seeking investor should seriously consider the stock for its future payout.

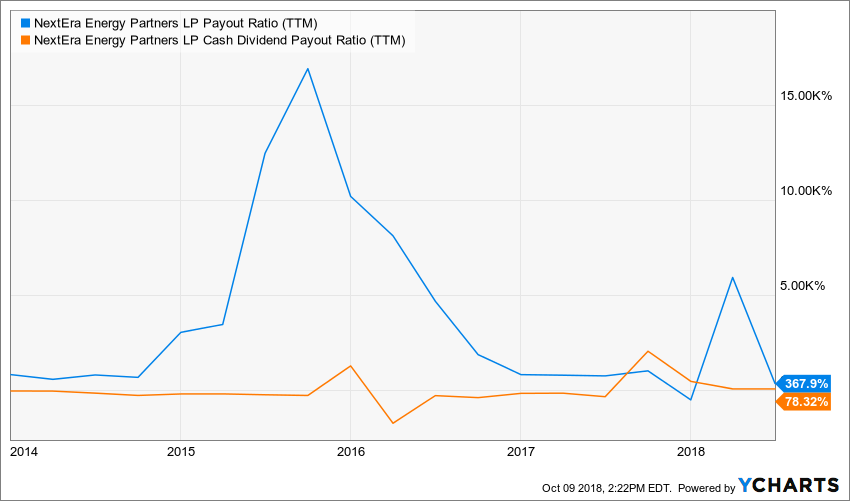

Source: Ycharts

At the moment, the company is a bit shaky. Payout ratios are really high (even if many of their peers are experiencing the same issue), which can scare investors away. As the company invests its available cash into new project ownerships, huge amounts paid can sometimes not be enough to cover the free cash flows generated by the other plants. Those situations make the graph look distorted and hard to read.

Don’t stress the 2015 sky-high peak too much. This is where the company acquired seven large natural gas plants in the US. Every dividend during those quarters was a big part of the real reported earnings.

Potential Downsides

Even if NEP’s operations are promising and the future is probably massively used energy, they’re still considered as a bit risky. The company relies solely on the success of its own plants in order to generate the required cash to sustain operations and continue handing out dividends to investors. Following the same train of thought, the company is highly dependent on weather conditions and their ability to capitalize on them.

In addition, NEP’s credit rating is shaky. From an investor perspective, credit ratings of BA1, BB and BB+ (respectively from Moody’s, S&P and Fitch) are not particularly attractive. This could very well play into the long term as the company may be looking to finance new projects.

Valuation

With NEP’s stock price soaring over the last few years, I was expecting a growing PE ratio. Earnings can’t always cope with a sudden growth in stock price, which is why we are seeing a higher level in 2018.

Source: Ycharts

The dividend discount model uses a $1.75 annual dividend as well as a 9% discounting rate. Growth rates are very different. Short term growth of 8%, despite the management’s generous 12-15% guidance, is here to pace investors on the intrinsic value of the stock. The same goes for the 5% mark on longer-term growth. As you may know, the model is sensitive to its inputs. Factoring in a high growth level would completely throw off the value.

| Input Descriptions for 15-Cell Matrix | INPUTS | ||

| Enter Recent Annual Dividend Payment: | $1.75 | ||

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% | ||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | ||

| Enter Discount Rate: | 9.00% | ||

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $94.61 | $70.32 | $55.78 |

| 10% Premium | $86.72 | $64.46 | $51.13 |

| Intrinsic Value | $78.84 | $58.60 | $46.48 |

| 10% Discount | $70.96 | $52.74 | $41.84 |

| 20% Discount | $63.07 | $46.88 | $37.19 |

Please read the Dividend Discount Model limitations to fully understand my calculations.

The output given by the DDM is not quite on point with the $46 mark we have on current markets. But if you look closely, a 10% discount rate would fall almost dead on target, which once again shows the importance of gauging the right inputs. I wouldn’t say the stock is undervalued, though. The industry is still kind of new and contains a lot of risk as the technology develops to a wider usage.

Final Thought

NextEra Energy Partners is a stock to be on the lookout for. Renewable energies will be a key factor in the upcoming years and that is something investors should be aware of. Optimism around new alternatives should benefit NEP’s operations and it seems like the management is ready for such an interest.

Income-seeking investors, use caution. Although it might seem a good opportunity, there are still a lot of implicit risks associated with NEP’s business. I would keep an opened eye on the stock and on their dividend output. We never know when the winds are going to turn!

Disclosure: We do not hold NEP in our DividendStocksRock portfolios.

Additional disclosure: The opinions and the strategies of the author are not intended to ever be a recommendation to buy or sell a security. The strategy the author uses has worked for him and it is for you to decide if it could benefit your financial future. Please remember to do your own research and know your risk tolerance.

Leave a Reply