Medtronic Inc. (MDT), is a global medical technology company focusing on producing a broad set of medical products.

-Seven Year Revenue Growth Rate: 7.0%

-Seven Year EPS Growth Rate: 12.6%

-Seven Year Dividend Growth Rate: 16.1%

-Current Dividend Yield: 2.41%

-Balance Sheet Strength: Moderately Strong

Overview

Founded in 1949, Medtronic, Inc. (NYSE: MDT) is a medical technology company focusing on alleviating pain, restoring health, and extending life for people all over the world. With over 45,000 employees and a market capitalization of over $40 billion, Medtronic is the world’s largest independent medical technology company.

Approximately 45% percent of company revenue comes from outside of the United States, and this percentage is growing. The company markets its products in over 120 countries.

The company is divided into two primary groups.

Cardiac and Vascular Group

Medtronic’s core area of expertise has long been the heart and related systems, and slightly more than 50% of total company sales come from this group. The two operating areas are Cardiac Rhythm and Cardiovascular:

Cardiac Rhythm Disease Management

This segment accounts for 31% of total company sales. Products in this segment include pacemakers, implantable defibrillators, leads and delivery systems, ablation products, electrophysiology catheters, and other products.

Cardiovascular

This segment accounts for 21% of total company sales. Products include coronary stents, delivery systems, heart valve replacement systems, and more.

Restorative Therapies Group

Medtronic has been growing their products for ailments unrelated to the heart since the 1990’s, and now they collectively represent nearly 50% of company sales.

Spinal

This segment accounts for 20% of total company sales. Products in this segment include thoracolumbar, cervical, neuromonitoring, surgical access, and more.

Neuromodulation

This segment accounts for 11% of total company sales. Products include implantable systems for treatment of chronic pain, movement disorders, bladder problems, and other conditions.

Diabetes

This segment accounts for 9% of total sales. Products include insulin pumps and disposable products.

Surgical Technologies

This segment accounts for 8% of total sales. Products of this segment are used to treat ear, nose, and throat conditions.

Ratios

Price to Earnings: 13

Price to Free Cash Flow: 11.5

Price to Book: 2.5

Return on Equity: 22%

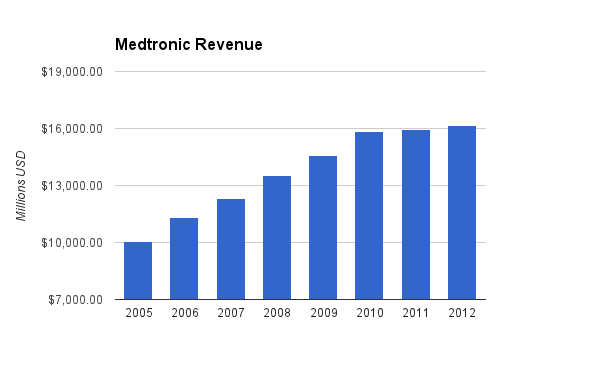

Revenue

(Chart Source: DividendMonk.com)

Revenue growth has been 7% per year on average over this seven year period, and the growth has been rather consistent and smooth over the decade, with no dips. However, revenue growth has slowed down significantly over the last few years.

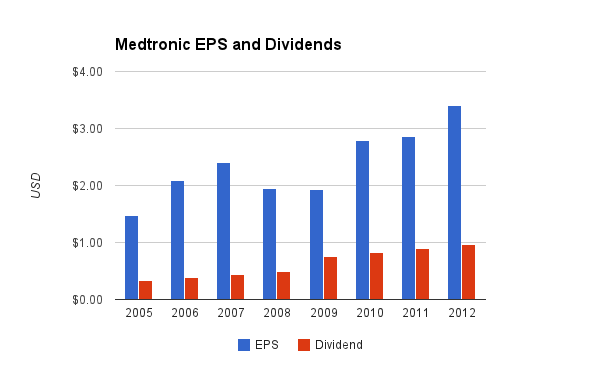

Earnings and Dividends

(Chart Source: DividendMonk.com)

Earnings have been rather erratic, but the growth rate was over 12%. Over the trailing twelve month period, EPS is up to $3.48.

The dividend currently yields 2.41% with a fairly low payout ratio of under 30%. It has grown for 35 consecutive years.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.41% |

| 2012 | 2.5% |

| 2011 | 2.4% |

| 2010 | 1.8% |

| 2009 | 2.3% |

| 2008 | 1.0% |

| 2007 | 0.8% |

| 2006 | 0.7% |

| 2005 | 0.7% |

The company’s yield is currently considerably higher than the historical average. While Medtronic’s dividend payout ratio did increase from the 20% range to the 30% range over this period, much of the difference is due to reduction in stock valuation.

How Does Medtronic Spend Its Cash?

For the three fiscal years of 2010, 2011, and 2012, Medtronic reported total free cash flows of over $10.6 billion. Over this same period, approximately $2.9 billion was spent on dividends, and approximately $3.6 billion was spent on buybacks. Another $1.8 billion or so was spent on net acquisitions.

Normally I do not like to see share repurchases outspending dividends, but Medtronic’s reasonable stock valuation over this period makes it acceptable, in my view. However, as a general rule, share repurchases are often not very shareholder friendly, because companies typically buy more shares when stock prices are high. For example, the company spent over $4.5 billion on share repurchases and issued over $1 billion in shares back in 2006 alone, and at that time, Medtronic stock was considerably overvalued, so a large portion of that money was wasted.

The buybacks are working fairly well in this period of reasonable stock valuation, but will likely be wasteful again should the stock trade for a high earnings multiple in the future.

Balance Sheet

Total debt/equity is a bit over 60%, which is solid. Total debt/income is under 3x, which is very healthy.

However, nearly 60% of shareholder equity consists of goodwill, which isn’t a particularly appealing figure in my view. Medtronic makes a number of acquisitions that can bolster R&D efforts but can have integration and profitability risks.

The most important metric in my view is the interest coverage ratio, which for Medtronic is nearly 13x. Medtronic’s operating income covers debt interest nearly 13 times over, showing the strength of the financial position.

Overall, Medtronic’s balance sheet is quite solid, with the one caution area being the large (but not unusual) goodwill figure.

Investment Thesis

Medtronic has been headed by a new CEO, Omar Ishrak, since 2011. He came from General Electric and has considerable experience with expansion into China. Medtronic’s growth from emerging markets is strong and the company continues to grow in that direction. The company recently announced that they will be acquiring China Kanghui Holdings, an orthopedics company, for approximately $800 million.

The company continues to spend more on research and development each year, and according to the most recent annual report, 38% of the company’s current sales are from products developed within the last 3 years.

The company’s method of tuck-in acquisitions supplements the strong R&D growth, and the risk-adjusted return hurdle for these acquisitions is in the mid-teens according to a Medtronic presentation to the UBS Global Life Sciences Conference this month.

The same presentation discussed Medtronic’s 5-year plans for shareholders. Expected free cash flow over the next five years is $25 billion (over 55% of current market cap), of which half is expected to be given to shareholders in the direct form of dividends and the indirect form of buybacks.

The company’s growth targets are mid-single-digit sales growth, with EPS increasing by 200-400 basis points faster than revenue. The company’s emerging markets are growing by around 20% per year currently, and the company expects the total revenue share from emerging markets to increase from ~10% currently to ~20% by fiscal year 2015 or 2016.

Risks

Like all large health care companies, Medtronic faces considerable litigation and regulatory risk.

More specifically, certain product divisions of the company have had issues. First, the Spine Journal reported that peer-reviewed studies may have under-reported complications of Medtronic’s INFUSE bone graph product. This has resulted in decreases in sales and the company has responded by granting money to Yale University to perform independent studies. Since the overall effectiveness in terms of risk/reward has been questioned, an outcome may continue to hurt Medtronic’s sales or may offer a rebound if results are positive. Similarly, the company’s Implantable Cardioverter Defribrillators faced sales declines due to investigations, although the company reported that this may have stabilized.

In addition to certain product-specific issues, the company faces some specific macroeconomic/political/regulatory risks. Healthcare reform in the United States includes a 2.3% excise tax on medical devices beginning in 2013. Plus, with the thirteen figure U.S. federal budget deficit, and the upcoming “fiscal cliff”, Medtronic’s patients’ reliance on Medicare for payments is a risk. Potential cuts would likely flow through to the company’s bottom line.

Conclusion and Valuation

Overall, I believe Medtronic stock is currently trading at a reasonably attractive valuation in the low-to-mid $40’s.

The stock is near its 52 week high, but in a broader and more absolute perspective, the valuation is fairly low. The stock price is currently lower than it was 10 years ago when it was considerably overvalued, and the valuation of MDT and health care stocks in general have been low since the beginning of the recession. Political and economic uncertainties have resulted in taking a closer look at health care costs, especially in the U.S. where the cost as a percentage of GDP and the cost per capita spent on health care is completely out of line with other developed countries.

But I believe the time to buy and hold a quality stock is when not all of the news is good. The company continues to grow sales and spread globally despite headwinds from certain product difficulties and a tough regulatory/political/economic environment.

Using the Gordon Growth Model, we can calculate a range for the fair value. The company targets mid single digit revenue growth, and another 2-4% growth in EPS on top of that figure (which is currently supported by their rate of repurchases). So if we use 7% perpetual dividend growth and a 10% discount rate, then we’re looking at a fair value of only around $35. On the other hand, an 8% dividend growth rate with the same discount rate leads to a fair value estimate of $53.

The current price of a bit over $43 seems fair based on the size of the company, the consistency of the revenue growth, and the company growth targets combined with a fair value estimate.

Back in October 2011 when I previously analyzed Medtronic, the price was in the low-to-mid $30’s, and I stated that the stock looked to be at a fairly attractive valuation. Now that the stock has gone up by roughly $10/share and paid out roughly $1 in dividends over the period, the return was over 30% for the year, my level of interest is moderately reduced due to this strong performance.

I wouldn’t view it as an incredible buy, and the margin of safety is not particularly appealing, but in a rather richly valued market, Medtronic stock looks decent at today’s prices.

Full Disclosure: As of this writing, I am long MDT.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Matt,

Thanks for the excellent analysis. I’ve had my eye a bit on MDT, as well as health care stocks in general, lately. It seems to be a reasonable buy in a richly valued market, as you state. I completely agree.

I wish I would have purchased more MDT when it was in the mid-$30’s…but you can’t buy them all. BDX is another attractive company in this space, especially when it’s in the low $70’s. I’d welcome a dip in either of these companies as an opportunity to buy.

Best wishes!

Matt

Great analysis, I have MDT on my buy list for when the market eventually corrects and produces some bargains out there.

Keep up the good work!