McDonald’s Corp (MCD) franchises and operates McDonald’s restaurants in the food service industry. Its geographic segments include the United States, Europe, Asia-Pacific, the Middle East and Africa.

-Seven Year Revenue Growth Rate: 3.47%

-Seven Year EPS Growth Rate: 7.19%

-Seven Year Dividend Growth Rate: 18.49%

-Current Dividend Yield: 3.52%

-Balance Sheet Strength: Strong

Overview

Mickey D doesn’t need an introduction anymore. It’s the largest fast food retailer with over 36,000 restaurants servicing over 69 million clients throughout 100 countries every day. It was one of the very few stocks to practically ignore the 2008 recession and continue to reward investors. However, the stock is now lagging the market since mid-2014. This is what caught my attention and led me to take a look at one of the most famous aristocrat stocks.

Source: Ychart

Business Segments

The company doesn’t offer 100 different products as you can eat the very same Big Mac in London UK that you would in Tokyo. However, management has divided its business according its geographic segments:

US

MCD shows decreasing sales of -1.7% in US for 2014 due to negative growth in guest traffic. In other words, the golden arch doesn’t serve as many clients as before. Competition is very tough and with MCD’s recent announcement to raise wages, there is little to help improve margins.

Europe

Economic weakness in both France and Germany along with a massive consumer confidence drop in Russia pulled sales down by 1.1% and operating income by 11%. A strong US dollar doesn’t help the company either. The only good news is coming from the UK where sales were up in 2014.

Asia/Pacific, Middle East & Africa

Supplier issues in China hit the company’s sales by 4.8% and operating income by 44%. While China is a very promising country for burgers, supplier issues may slow down MCD enthusiasm.

Other countries including Canada and Latin America as well as Corporate

McDonald’s restaurants are 80% owned by franchisees as followed:

57% conventional franchisees

24% licensed to foreign affiliates or developmental licensees

18% are company owned.

Source: McDonald’s website.

At first glance, I’m under the impression of looking at a company that was once the perfect example of a successful business model but the star seems to have dimmed a little. Let’s break down some numbers to see what MCD has to offer its shareholders.

Ratios

Price to Earnings: 20.02

Price to Free Cash Flow: 22.42

Price to Book: 7.23

Return on Equity: 31.81%

Revenue

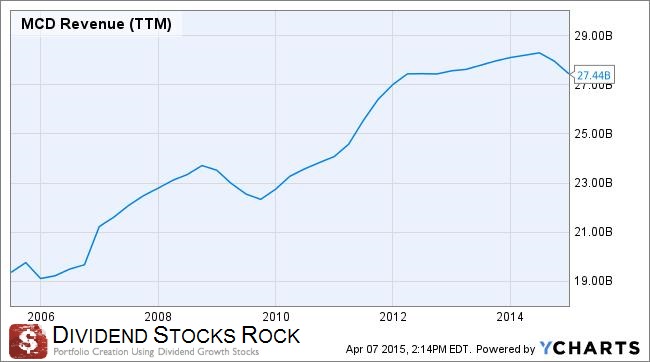

Revenue Graph from Ycharts

As you can see, the company seems to have hit a plateau since 2012. A stronger US dollar, rough competition and global economic slowdown explain why MCD is finding it hard to sell more burgers. The company is also struggling to deliver an updated menu that would help grab back market share from its competitors.

Earnings and Dividends

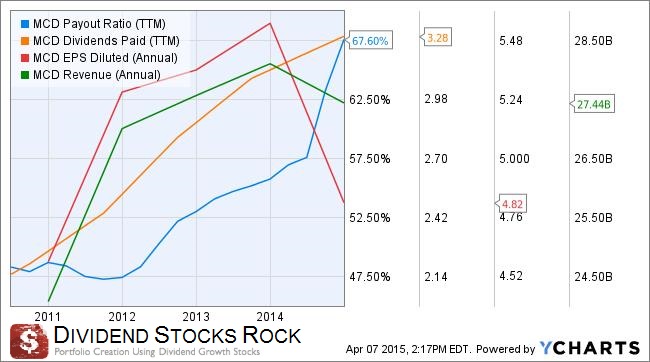

Source: Ycharts

We can see in the previous graph that both sales and earnings are slowing down since 2014. The dividend payout has increased significantly but we can now wonder if the company will be able to maintain such a pace. The payout ratio hiked significantly over the past 12 months. Management has been talking about “challenging markets” for a few quarters now but doesn’t seem to be able to provide a long term solution.

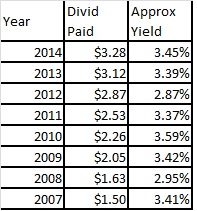

Approximate historical dividend yield at beginning of each year:

While the overall dividend growth over the past 7 years is impressive, we can see that the numbers have been back to a more normal pace over the past three years. Exactly at the same time when we can see the business model struggling while facing fierce competition. I don’t think we can expect a dividend growth of over 5% in the upcoming years.

How Does MCD Spend Its Cash?

The company focuses on distributing cash to its shareholders through numerous consecutive years of dividend increases along with a strong share buyback program. In the last quarter of 2014, the company had redistributed 1.8 billion alone. In 2014, management announced they will redistribute a total of 18 to 20 billion to shareholders through dividend payments and share buybacks. MCD also wants to refranchise a total of 1,500 restaurants and reallocate resources to higher growth initiatives.

Regardless of the business’ recent slowdown, MCD keeps generating a high level of cash flow and will use its liquidity to reward investors for their patience.

Balance Sheet

McDonald’s shows a strong balance sheet. McDonald’s Debt to Equity ratio is fairly low at 1.667, long term debt is only 2.8 times its average net income and (obviously) the MCD current ratio is in very good standing (1.5). The company’s biggest assets are not its burgers, coffee offerings or its branding. The company’s biggest asset is its real estate properties. With over 33B in buildings and land, the company owns some of the best locations in the world for retail business.

Investment Thesis

An investment in MCD today is an investment to build a core dividend growth portfolio. The company will not be your home run this year and will not post double digit growth. However, the business will definitely pay a higher dividend next year and its payment is not at risk for the moment.

Risks

I see a long term risk for MCD in that it hasn’t proven to the market it can reinvent Mickey D and generate growth. While the McCafé has been a good addition to its menu, it doesn’t seem to be enough to grab market share in this highly competitive industry.

Healthy food trends are also hurting MCD as burgers are not seen as a good choice for many consumers. While I’m pretty sure people will continue to eat burgers and fries, I’m also convince that fast food restaurants are no longer on the fast growing track anymore.

I’m afraid that MCD may become nothing more than a strong dividend payer that will lag the market in the years to come. Let’s see if the company is trading at an interesting value before coming to our conclusion.

Valuation

I’ll start the valuation process by looking at its historical P/E ratio. This will give me an indication of where the market sees the stock:

The company’s valuation seems to be at its highest point since 2006 (excluding the market crash of 2008). The stock seems to be one step away frombeing overvalued at the moment using the P/E approach.

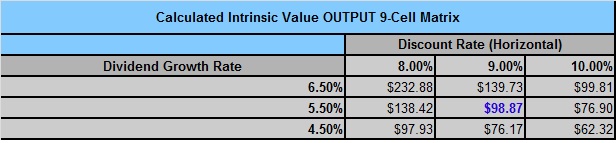

Since my goal is to buy dividend stocks, I always use the Dividend Discount Model to value a company. Since the company shows a strong balance sheet and because the company owns lots of real estate property, I will use a discount rate of 9%. While the 7 years dividend growth is standing at 18%, I don’t think it’s fair to expect such high dividend increases for the future. A 5.5% dividend increase seems more reasonable and achievable considering the recent payout ratio. Here’s what the Dividend Toolkit Dividend Discount Model Table gives me:

The stock seems fairly price with a discounted rate of 9% but if you are more concerned about its lower margins and use a higher discount rate, you quickly put MCD in the overvalued stock category.

Conclusion

Overall, we can say MCD is not a trading bargain at the moment. The price/earnings ratio is a bit high and the DDM gives a fair price considering my assumptions. The hope of more franchise restaurants in China along with massive share buybacks is maintaining the current stock price level. The fact that MCD is the leader in the breakfast industry and the strong dividend payment will continue to attract investors, I can see the company being part of a core conservative portfolio to provide both stability and good quarterly payments.

However, higher commodity prices related to the food industry combined with aggressive competition and increasing wages are all factors that will slow down McDonald’s profitability over the upcoming years. If I had $10,000 free in my investment account, I would not use it to buy MCD. I think it would be safe to wait for another year to see if the company is doing more than a simple step in the right direction.

Full Disclosure: As of this writing, MCD is part of our DSR Portfolios.

Nice review on Mickey D! I agree with you about MCD fits on a conservative portfolio. The company seemed to not favor a bullish economy right now, as consumers are making money their spending habit changes as well, restaurant goers favor the likes of Chipotle and Panera Bread that offers a healthier ingredients and consumers don’t mind paying premium prices. One thing I am sure of though, MCD can withstand recessions and bear market, I am not sure if the likes of Panera and Chipotle are recession proof.

Hello FFF,

I agree with you MCD is built to face headwinds and it’s not that obvious with other restaurant chains asking customers to pay for a premium. Then again, their location across the world will continue to prevail.

Thx for stopping by!

Mike

I full agree here. Although my cost basis is a bit higher than the current price, I still view it as overvalued, and want to hold off a bit. Great analysis; this is really in the way of the the old DM, and that’s awesome.

Hello DD!

thx for stopping by! MCD is definitely the kind of holding you keep in your book and simply forget about it. Great to build a core portfolio, not so good if you are looking for double digit growth.

I’ll do my best to keep it that way, I enjoy DM’s analytical side.

Cheers,

Mike