A more recent analysis of Smuckers is available on the Best Dividend Stock Report List.

Summary

Smuckers is a food company that produces its name-brand jellies and jams, as well as peanut butter, Folger’s coffee, and numerous other top brands.

Five-year Revenue Growth: 17.5%

Five-year EPS Growth: 10.5%

Current Dividend Yield: 2.68%

Balance Sheet: Strong

At the current price, I consider Smuckers stock to be a hold. The family-run company has a lot going for it, but the rich stock price balances out the upside, resulting in what I think is a fairly priced dividend stock.

Overview

The J.M. Smuckers Company (symbol: SJM) was founded in 1897, is headquartered in Ohio, and is still run by the Smuckers family.

The company produces jam, jelly, preserves, peanut butter, sandwich products, ice cream toppings, baking products, oil, juices, and coffee. The company draws its revenue mostly from North America. With a market capitalization of around $8 billion, it’s one of the smaller dividend paying large-caps out there.

Business Segments

The four business segments are:

U.S. Retail Coffee Market

This segment has high profit margins, accounting for 40% of total company sales. The biggest product here is Folgers Coffee which was acquired from Proctor and Gamble, and Smuckers also markets Dunkin Donuts coffee.

U.S. Retail Consumer Market

This segment accounts for 22% of total company sales. Majors brands include Smuckers jam and jelly, and Jif peanut butter.

U.S. Retail Oils and Baking Market

This segment accounts for 18% of total company sales.

Special Markets

This segment accounts for 20% of total company sales.

Revenue, Earnings, Cash Flow, and Metrics

Smuckers has had significant revenue, earnings, and cash flow growth because it has issued shares to pay for big acquisitions, but also grew shares on an individual basis.

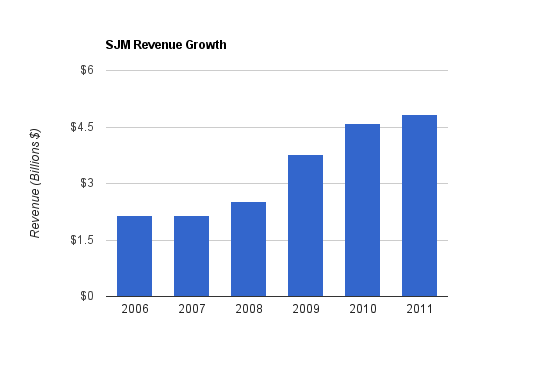

Revenue Growth

| Year | Revenue |

|---|---|

| 2011 | $4.826 billion |

| 2010 | $4.605 billion |

| 2009 | $3.758 billion |

| 2008 | $2.525 billion |

| 2007 | $2.148 billion |

| 2006 | $2.155 billion |

Revenue has increased by a compounded rate of 17.5% over the last five years. A significant part of this has to do with the purchase of Folger’s Coffee from Procter and Gamble (PG).

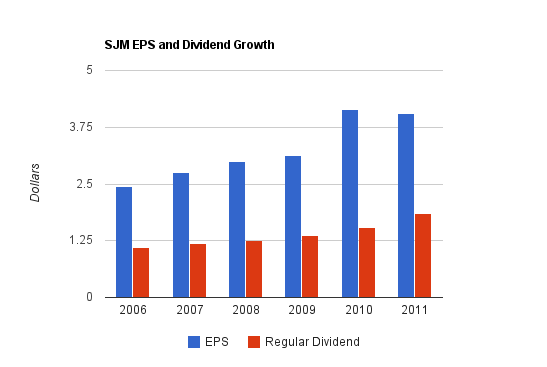

EPS Growth

| Year | EPS |

|---|---|

| 2011 | $4.05 |

| 2010 | $4.15 |

| 2009 | $3.12 |

| 2008 | $3.00 |

| 2007 | $2.76 |

| 2006 | $2.45 |

Smuckers has grown EPS at a rate of approximately 10.5% per year, on average, over these last five years.

Cash Flow Growth

| Year | Cash Flow |

|---|---|

| 2011 | $392 million |

| 2010 | $713 million |

| 2009 | $445 million |

| 2008 | $192 million |

| 2007 | $273 million |

| 2006 | $198 million |

Cash flow has been erratic for the company. From 2006-2011, the rate of cash flow growth has averaged a bit over 14.5%, but this number would change dramatically if computed over a slightly different period. Cash flow is down in 2011, and over the trailing twelve month period. 2010 had numerous bonus factors, so the 2011 figure is best compared to the 2009 figure. For the 2011 fiscal year, Smuckers has increased its inventory, which is the primary reason for good earnings and not-so-good cash flow.

Metrics

Price to Earnings: 17.3

Price to FCF: 58 (fluctuates significantly)

Price to Book: 1.53

Return on Equity: 9%

Dividends

Smuckers currently has a dividend yield of 2.68% with an earnings payout ratio of under 50%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.84 |

| 2010 | $1.55 |

| 2009 | $1.37 |

| 2008 | $1.26 |

| 2007 | $1.18 |

| 2006 | $1.11 |

The above table shows the regular dividend of Smuckers, which has grown by an average of 10.6% per year over the last five years.

Balance Sheet

Smuckers has a strong balance sheet. Total debt/equity is 0.25, which is very conservative. Slightly over half of shareholder equity consists of goodwill, which is due to the Folger’s acquisition and due to the smaller acquisitions in Smuckers history. The interest coverage ratio is over 11, which is moderately strong.

Investment Thesis

Smuckers is an interesting investment choice. With a market capitalization of over $8 billion, Smuckers has size and stability but plenty of room to grow. There are several Smuckers family members that own millions of dollars in company stock and run the company. When you have your name and your wealth on the line, in addition to 110+ years of operating history, you’re almost certainly going to think in the long-term instead of stressing about short term profits to please shareholders. Family-run companies in general tend to align with what makes a dividend-paying company good in the first place: consistency and an emphasis on long-term returns. The leaders are likely to be focused on building their company for the next generation.

The company, as can be seen by the above financial information, has chosen to focus on a path of dramatic growth that it has fueled by issuing shares to pay for acquisitions. In fact, between 2002 and 2011, Smuckers has increased its number of shares from 25 million to 117 million. Its largest purchase by far was Folgers which had a huge effect on company revenue and earnings. Normally, issuing so many shares would be concerning, but over this period, Smuckers has grown book value per share from around $11 to nearly $45, and grew EPS from $1.24 to $4.05. Over the trailing twelve month period, EPS is up to $4.17.

It’s remarkable that Smuckers has been able to grow so quickly by issuing shares, while also growing the value of each share at an above average rate. The company, therefore, significantly beat the market over the last decade. The company does acquisitions better than almost any other company out there. The main emphasis by this company is to focus on establishing and maintaining #1 brands.

In 2008, Smuckers initiated and completed a very large acquisition of Folgers coffee from Proctor and Gamble, and this was reported under the 2009 fiscal year. This resulted in issuance of stock, a special large dividend, and massively increased revenue and profits. Smuckers, over these years, now has a huge string of growth along with share dilution with the overall result being increased shareholder value.

In the next few years into 2013, Smuckers is focusing on company restructuring. They will be consolidating fruit spreads, ice cream toppings, and syrups into an existing Ohio facility and a new Ohio facility. Coffee manufacturing will be consolidated into two existing facilities in Louisiana.

Many dividend growth investors like to invest in companies that have histories of 25, 30, 40, or even 50 years of consecutive dividend growth and historically market beating returns. But hindsight is 20/20, and while many of those companies continue to be good values, perhaps few of them will be able to deliver the same shareholder growth for the next few decades. I could be incorrect, but I believe SJM could be one of those companies that, 20 years from now, was one of those very large cap blue-chip companies that delivered decades of consistent EPS and dividend growth and great shareholder returns. In my view, it has all the signs of a future dividend champion.

Risks

Like any company, SJM has risks. Being a food company, they are a defensive stock, but they always face risk in two main forms: commodity costs and cheaper private label competition. In addition, in contrast to many large American companies, Smuckers has most of its sales and operations in North America, meaning it is geographically concentrated. Numbers for 2011, with increased inventory and reduced free cash flow, were not as strong as one could hope for.

Conclusion and Valuation

I find that Smuckers, while reasonable priced, doesn’t offer any margin of safety in the low $70s where it currently trades. Although there are some headwinds, mainly in the form of commodity costs, I think the long term future of the company is bright. Unfortunately, a rich stock valuation results in a modest dividend yield. When computing the PEG ratio, even when adjusting for the dividend by adding the dividend yield to the growth figure, I get a value in the ball park of 1.4, which is a bit high in my view. Factoring in a great balance sheet, a defensive business, strong brands, an excellent history of growth, moderate company size, and the family ownership, I think Smuckers deserves a rich valuation of at least 15-16 times earnings, but investors will likely be limited to moderate returns. I’m currently a holder of SJM, but I’m not buying at this price.

Full Disclosure: I own shares of SJM and PG at the time of this writing.

You can see my portfolio here.

If you liked this article, consider subscribing to get my articles delivered to your email or reader.

Dividend Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, and investing tips:

I like the growth chart, but I would wait for a price break before buying. Nice analysis!

Matt,

Excellent analysis. I don’t have a position with this one, but it will be on my watch list. The growth in earnings, revenue and dividends have all been very solid. The acquisition of Folger’s seems to be well-timed and fits in well with their business.

On a side-note, I personally provide Smucker’s with a lot of revenue with my frugal diet of PB&J sandwiches! You can thank me later since you’re a shareholder! :)

Take care.

Hello. This is on my list for possible purchase. I read your earlier article and noted that you suggested that a price in the low 60s would be offer an attractive buying opportunity. Would you still see that level as a good entry point?

Thanks,

Tim

Hi Tim,

Yes, I think that in the low to mid $60s, SJM offers a good buy.

Thanks again Matt

Tim

I never considered this one before, thanks for the good read. From a bird’s eye view, this stock seems very similar to PG (price, industry, dividend). If you were going to invest in one of the two today, which one would you pick?

Big J,

I currently hold both SJM and PG. But if I were to invest fresh money, both of these seem fairly valued to me, so I’m putting money in less defensive areas right now.