Enbridge Inc. is a large and diversified Canadian energy company with a consistent stretch of dividend growth.

-Seven Year Revenue Growth Rate: 16.8%

-Seven Year EPS Growth Rate: 4.4%

-Dividend Yield: 2.91%

-Balance Sheet: Fairly weak, but stable

My overall view of Enbridge is that it’s an excellent business, but that Enbridge stock is trading at an overvalued price. It would be an excellent dividend stock to own at a lower valuation.

Overview

Enbridge Inc. (ENB) has energy generation and transportation operations throughout Canada and the United States. The focus is on gathering, transmission, and distribution of energy.

In 2011, the company had earnings of CAD $505 million from liquids pipelines, CAD $176 million from gas distribution, CAD $293 from gas pipelines and processing, CAD $344 from sponsored investments, as well as the loss from the corporate segment due to normal business expenses. The overall net income in 2011 was around CAD $1 billion.

A somewhat more visual description:

-Their natural gas gathering systems are located around the Gulf of Mexico.

-Their liquids pipelines extend from the Gulf of Mexico, up through the mid-continent, throughout the mid-western U.S., and then thousands of miles throughout Canada.

-Their gas pipelines extend from mid-western U.S. up through northwestern Canada.

-Their gas distribution network is located in eastern Canada.

-They also have wind turbines located in both eastern Canada and western Canada, as well as solar installations in eastern Canada.

Stock Metrics

Price to Earnings: 28

Price to Book: 3.8

Return on Equity: 13%

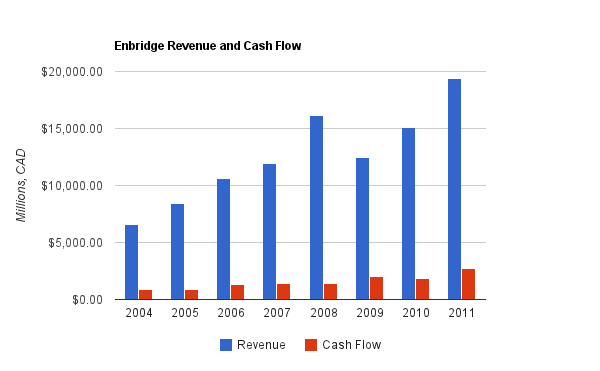

Revenue and Operational Cash Flow

Revenue grew by a compounded rate of 16.8% per year over this period, which is huge. Operational cash flow grew at a similar rate. Free cash flow, however, has often been negative due to large capital expenditures.

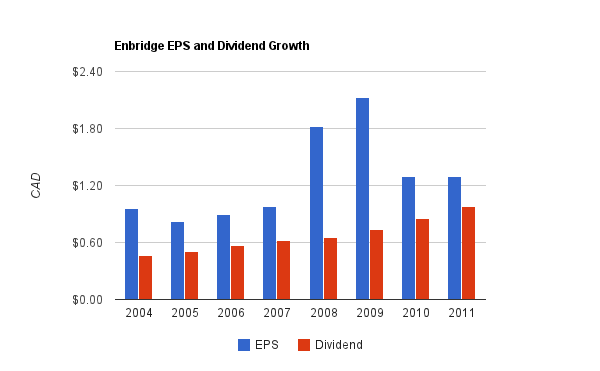

Earnings and Dividends

Earnings per share grew by about 4.4% per year, adjusted for a stock split. Dividends over the same time period grew by 11.4% annually. Going forward, dividend growth will have to be limited approximately to EPS growth. As can be seen, EPS grew at a substantially lower rate than revenue, which was due to decreasing profit margins and decreasing return on equity.

EPS growth is indeed expected to increase, however. Analysts currently target an average of 20% EPS growth over the next two years.

The current dividend yield is a bit under 3%. It’s comfortably supported by earnings, but free cash flow is erratic and fairly weak due to heavy capital expenditure.

Balance Sheet

Total debt/equity is over 1.8, total debt/income is around 16, and the interest coverage ratio is under 3.

Enbridge is a very asset-heavy business with reliable cash flows, and therefore requires large amounts of debt in order to achieve a reasonable return on equity. The company, however, is rather leveraged, even for an asset-heavy business. I view the balance sheet as fairly weak, but stable. Their leveraged position makes sense for the type of business they’re in.

Investment Thesis

Overall, Enbridge is a profitable and diversified energy business. With liquids pipelines, gas pipelines, gathering systems, and gas distribution, along with some renewable energy, Enbridge is well positioned. Combined with management culture that has consistently grown the dividend every year since the mid-90’s, this can potentially be a very attractive investment for Canadians and Americans.

The areas of growth are practically unlimited, as the business can operate in a variety of areas of energy production and energy transportation. There is potential for considerable oil and gas production increases in North America in order to have more reliable sources of energy. In addition, being open towards renewable energy installation projects is a plus.

General Partner

In addition to their wholly owned operations, Enbridge owns the General Partner and a percentage of the Limited Partner units of Enbridge Energy Partners L.P. Along with their general partner holding, Enbridge owns the Incentive Distribution Rights (IDRs) of this partnership.

Holding a general partner interest, and specifically the IDRs, can be extremely lucrative if operated well. I believe this is a major reason for Enbridge’s currently high valuation; their general partner cash flows can grow rather dramatically.

The reason is this: As Enbridge Energy Partners L.P. continues to grow its distribution, Enbridge Inc. benefits disproportionally. They will get a larger percentage of the total cash flows of the partnership. In addition, MLPs are particularly suited towards raising new capital; they finance their growth primarily through means of issuing units. As the partnership grows, Enbridge Inc. receives a larger and larger percentage of the growing total cash flows. So Enbridge Inc. benefits both when the partnership grows by issuing new units, and also when they increase distributions per unit.

If the partnership performs well, the limited partners will receive a high distribution yield and low/moderate distribution growth, while Enbridge Inc., the general partner, will benefit disproportionally, and receive larger and larger incentive distribution cash flows from the partnership. For more information, I discuss in more detail the benefits of being a general partner in my Energy Transfer Equity analysis.

Growth

Enbridge is not lack for growth opportunities. They have announced plans for very large expansions to some of their operations, including their joint Seaway project and their Flanagan South project. These will come online in a couple of years.

Longer term, the Northern Gateway project, if not delayed, could come online in 2017. This is a large project that will send oil through a westward pipeline, and condensate through an eastward pipeline, across western Canada. The product can then be shipped to customers across the Pacific. This 36-inch pipeline, if completed, is projected to produce cash flows for decades.

Risks

Enbridge operations are fairly reliable overall, since they have entrenched infrastructure positions, and much of their business is regulated. There are risks related to disruptions or spills, and a key risk is the cost of capital for their debt. The company also requires large capital expenditures that don’t result in very attractive levels of free cash flow.

I’d classify it as a rather low-to-moderate risk investment as far as equities are concerned, at least in terms of business operations. In terms of stock risk, however, there is risk for a reduction in the valuation of the company, and therefore a loss of paper investment value.

Conclusion and Valuation

After all the great things that have been said, a key question should be whether a company is attractively valued or not.

For a company like this, my preferred valuation method is the dividend discount model. If Enbridge grows the dividend at a low double-digit rate over the next five years, followed by high single digit dividend growth thereafter, then a price in the mid-$30’s is reasonable. Those estimates don’t leave any margin of safety, however. The current price is in the upper $30’s, almost $40.

I wouldn’t pay more than $32 for Enbridge stock, which is a substantial discount to the current price. This is based on a 11% discount rate, estimates of fairly high dividend growth, and a small margin of safety.

Full Disclosure: As of this writing, I have no position in ENB, and am long ETE.

You can see my dividend portfolio here.

Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

Great review Matt. I agree with your analysis, but believe the valuation premium is mainly due to scarcity value. In Canada, there is a limited supply stable dividend growth stocks, especially in the large cap space. As a result, Enbridge is a top 10 holding in virtually every Canadian Dividend Fund and has a very loyal following among institutional and retail investors.

Given the amount of leverage in the business, the valuation is also very sensitive to rising interest rates. We have also witnessed a lot of “bond refugees” take a position in Enbridge in recent years.

Thanks for the comment and the recommendation to do the analysis.

I think the General Partner aspect does contribute somewhat to the valuation, as ENB can grow faster than a utility that doesn’t hold a GP. But you may be right about scarcity being involved. The stock does seem to have a very large holding among Canadian institutions- banks, asset managers, etc.

Hi DM,

Completely agree with your view. A good business should be expensive, but it should not be outrageously priced, otherwise investors will not receive the returns they are hoping to get.

I wrote a similar posting (albeit less in-depth) on a few of today’s darling stocks (Starbucks, Lulu, Enbridge and LinkedIn).

http://averagecfa.blogspot.ca/2012/03/priced-to-perfection.html

Would you go as far as shorting Enbridge at these prices?

Regards,

Paul

Personally I wouldn’t short it, since I don’t make predictions about timing; only estimates about valuations. I can calculate a range of what something is worth, but predicting investor psychology about where or how it will return to that range is not something I do. A short would leave me open to market psychology.

Interestingly, Morningstar has a higher calculated fair value than I do for the stock, although still a number that’s lower than the current price.