Summary

Emerson Electric Company (EMR) is a broad industrial technology company that is involved with a number of different industries worldwide.

-Seven Year Sales Growth Rate: 6.5%

-Seven Year EPS Growth Rate: 11.9%

-Dividend Yield: 3.20%

-Balance Sheet: Moderately Strong

Shares of EMR stock look reasonably valued at the current price of $50 in my opinion. Significant stock price dips compared to early 2011 have resulted in what I consider to be a fairly appealing dividend stock price.

Overview

Emerson Electric Company (NYSE: EMR) is a Fortune 500 industrial technology company based in Missouri. The company was founded over 120 years ago and provides a very large array of technology products and services. The company draws 45% of its revenue from the United States, 23% from Asia, 22% from Europe, and 10% from other places of the world. With over 130,000 employees, Emerson’s technologies are powering the world’s data centers, telecommunications equipment, and facilities.

Business Segments

Emerson Electric Co. currently consists of five business segments:

Process Management

Emerson’s largest business segment, Process Management, accounts for 28% of revenue. The Process Management segment provides control systems, monitoring systems, asset optimization, components, and services. Only 38% of the revenue from this segment comes from the United States, with the rest being spread out rather equally from Europe, Asia, and the rest of the world. Compared to 2010, sales and earnings were up 16% and 28%, respectively, in 2011.

Network Power

Emerson’s Network Power segment accounts for 27% of revenue. In this segment, Emerson provides power products and solutions for data centers and telecommunications networks. This includes AC power systems, DC power systems, cooling systems, embedded computing and power, uninterrupted backup systems, and service (including 24-hour service). Only about 39% of the revenue from this particular segment comes from North America, with Asia accounting for another 33% of this revenue. Compared to 2010, sales were up 17% and earnings were down 6%, respectively, in 2011. The earnings decrease was due to narrower margins, which were attributed to higher Chinese labor costs, increased material costs, competitive pricing in the Chinese telecommunications sector, and additional investment in next generation data center technologies.

Industrial Automation

Emerson’s Industrial Automation segment accounts for 21% of revenue. They provide a variety of automation products for companies, including industrial equipment, power systems, motors and drives, mechanical power transmission, and fluid automation. Revenue from this particular segment comes strongly from Europe and North America, though Asia and other areas provide revenue as well. Compared to 2010, sales and earnings were up 23% and 40%, respectively, in 2011.

Climate Technologies

Emerson’s Climate Technologies segment accounts for 16% of revenue. Emerson provides compressors, temperature controls and electronics, and sensors, as well as a variety of other products and services, to provide homeowners and businesses with the tools needed for heating, air conditioning, refrigeration, and overall climate control. Slightly over half of the revenue from this particular segment comes from North America, while the rest is spread out fairly equally around several other parts of the world. The segment is rather concentrated in compressors, as they account for three quarters of this segment’s total sales. Compared to 2010, sales and earnings were up 5% and 3%, respectively, in 2011.

Tools and Storage

Emerson’s Appliances and Tools segment accounts for 8% of revenue. They produce a variety of products in this segment, ranging from commercial motors to waste disposals to storage solutions to pipe-working tools. Over 80% of the revenue from this particular segment comes from within North America. Compared to 2010, sales and earnings were both up 5% in 2011.

Sales, Earnings, Cash Flow, and Metrics

Emerson Electric Co. and Emerson stock was hit hard by the recession, as they sell many of their products and services to businesses that encountered severe financial troubles. The company, however, has decades of consistent growth, through peaks and recessions. They maintained profitability throughout the low point in the economy, and increased investment during the most difficult periods.

From 2002 to 2008, sales increased at a very swift annualized rate of over 10%. Net income more than doubled between 2003 and 2008. But from 2008 until 2011, economic difficulties disrupted the growth, resulting in a decrease followed by a rebound.

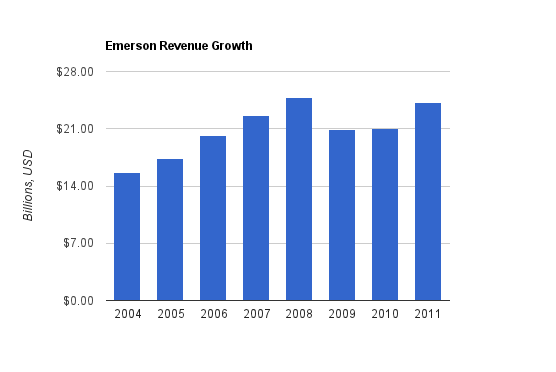

Sales Growth

| Year | Revenue |

|---|---|

| 2011 | $24.222 billion |

| 2010 | $21.039 billion |

| 2009 | $20.915 billion |

| 2008 | $24.807 billion |

| 2007 | $22.572 billion |

| 2006 | $20.133 billion |

| 2005 | $17.305 billion |

| 2004 | $15.615 billion |

Sales growth over this period was nearly 6.5% annualized, but the high point was in 2008.

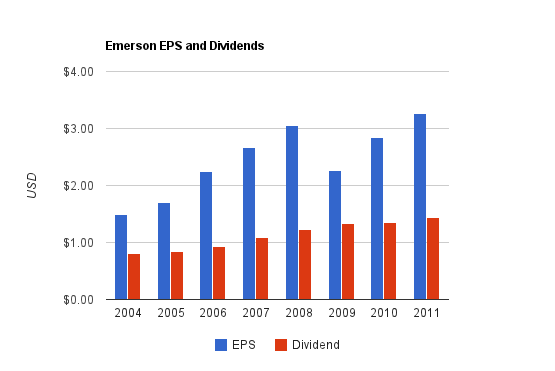

Income Growth

| Year | EPS |

|---|---|

| 2011 | $3.27 |

| 2010 | $2.84 |

| 2009 | $2.27 |

| 2008 | $3.06 |

| 2007 | $2.66 |

| 2006 | $2.24 |

| 2005 | $1.70 |

| 2004 | $1.49 |

Emerson has averaged 11.9% EPS growth over this period, although the bulk of the growth occurred before 2008.

Cash Flow Growth

| Year | Operating Cash Flow | Free Cash Flow |

|---|---|---|

| 2011 | $3.233 billion | $2.586 billion |

| 2010 | $3.292 billion | $2.768 billion |

| 2009 | $3.086 billion | $2.555 billion |

| 2008 | $3.293 billion | $2.579 billion |

| 2007 | $3.016 billion | $2.335 billion |

| 2006 | $2.512 billion | $1.911 billion |

| 2005 | $2.187 billion | $1.669 billion |

| 2004 | $2.216 billion | $1.816 billion |

Emerson has grown operating cash flow by approximately 5.5% annualized over this period, and free cash flow by approximately 5.2% annualized.

Q1 2012 Performance and Full Year 2012 Outlook

Emerson’s first quarter performance for 2012, which occurs during the fourth quarter of the previous calendar year, was somewhat subdued. Sales were down 4% and EPS was down over 20%. Much of this was attributed to $300 billion worth of sales delays caused by supply line disruptions from Thailand flooding, and some of it was attributed to general economic weakness or timing of capital expenditures from businesses. The company reports that the supply lines are restored, and that the company management expects 2012 to “be a good year with record financial performance”. Specifically, the process management and network power segments were struck the hardest by the Thai flooding, and record backlogs in the process management segment are expected to provide good sales.

For 2012, management’s outlook is for reported sales growth of 2-4%, EPS of $3.45 to $3.60, operating cash flow of $3.5 billion, and capital expenditures of $700 million.

Metrics

Price to Earnings: 15.8

Price to Free Cash Flow: 14.5

Price to Book Value: 3.5

Return on Equity: 23%

Dividends

Emerson has increased their dividend for 55 consecutive years, which is absolutely remarkable. For over half of a century, there has not been one year where Emerson did not raise their dividend for shareholders. It’s notable that several businesses such as Emerson Electric (EMR), Leggett and Platt (LEG), Dover Corporation (DOV), and Illinois Tool Works (ITW) are in rather cyclical industries and yet have some of the longest dividend records around.

The current dividend payout ratio from earnings is approximately 50%, and the dividend yield is 3.20%.

Dividend Growth

| Year | Dividend |

|---|---|

| 2011 | $1.435 |

| 2010 | $1.35 |

| 2009 | $1.325 |

| 2008 | $1.23 |

| 2007 | $1.0875 |

| 2006 | $0.93 |

| 2005 | $0.845 |

| 2004 | $0.8075 |

Emerson grew its dividend at an average annual rate of approximately 8.5% over this period. Dividend growth was rather low through the recession in 2008, 2009, and 2010, but in 2011, the company boosted the quarterly dividend from $0.345 to $0.40, which is a 14.5% increase.

Share Repurchases and Acquisitions

Between 2006 and 20011, Emerson brought in $12.4 billion in free cash flow.

Over this same period, $4.5 billion was spent on net acquisitions, from which nearly half occurred in 2010 with what are in my opinion, smart and targeted acquisitions in the network power segment. $5.5 billion was paid out in dividends over this period. $4.6 billion was spent on share repurchases, and the number of Emerson shares decreased from 820 million to 750 million.

Balance Sheet

Emerson Electric has a total debt/equity ratio of approximately 55%. Goodwill, however, makes up 85% of shareholder equity, due to Emerson’s acquisitions. The interest coverage ratio is 15, which is quite solid. The total debt/income ratio is under 2.5.

Overall, Emerson’s balance sheet is very robust.

Investment Thesis

Emerson Electric Company produces technology and services that stretch across numerous industries and are highly necessary. Process Management and Automation control systems allow manufacturers and energy producers to do what they do, and Network Power allows data centers and telecommunications networks to do what they do. Much fundamental backbone business infrastructure relies on Emerson. As the world continues to develop and modernize, Emerson has an ocean of opportunities to grow as long as it can continue to be competitive.

Emerson is an engineering company that doesn’t require a huge amount of technical expertise to invest in. Although sometimes technically complex, the products are straightforward, easily understood in principle, not flashy, and they have long product life times. They sit in the back room and keep the business running. Emerson also has a role to play in clean energy, providing products and services to control and optimize various forms of energy production.

Even in the deepest part of the recession, although EMR was very much affected, the cyclical company continued to produce a profit. Their stable financial condition, necessary products, and geographical spread around the world allowed them to weather the storm. In fact, Emerson spent $2 billion for acquisitions during 2010, which is up significantly from previous years. Specifically, the largest acquisitions were Avocent, which provides a host of technologies for data centers, and Chloride, which provides uninterruptible power supplies.

It’s not too hard to argue that being a leading player in the data center industry is going to be a good long term growth area for Emerson. In addition to continued growth in emerging markets, data centers play a key role in the shift of computing hardware from the client side to the server side with what is termed “cloud computing”. Various online media sources and business tools all need to run in data centers, and data centers need to be supported by multiple redundant systems and continually improved cooling technology. Emerson provides a broad set of products and services that support data centers, and recent acquisitions should strengthen its already strong position.

The fact that Emerson serves telecommunications carriers with similar technology is a bonus in my book as well. Data consumption isn’t going down any time soon.

The process management and industrial automation segments are in industries that, globally speaking, have nowhere to go but up, in my view. Improved technologies allow Emerson to put wireless automation and measurement systems in extremely hot metal production areas, in arctic oil production areas, and in Middle Eastern deserts. As another example, in February 2012 Emerson won a contract to install a control system with 7,500 I/O points into one of the largest waste-to-energy facilities in China. That’s a good trend to be involved in. Automation technologies from Emerson also play a role in wind turbines and solar installations, which are well-known growth areas.

Combining these necessary products and services with a company culture that has produced over a half-century of consecutive dividend increases, I expect Emerson to continue to do well for years to come. Their balance sheet and cash flow are fairly strong, and the company exists within growing industries and operates around the world. I specifically like the largest business segments of Emerson Electric (Process Management, Network Power, and Industrial Automation), and I believe this gives them a very strong position for good total shareholder returns.

Risks

Like any company, Emerson has risks. Notably, Emerson took a rather large financial hit in this recession. The company is reliant upon the health of businesses around the world, and has a variety of competitors from around the globe. It is well-positioned within appealing industries, and to preserve its status and maintain its margins, it’s going to have to compete against other businesses that want a share in the growth. There is integration risk for acquisitions, risk of acquisitions not providing enough synergy to justify their costs, and currency risks. The Thai flooding demonstrated supply line risks as well.

Timing of capital expenditures from businesses can affect Emerson Electric’s reported income and sales. Expanding telecommunications facilities, or adding new data centers, are major acquisitions and can sometimes be delayed.

EMR stock has been somewhat volatile in recent years, which can be a good thing for value investors.

Conclusion and Valuation

When Emerson stock was in the mid-$50’s, I reported that the stock price looks fair, albeit without any margin of safety, and that looking for price dips might be prudent. Emerson stock has come down a bit in price, and at $50 it looks reasonably appealingly valued to me.

I think in the long term, Emerson Electric Co. is likely to continue to prosper as a company, and I think that EMR stock is a reasonable buy at around $50. The estimated forward P/E of Emerson stock is currently around 14, and estimated forward P/FCF is around 13. Taking into account acquisition expenditure, and also realizing that coming up with a precisely estimated long term growth rate for a company with this amount of economic sensitivity is unrealistic, there is a rather broad range of intrinsic values for which it is reasonable to purchase Emerson stock. Using a high-single-digit estimated EPS and dividend growth rate coupled with a low-double-digit discount rate results in an intrinsic value of above the current stock price, thus providing a margin of safety. I’m willing to add to my position when the stock is in the $40’s and $50’s, and I also view this a good stock to write puts on with the intention of buying should the options be assigned.

Full Disclosure: I am long EMR and LEG at the time of this writing.

You can see my dividend portfolio here.

Get the Dividend Stock Newsletter:

Sign up for the free monthly dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

I bought this a couple months ago, and sold with a fast 10% gain. If it dips back below $48 again, I may buy back in.