One of the quickest ways to check the valuation of a stock is to look at its price-to-earnings ratio (P/E), also known as the earnings multiple. This is probably the most common and efficient way to assess whether or not you are paying too much for a stock. This article will explain how to quickly assess the value of a stock with the earnings multiple approach to valuation. It will also show you how you can use the P/E ratio in your investing process and help you understand the limitations of this approach to valuation.

What is the Earnings Multiple and How to Calculate It?

In simple terms, the earnings multiple is the stock price divided by earnings per share (EPS), and the units are expressed in years – that is, how many years of those earnings it would take to equal that stock price.

For example, if a stock is $50, and its EPS is $2.50, then the earnings multiple is $50/$2.50 EPS = 20. The stock price is expressed in dollars, the EPS is expressed in dollars per year, so the earnings multiple of 20 is expressed in years. It would take twenty years of $2.50 each year to get $50.

Of course, the earnings multiple alone doesn’t tell us much. If the company is growing its EPS each year, then in reality it will take less than that number of years for cumulative EPS to sum to the current stock price. Therefore, what constitutes a “fair” earnings multiple depends on several factors like growth and stability. Depending on the sector and type of company, a “fair” P/E ratio is completely different. We’ll get there later in this article.

The Earnings Multiple Valuation Approach

Having an intuitive understanding of what constitutes a “fair range” of earnings multiple for a stock allows an investor to calculate some scenarios about future stock price. This method can serve as an alternative to doing Discounted Cash Flow Analysis and can be used whether or not the company pays a dividend.

The method is to estimate EPS growth over a period of years. Then place a hypothetical earnings multiple on the EPS figure at the end of that period. Finally, compare that hypothetical stock price to the current stock price, which can allow for quick calculation of expected rate of return over that period. There are three components to the final value:

1) The final stock price at the end of the period.

2) Cumulative dividends received over that period.

3) The impact of cumulatively reinvesting those dividends.

An Example of the Earnings Multiple Valuation Approach

Suppose a railroad company, called “DM Rail” currently has EPS of $2, pays annual dividends of $1, and has a stock price of $40. Since 40/2 is 20, the earnings multiple is 20.

You think that may be a little bit high and would rather see a lower earnings multiple. You decide to look at the track record of growth along with the future company plans to make a 10-year estimate. Based on previous growth, management goals for EPS growth, explanations of how they’ll reach those goals, and other factors, you estimate a 10% rate of EPS growth over the next ten years. You then assume that the dividend payout will stay the same, so the dividend also grows by 10% per year.

The table of growth would like something like this:

| Year | EPS | Dividend |

|---|---|---|

| 0 | $2.00 | $1.00 |

| 1 | $2.20 | $1.10 |

| 2 | $2.42 | $1.21 |

| 3 | $2.66 | $1.33 |

| 4 | $2.93 | $1.46 |

| 5 | $3.22 | $1.61 |

| 6 | $3.54 | $1.77 |

| 7 | $3.90 | $1.95 |

| 8 | $4.29 | $2.14 |

| 9 | $4.72 | $2.36 |

| 10 | $5.19 | $2.59 |

The numbers of Year 0 are the trailing twelve-month period that you’re looking at, so the holding period, if you buy the stock, would be years 1-10 (for a ten year holding period).

You believe that the earnings multiple is a bit rich currently. On the other side, you feel that the company has this fairly strong growth ahead. You would like to simulate what would happen if, over time, the market decides to lower the earnings multiple of the stock. You assume an earnings multiple of 16 is fair.

Fast Forward 10 Years From Now

In ten years, if the company grows as expected, EPS will be about $5.19, and 16 x $5.19 = $83.04. That’s the estimated stock price 10 years from now, but we still must consider dividends.

The cumulative dividend value over that ten-year period (year 1 through year 10, just adding up ten years of dividends) was $17.52. This was calculated with a simple spreadsheet. We will obviously not just collect dividends and leave them in an account. We could instead reinvested them somehow (either back into the stock using a DRIP program or into another investment). Therefore, those dividends have a time value and made more money during the decade, which we now have to take into account.

We can say, roughly, that dividends can be invested for an 8% rate of return. This is close to and a bit under the S&P 500 average rate of return, just to be on the conservative side. Assuming that, then these dividends mean that an additional $6.38 was generated over this period due to the money made from reinvesting those dividends. That calculation assumes dividends were reinvested annually – assuming a quarterly reinvestment rate will change the value by a few extra pennies.

You can also use an 8% assumed rate of return for the dividends over a ten year period without using a spreadsheet. You can say that the amount generated from reinvested dividends was about a third of the total cumulative dividend value (in this case, $6.38/$17.52 = 36%). So, that’s just a quick shortcut. Rather than calculating the effect of reinvested dividends each time, if you’re assuming an 8% rate of return and a ten year period, you can just take cumulative dividends, and then add another 1/3rd of the cumulative dividends which represents the reinvested value of those dividends.

Total 10 Years Result

So, the total value at the end of this period is:

(Final Stock Price) + (Cumulative Dividends) + (Value from Reinvested Dividends)

Using the shortcut, it’s just:

(Final Stock Price) + (1.33 x Cumulative Dividends)

In this example, using the longer method, the final value is:

$83.04 + $17.52 + $6.38 = $106.94.

This means that over this ten-year projected period, $40 turned into $106.94. This translates into an annualized rate of return of 10.3%, even though the earnings multiple dropped from 20 to 16. This simulation can be run in various ways for different rates of EPS/dividend growth. You can also use different final earnings multiples as assigned by the market at that time in order to determine a range of scenarios that might happen. This can give you an idea of what some poor scenarios are, as well as some fair scenarios or particularly bullish scenarios.

How I Use the P/E Ratio in My Analysis

Unfortunately, the technique explained above is only as good as your assumptions. If you are like me, your crystal ball is broken, and you can’t know for sure what the company’s earnings dividend growth will look like 10 years from now. For this reason, I’ve created a shortcut to use the price-earnings ratio in my stock analysis.

An easy way to know if you are paying too much for a stock is to look at the company’s 10-year P/E ratio history. This will tell you how much investors are willing to pay on average for shares of a company. Proceed with caution; even if you pay a lower multiple than the 10-year history, it doesn’t mean you got a deal. Let’s use an example to illustrate how to interpret P/E variation over time.

Apple P/E Ratio Between 2010 and 2021

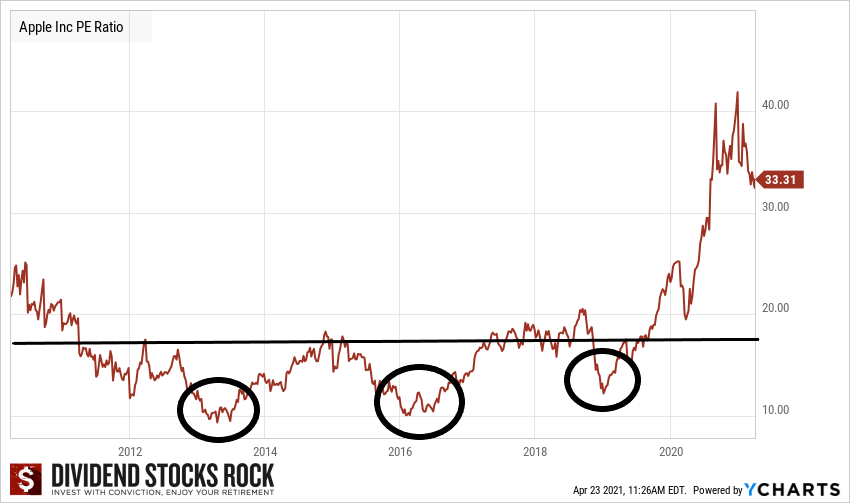

Let’s take a well-known company, Apple (AAPL), and see how its price-earnings multiple has fluctuated between April 2010 through April 2021.

source: Ycharts

I’ve picked AAPL to show how an investor “success-story” could have been hard to read when you look solely at its valuation. As crazy as it seems, you had the chance to grab shares of AAPL at a P/E ratio of 10-12 three times in the past 10 years.

When we know what happened to the stock in the past 10 years, it seems obvious to buy it whenever its valuation reaches such a low point. However, if you remember what happened back in 2014, the picture wasn’t that clear. Back then, the iPhone was pretty much the only reason why Apple was in business. The popular smartphone brand was losing market share to its rival, Samsung. Chatters started that Apple would get “blackberried” by its competitor the very same way it did with the one hit wonder handheld BlackBerry. The market didn’t believe Apple could weather the storm and that sales would plummet.

For these reasons, the P/E ratio decreased all the way down to 9. Lesson #1, when the P/E ratio decreases, start looking for reasons to explain this shift. Some companies trade at a very low P/E before reporting losses and eventually become bad investments. In other words, a P/E contraction may be a message telling you the market doesn’t believe in the stock anymore. It could be a great opportunity, or simply the reality that this business won’t thrive. A complete stock analysis process will reveal the answer to this question.

What is P/E Expansion?

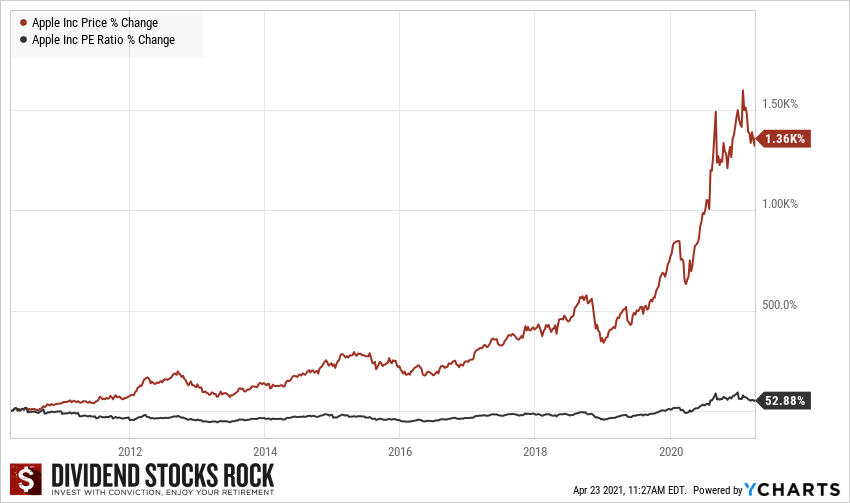

While Apple had a few rough periods, what catches our attention now is the incredible run the stock has had on the market. Over the same period, the stock price skyrocketed by more than 1,000%! Not bad for a PE expansion of “only” 53%.

Source: Ycharts

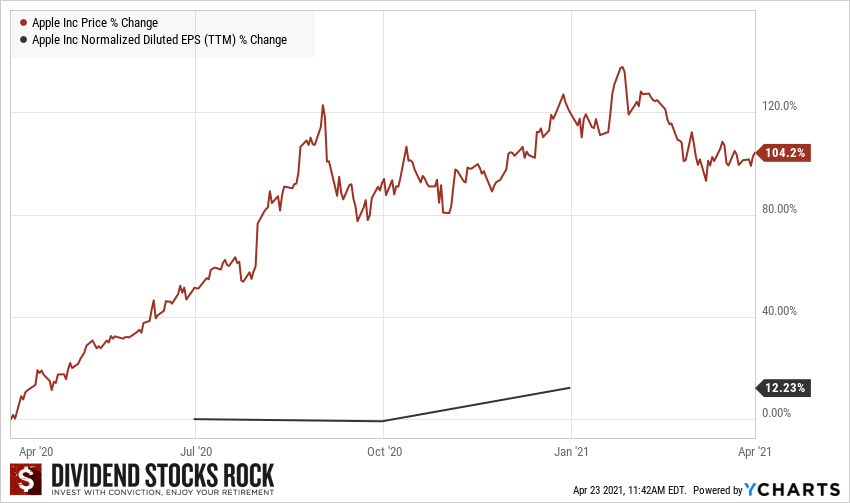

P/E expansion happens when there is hype building around a stock. This means its price goes up faster than its earnings growth. In Apple’s case, the period between April 2020 and April 2021 is a perfect example of a P/E expansion. While AAPL’s EPS grew by 12% over the past 12 months, its price more than doubled.

Source: Ycharts

In some cases, this is a clear message that you are about to pay a steep price that is unjustified. This is always a risk when the market anticipates future earnings growth (go back to the The Earnings Multiple Valuation Approach section of this article). What if earnings don’t grow as expected?

The story around Apple’s stock surge is the eventual shift of consumers from regular iPhones to a smartphone that will use the 5G technology. At the time of the writing of this article, the market expected over 300M iPhone owners were ready to make the switch and buy a better (and pricier) iPhone to enjoy the 5G. This thesis obviously leads to strong earnings growth. However, we are just talking about assumptions here.

Final Thought on Using the P/E 10-year History

The earnings multiple approach to valuation is far from perfect. Most of the time, P/E fluctuation will be explained by either a massive market movement (general bullish or bearish movements) or by specific events / news around a company or a sector.

By identifying the earnings multiple variations, you get your starting point to investigate further. You can then find the narrative driving the multiple up or down and decide if you agree. The best-case scenario is when you see a P/E ratio under the 10-year average but there are no specific events to explain the P/E ratio level. This may mean, the entire market is bearish, and you just found a great opportunity.

Proving a Fair Earnings Multiple

Often, earnings multiples are just used to compare two companies within the same industry. You can also use earnings multiple to compare the same stock at two different points in time. It can also be used to check the valuation of the entire market, like with the Shiller P/E ratio.

However, using other valuation methods like the Dividend Discount Model or Discounted Cash Flow Analysis, you can determine an intrinsically fair stock price for a company, based on expected future profitability and a target rate of return. Playing around with valuation methods and checking the P/E ratios of those calculated fair values will help investors making decisions. It will provides investors with experience about what earnings multiples are fair compared to amounts of growth and stability. Once an investor has that intuitive understanding, it’s easy to do back-of-the-envelope calculations about stocks. It is easy to look at earnings multiples, expected growth levels, and make reasonable estimates of fair value.

Finding the right stock value before making a purchase

As you can see, determining the entry point of a stock is not easy. The one product I offer on this site is the Dividend Toolkit, which is a comprehensive stock guide that also comes with an easy-to-use valuation spreadsheet to calculate the fair price for dividend stocks. The book along with its spreadsheet will save you time and simply your stock valuation methodology. You will also find complete information on how to use the calculation table in order to buy stocks.

Disclaimer: I hold shares of AAPL.

Great explanation, especially on the complex issue of determining a “fair” P/E ratio.

The nugget about using EPS growth to estimate future dividend growth is something that I had not realized before.

Your article has reinforced in my mind that there is something to be said for simply averaging into high-conviction companies over the long run.

Hello,

Which particular EPS( I mean Basic or Diluted or Normalized Diluted) do you use to determine the P/E ratio.

Thanks.

Marcel

Hello Marcel,

I prefer to use the diluted normalized EPS.

Cheers,

Mike