The Dividend Discount Model (DDM) is a key valuation technique for dividend growth stocks.

The most straightforward form of it is called the Gordon Growth Model. This guide explains how it works and the streamlined way to use it. The Gordon Growth Model is used to determine the intrinsic value of a stock based on a future series of dividends that grow at a constant rate. In other words, the model will give you the value to pay today for a stock that will pay and hopefully grow its dividends in the future.

Determining the fair value of a company means using Discounted Cash Flow Analysis (DCFA). DCFA, put simply, states that the present value of a company is equal to the sum value of all future cash flows that the company produces. But each future cash flow must be discounted to translate it into today’s dollars. This is logical: the purpose of a business is to produce cash flows, so the value of the business is equal to the sum value of all future discounted cash flows.

What Discounted means?

By discounted, what I mean is that due to the time value of money, a payment in the future is worth less than the same payment today. Imagine you can earn a 10% rate of return on your money over time. Therefore a payment of $10,000 one year from now would only be worth $9,091 to you today, because if you had $9,091 today, you could invest it at a 10% rate of return and turn it into $10,000 a year from now ($9,091 multiplied by 1.10 equals $10,000).

Therefore, the discounted value (also referred to as the net present value) of $10,000 one year from now, is equal to $9,091.

Here’s another example. Imagine you were to receive $10,000 in five years. Therefore, this sum would only be worth $6,209 to you today. You could take $6,209, invest it at a 10% annual return and get $10,000 in 5 years. $6,209 multiplied by 1.10 five times in a row equals $10,000.

Therefore, the discounted value (or net present value) of $10,000 five years from now, is equal to $6,209.

Assess the value of a business

In finance, we use the discounting concept to find the current value of a business or a stock price.

To value a business, you would take the discounted values of all future annual expected cash flows, sum them together, and that’s the fair value of the business. You’re trading a present sum of money (the fair value), for a future series of expected cash flows, but each cash flow has to be translated into today’s value to take into account the time value of money and your target rate of return on your current money.

The inputs you need are the current free cash flow figures, the projected growth rate of those cash flows, and your target rate of return to use as the discount rate.

Obviously, there is a mix of art and science involved here. If appropriate inputs (expected cash flows) are used, the output (current intrinsic value) is objective. But since the inputs are future expected cash flows, there is uncertainty in those figures, and it requires reasonably accurate estimates to be useful.

Enter the Dividend Discount Model

You can take that same approach, and tailor it specifically for analyzing a stock that pays dividends. This method is the Dividend Discount Model (DDM). It’s also called the Dividend Growth Model, and the most straightforward form is called the Gordon Growth Model.

The DDM is based on the exact same idea, except that the share of stock represents what we’re valuing, and all future dividends represent all future cash flows of that share. The value of the stock is equal to the sum of the net present value of all future dividends.

For example, let’s say you’re analyzing a share of stock that pays $0.50 in dividends per quarter, or $2.00 per year. Furthermore, it’s a dividend king that has raised the dividend consecutively every single year for 50 years or more. You look over its history and find that it has increased the dividend by an average of 8% per year over the course of several decades, but that the growth is slowing down. So, you estimate that the dividend will continue to grow by an average of only 5% per year going forward.

If you desire an 11% annual rate of return on your money, which would represent a very good return, then you can use that as your discount rate. Using the discounting concept, when the $2 in dividends goes up to $2.10 next year (because it grew by 5%), this $2.10 is only worth $1.89 to you today. If you had $1.89 today, then you could turn it into $2.10 in a year if you could compound it by 11% during that period.

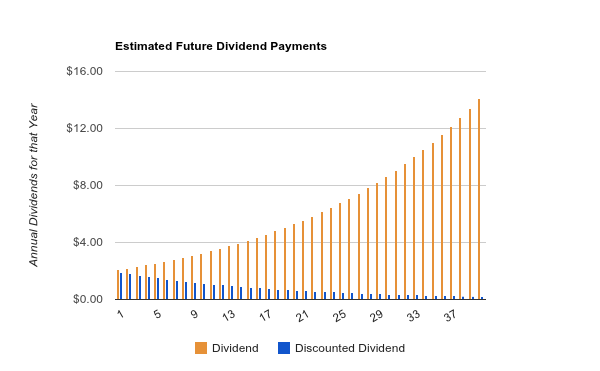

The following chart shows the estimated value of dividend payments over the next forty years.

The orange values are the actual dividends you expect to be paid if the dividend grows by 5% per year. The blue values are the discounted versions of those dividends; the dividends translated into today’s value based on your discount rate of 11%. As can be seen, if this chart continues forever, the sum of all dividends would be infinite, but the sum of all discounted dividends is finite, because the discount rate is larger than the dividend growth rate. In other words, a dividend paid in 50 years from now isn’t worth much today.

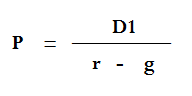

The Dividend Discount Model Formula

To calculate the fair value of this stock, we need to sum up all those discounted dividends. It can be done with fancy math, but after several mathematical cancellations, the accurate equation is extremely simple, and this is called the Gordon Growth Model:

In the formula, P is the fair price of the stock. D1 is next year’s expected dividend, which would be $2.10 in this case. The r value is the discount rate (1.11 in our example), and g is the dividend growth rate of 1.05.

When you enter all the numbers into the equation, you get $35. That’s the fair value of this hypothetical stock, assuming the current dividend of $2.00 really grows at that 5% per year into the future, and assuming an 11% rate of return is desirable to you. The math shows that it would be fair to trade $35 in present value for the sum value of all future dividends, because when they are discounted by 11% per year, the sum of them all is $35.

If your estimates are correct, you’ll get a nice double-digit long-term rate of return.

Shortcomings of the Dividend Discount Model

The first flaw of the Gordon Growth Model is that it assumes a constant dividend growth rate; it’s a constant growth model. This may be an acceptable estimate for a high-yielding mature company, but for stocks with lower dividend yields and higher dividend growth, this may not be appropriate.

To fix this, you can move towards a more general two-stage or multi-stage Dividend Discount Model. The math gets a bit more tedious at this point, but a multi-stage DDM allows you to estimate that the dividend will grow at a certain rate for several years, and then slow down to another growth rate after that.

The second flaw of both the Gordon Growth Model and the whole Dividend Discount Model is that it’s quite sensitive to the accuracy of the inputs. Because dividend growth rates tend to be high (higher than core company net income growth usually, due to share buybacks), even minor variances between the estimated dividend growth and the real dividend growth will radically alter the valuation. This is why you should always have a margin of safety in your estimates. This also means that the DDM tends to be better for high yielding dividend stocks with lower dividend growth, rather than lower yielding stocks with higher dividend growth rates.

Finally, the use of a different discount rate will have a major impact on your results. The difference between using a 9% discount rate vs 10% would make the stock switch from a bargain to a highly priced investment.

Related article:

Dividend Discount Model Limitations – And How to Manage Them

Dividend Discount Model Spreadsheet

The one product I offer on this site is the Dividend Toolkit, which is a comprehensive stock guide that also comes with an easy-to-use valuation spreadsheet to calculate the fair price for dividend stocks.

Specifically, it’s a spreadsheet tool that lets you put in a single set of inputs, and then it automatically calculates a range of fair values based on different outcomes.

All valuation methods rely on estimated inputs. The two main things you need are an estimate for the growth rate, and your discount rate. (Your discount rate should be your target rate of return.). But if those inputs are off even slightly, the whole valuation method will be off. With basic freebie valuation calculators, you need to put in more than one set of inputs if you want to see several output options, and you have no way of keeping track of the differences.

How to use the Dividend Discount Model Spreadsheet

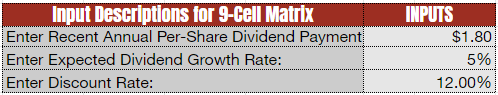

Suppose you want to calculate the fair value of a stock using the Dividend Discount Model (which is explained in significantly more detail in the book), and you estimate that the dividend will grow by 5% per year, and you’re using 12% as your discount rate. First, you put the simple inputs into the Dividend Discount Model spreadsheet tool:

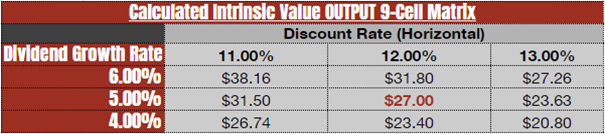

And the tool instantly updates the output chart to tell you the fair value of the stock:

This output chart will not only tell you the fair stock value based on those inputs but will also tell you the fair stock value based on nearby inputs. In this example, in addition to calculating the results for 5% dividend growth and a 12% discount rate, it will automatically show what the fair value is if it turns out that the stock only grows its dividend by 4%, or if you use a discount rate of 11% instead.

Different inputs, different results

This tool provides nine total output values, centered around the primary estimate. In this example, because I chose 5% for my estimated dividend growth rate, the output chart automatically adjusts to show the calculated fair values for 4%, 5%, and 6% growth. And because I chose 12% for my discount rate, the output chart automatically adjusts to show 11%, 12%, and 13% discount rates.

So, there are nine total outputs. In this example, I was looking to estimate the value of this stock that paid $1.80 in dividends with estimates for 5% annual dividend growth and a 12% discount rate. The primary result is the $27.00 figure in the middle, which corresponds to 5% growth and 12% target rate of return. The result in the top left corner shows a related estimate, except that it shows the fair value for the same stock with a 6% dividend growth rate and with a less aggressive 11% discount rate. The result in the bottom right corner shows another estimate, except that it shows the fair value if the stock only has a 4% dividend growth rate and if a 13% discount rate is used. The other cells show other combinations in between those two extremes.

Take a look at the Dividend Toolkit if you want that tool, or read the reviews. Thousands of investors use it now. The guide covers how to make reasonable estimates for dividend growth as well.

You can also use this free dividend discount model calculator to see how it works.

Dividend Discount Model calculator Google spreadsheet

Either way, make sure you’re signed up for the monthly dividend newsletter, at no cost

Strategic Dividend Stock Newsletter

Sign up for the free dividend investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies.

[…] using the same model, but getting completely different results. Today I will take a look at the dividend discount model (DDM) limitations and how I deal with […]