Automatic Data Processing (ADP) is a conservatively managed, diversified company that has increased its dividend every year for over 3 decades.

-Seven Year Revenue Growth Rate: 3.3%

-Seven Year EPS Growth Rate: 6.7%

-Seven Year Dividend Growth Rate: 14.2%

-Current Dividend Yield: 2.94%

-Balance Sheet Strength: Extremely Strong

I view ADP as an excellent business, but not one that’s at a particularly attractive price. If the stock price were to decrease by at least 5-10% down to the mid $50’s, I would view it as a better dividend stock selection.

Overview

Automatic Data Processing (ADP) is one of the world’s largest outsourcing companies. ADP handles human resource needs, benefits, payroll, and computing processes for many companies around the world. They prepare employee payroll checks, direct deposits, and tax reports. They capture, calculate, and record employee time and attendance. They perform hiring services. They provide record-keeping and administrative services for retirement plans.

ADP also assists companies in certain industries with computing needs. For client businesses that sell cars, boats, are involved with heavy trucking, or similar fields, ADP can supply important software to help the business operate, from inventory, to networking, to data integration.

Ratios

Price to Earnings: 21

Price to Free Cash Flow: 23

Price to Book: 4.5

Return on Equity: 22%

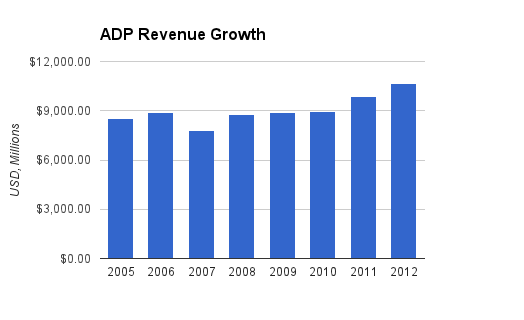

Revenue

(Chart Source: DividendMonk.com)

Revenue growth over this period has been fairly mild, at a 3.3% annualized pace.

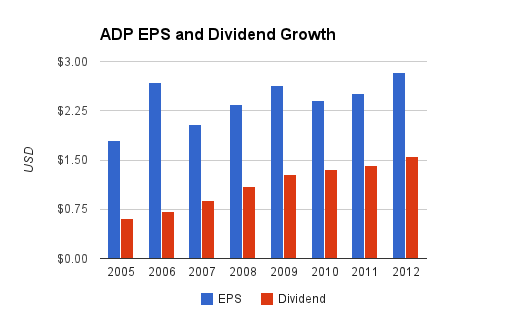

Earnings and Dividends

(Chart Source: DividendMonk.com)

ADP has erratic earnings growth at an average rate of 6.7% per year over the last seven years.

Dividend growth has averaged over 14% per year over the last seven years, and the company has a streak of consecutive annual dividend increases that is nearing four decades. The most recent quarterly dividend increase was approximately 10%. The payout ratios from earnings and free cash flow are safe.

Approximate historical dividend yield at beginning of each year:

| Year | Yield |

|---|---|

| Current | 2.94% |

| 2012 | 2.9% |

| 2011 | 3.0% |

| 2010 | 3.2% |

| 2009 | 3.3% |

| 2008 | 2.6% |

| 2007 | 2.1% |

| 2006 | 1.8% |

| 2005 | 1.6% |

How Does ADP Spend Its Cash?

For the fiscal years 2010, 2011, and 2012, ADP brought in a total of approximately $4.5 billion in free cash flow. Over that same period, the company spent around $2.1 billion on dividends, a bit over $2.2 billion on net share repurchases, and approximately $1.1 billion on net acquisitions.

As far as the effectiveness of the buybacks is concerned, the ADP reduced its share count from approximately 600 million to 490 million over the last decade.

Balance Sheet

Automatic Data Processing has nearly zero debt, which means their ratios that are normally reported such as the interest coverage ratio and the total debt/equity ratio are essentially perfect. ADP is one of only four non-financial companies in the United States to have a perfect AAA credit rating.

The company does have over $3 billion in goodwill, which makes up about half of their shareholder equity. This goodwill from their acquisitions is fairly modest and does not have a large negative affect on my view of the balance sheet.

Investment Thesis

There are a number of things that could be said for ADP’s strong market position. Although the company does have competitors, they’re not on the same scale as ADP. Their largest competitor in the U.S. is Paychex (PAYX), which has revenue of approximately one-fifth of ADP. Since ADP offers services that are so essential, so widespread, and go so deeply into a business, the company’s services have very high switching costs. For a business to switch a big segment of its human resources, payroll, and administrative components, it would be a significant expense and hassle. This is why the average client stays with ADP for over 10 years and their client retention rate is over 90%. Lastly, their strong balance sheet allows them to weather nearly any financial difficulty.

The company has over 600,000 clients, and none of the larger ones account for even 2% of revenue each. In addition, the business has been expanding successful internationally. For instance, ADP’s “GlobalView” service accounts for 1.1 million employees total.

Overall, ADP is large and diverse enough and represents a large enough chunk of U.S. payroll data that their monthly U.S. jobs report is watched by market analysts and can be a factor in the movement of the S&P 500 on the days it is released.

Eventual Catalyst for Growth: Interest Rates

The recession has had more than the obvious effect on ADP. Apart from facing the same economic downturns as everyone else (and handling them defensively with their essential and widespread services), the company has faced the problem of low interest rates. Unlike other companies that use debt and therefore benefit from low interest rates, ADP would prefer higher interest rates for growth.

This is because ADP holds an enormous amount of client funds that they use for payroll and other functions. The result is similar to an insurance company, where an insurance company collects premiums, pays out claims, and uses that float, that collection of billions of dollars, to invest in income-producing assets from which get to keep the income. As of 2012, ADP holds nearly $18 billion in client funds, uses those funds for client purposes, but gets to keep the investment income that comes from those funds. Of course, ADP is conservatively managed and must keep these funds safe, so they invest in AAA/AA investments that produce a reliable, but low-return investment income. Due to the recession, interest rates have been held artificially low for an abnormal amount of time, which has affected ADP’s interest income.

Interest rates play a large role in ADP profitability. In 2012, the company reported $493 million in interest income. This fell 9% from 2011 levels of $540 million, because although their base of client funds grew, their average interest rate decreased.

| Year | Client Funds | Average Interest Rate | Interest Income |

|---|---|---|---|

| 2012 | $17.90 billion | 2.8% | $493.3 million |

| 2011 | $16.87 billion | 3.2% | $540.1 million |

| 2010 | $15.19 billion | 3.6% | $542.8 million |

| 2009 | $15.16 billion | 4.0% | $609.8 million |

| 2008 | $15.65 billion | 4.4% | $684.5 million |

| 2007 | $14.68 billion | 4.5% | $653.6 million |

| 2006 | $13.57 billion | 4.1% | $549.8 million |

This is an important chart, because it helps to show a part of ADP’s “real” growth as compared to their reported income growth, which has been negatively affected by reduced interest rates. In addition to other metrics of growth such as number of clients, number of employees served, total revenue growth, and more, funds held for clients is a rather important metric of continued business growth and expansion for ADP. The amount of funds held grew by almost 4.7% annually over this six-year period, on average, but reduced interest rates have kept interest income low. ADP defends against interest rate changes by laddering the expiration of their investments, but as the interest rates have been held low for so long, ADP has had to continually reinvest the funds into lower-return investments, which is why there has been the gradual decline in interest rates.

Interest income only accounts for a small portion of revenue. Out of nearly $10.7 billion in 2012 revenue, interest from client funds was only $493 million, or less than 4.6%. However, total net income for 2012 was $1,389 million, so a major change of a couple hundred million dollars in total interest income has a considerable effect on net income and EPS results. This is part of the reason that ADP growth looks so slow; interest rates have been acting as a headwind on their income and margins even as the business continues to grow. If a 4.0% interest rate were fixed onto the 2012 figure for client funds instead of the actual 2.8% figure, it would have boosted 2012 reported net income by around $220 million, or more than 15%.

Over time, interest rates will eventually increase, and this should act as a tailwind, rather than the headwind that it has been, for ADP’s reported net income and EPS. I believe that optimism of the current valuation is taking this into account, although interest rates will likely stay low for quite some time and even with generous interest rates factored in, the laddering of interest rates means the company will have a gradual increase in rates much like they had a gradual decrease in rates.

Risks

ADP faces macroeconomic risk like any other large firm. In particular, 14% of employer services revenue for ADP comes from Europe.

As previously described, interest rates are a risk because they have a direct affect on profitability for the company.

Over 26,000 dealers of cars, trucks, boats, RVs, and other vehicles in over 100 countries use ADP software for dealer management. Downturns in this particularly industry can negatively affect ADP.

Conclusion and Valuation

I analyzed ADP almost exactly one year ago, and the company had the same stock valuation as it does now, with a P/E of around 21. The conclusion of that report was that the stock appears a bit overvalued, and over the last year, the stock has underperformed the S&P 500.

With rough the same valuation now, I believe the stock appears to still be trading in a range that is not particularly appealing for value investors that look for a margin of safety. ADP’s strong business position and particularly robust balance sheet mean that the company does deserve a stock price premium due to lowing the ‘risk’ aspect of risk-adjusted returns, but I believe the current price leaves little room for value.

Using the dividend discount model, the company needs to increase the dividend at a long-term rate of over 7% per year in order to justify the current stock price in the high $50’s if a 10% discount rate (desired rate of return) is assumed. This is reasonable, and overall I wouldn’t view ADP as a poor investment, especially when the defensiveness of the company is considered.

However, I think this one is worth watching for dips. A P/E of below 20 and a dividend yield of over 3% would be rough boundaries where I think it would start looking a bit better.

Full Disclosure: As of this writing, I have no position in ADP.

You can see my dividend portfolio here.

Strategic Dividend Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

That is a terrific analysis of ADP. I especially like the chart showing interest income from client funds. I own some shares of ADP, but haven’t really added any in over a year. The high P/E ratio is preventing me from doing so.

Thanks for the look at ADP. I’ve been meaning to look more closely at them myself. Most of the stocks that I would like to own more of are needing that 5-10% pullback for me to want to start buying. I had completely forgot about their “float” earnings, once rates start to rise that’s going to give a nice boost to their earnings on top of the operations improving.

Thanks for the comments. ADP is one of my preferred analysis articles each year since I like their business structure. I’d snap up some shares in an instant if I could find the stock at a better valuation.

ADP is a great stock. I have it in my watch list too and will be buying as soon as my portfolio building rules allow.

Nice review of ADP. I really like the company. I’ve tried to buy ADP several times in the past on dips, and every time it’s always managed to shoot back into overvalued territory before I can buy it. Maybe it’s time to try again.

I have followed ADP for quite sometime and marvel at its business model. I have been waiting patiently for the stock to come down to my buy up to price. This is one of the first stocks I plan to gobble up in the next market crash.