-Revenue Growth Rate: 8.5%

-EPS Growth Rate: 11.1%

-Book Value Growth Rate: 11.6%

-Dividend Growth Rate: 17.2%

-Current Dividend Yield: 2.23%

-Financial Strength: AA-, Aa3

Aflac’s core performance has been remarkable over the last decade, and they have improved their financial condition compared to last year. Concerns over a potential Japanese default are keeping the stock valuation low.

Overview

AFLAC Incorporated (NYSE: AFL) is a large international supplemental insurer. They provide cash that can cover several types of expenses to those receiving payouts due to illness or deaths. This is supplementary to primary medical insurance which helps cover medical expenses but leaves other expenses without a solution. This Fortune 500 company was founded in 1955, and has a large presence in Japan and the US. AFLAC stands for the American Family Life Assurance Company.

The company made a big move in Japan in the 1970s by selling insurance for cancers when people were becoming particularly mindful of cancer. Decades later, approximately three-quarters of Aflac’s diverse premiums now come from Japan.

Aflac primarily targets places of employment for its insurance products, rather than individuals outside of work. The company offers plans to employers that allow them to provide Aflac insurance as part of their benefits package to employees without paying any cost themselves.

The premise behind an insurance company is that they spread risk out over a wide number of people and businesses. They collect premiums (payments) from clients and in return those clients are covered in case of a serious loss. From an insurance business standpoint, it’s ideal to collect more in premiums than you pay out for losses. This is not the primary form of earnings, though. An insurance business, after collecting all of the premiums, holds a great deal of assets that, over time, are paid out for client losses. An insurance company constantly receives premiums and pays out for losses, so as long as they are prudent with their business, they get to constantly keep this large sum of stored-up assets. As any investor reading this knows, a great sum of money can be used to generate income from investments, and that’s how an insurance company really makes money. Aflac invests its stored up collection of assets primarily in fixed income securities to receive upwards of $3.4 billion in annual investment income.

Ratios

Price to Earnings: 8.7

Price to Book: 2.1

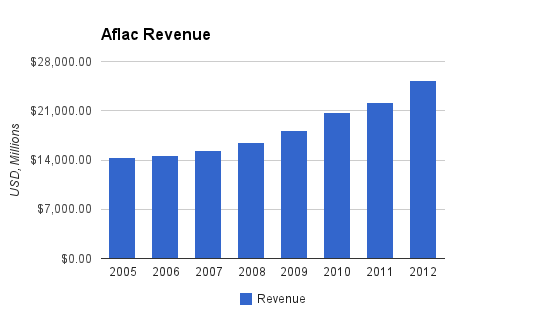

Revenue

(Chart Source: DividendMonk.com)

Aflac has had particularly strong core business performance over the last decade. Revenues from both premium income and investment income have increased every year for at least the last ten consecutive years, although this is so far not the case for the trailing twelve month period and it appears that the streak will be broken. The annualized revenue growth rate over the last seven years was 8.5%.

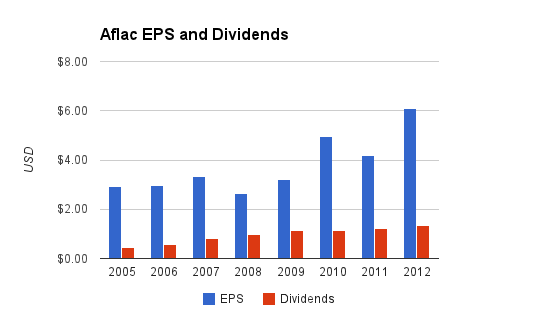

Earnings and Dividends

(Chart Source: DividendMonk.com)

Aflac has had somewhat erratic EPS numbers, but the average growth over this seven year period was 11.1% per year. EPS spiked to $7.20 over current the trailing twelve month period, which the chart doesn’t show. The company’s operating earnings per share, which excludes yen currency effects, impairments, and certain other items, has increased every year for over two consecutive decades.

As for the dividends, Aflac has increased the dividend for thirty consecutive years. The payout ratio is rather low, at under 20%. Despite the low payout ratio, the dividend yield at 2.23% is at least higher than the average S&P 500 yield, because the stock valuation is so low. The yield was closer to 3% last year before the stock price increased substantially. The payout ratio is actually lower than it was 5 years ago because earnings have strengthened recently and the dividend was only increased at a moderate rate, so I’d expect the dividend increases over the next few years to be rather generous.

Approximate Historical Dividend Yield at Beginning of Each Year:

| Year | Yield |

|---|---|

| Current | 2.23% |

| 2013 | 2.7% |

| 2012 | 3.0% |

| 2011 | 2.1% |

| 2010 | 2.3% |

| 2009 | 2.1% |

| 2008 | 1.3% |

| 2007 | 1.4% |

| 2006 | 0.9% |

| 2005 | 1.0% |

As can be seen, the dividend increased quickly earlier in the decade but then began increasing more slowly during the worldwide financial crisis. This leaves extra room for dividend growth over the next few years, assuming their Japanese market remains reasonably strong.

Balance Sheet

The balance sheet dynamics have changed during the previous few years. The company’s large investment portfolio had significant exposure to some of the most financially troubled European countries, and this resulted in billion-dollar capital losses in the peak years of the problem. Aflac has managed that situation well, but now the issue that’s keeping the stock valuation low is their exposure to Japanese default risk.

Realized Investment Gains (Losses) By Year, in Millions:

| Year | Gain / (Loss) |

|---|---|

| Trailing 12 Months | $471 |

| 2012 | ($349) |

| 2011 | ($1,552) |

| 2010 | ($422) |

| 2009 | ($1,212) |

| 2008 | ($1,007) |

| 2007 | $28 |

| 2006 | $79 |

| 2005 | $262 |

Gains and Losses from the portfolio were a fairly minor portion of the business until 2008 when the financial crisis began showing itself. With over $1 billion in impairments in certain years, this kept the stock price and the stock valuation low.

Investment Thesis

Aflac has a notable business model. Rather than targeting individuals, Aflac insurance agents target businesses. Aflac works with employers to give employees the option to purchase Aflac Insurance via payroll deductions, similar to their other benefits. This “cluster-selling” technique keeps costs comparatively low, and gives the company a major competitive price advantage. It creates a win-win situation with employers it does business with.

In addition to having a solid distribution network for its insurance products, Aflac has a strong brand name that is well known in Japan and US, with the duck mascot. The brand is stronger than most other insurers, especially in Japan.

Plus, its insurance is rather resistant to health care reform or other insurance regulation (although not untouched). The company provides supplemental insurance; cash to people when they need it most.

The company has been recognized as one of the “World’s Most Ethical Companies” by Ethisphere Magazine, and also one of the best places to work. It has won similar awards from a variety of sources.

Aflac’s US exposure is significantly smaller than its Japanese exposure despite being a US-based company. Their customer retention rates are not as high in the US as they are in Japan, but the other side to this is that there is more growth and improvement opportunity.

Risks

Aflac, despite superior performance over the last decade, has faced some of the harshest macroeconomic problems there are. During the financial crisis, they had several billion dollars worth of exposure to bonds from the European countries that were being bailed out, which resulted in investment losses. Over the last year, this risk has shifted away from Europe and to Japan.

Japan is one of the world’s largest economies, and has the highest ratio of public debt to GDP out of any country in the world. The ratio is well over 200%, which is more than twice that of the United States. This has historically not been a problem for Japan for the last couple of decades because the strong economy kept interest rates low. As long as the interest rates were low, the debt was easy to maintain. (In comparison, those European countries with lower debt-to-GDP ratios began entering default during the financial crisis because investors lost confidence in the economies of those countries and interest rates spiked to unworkable levels.) The interest rates in Japan are still very low, so there’s still not a current issue. But, it has become increasingly clear to investors that Japan is heading to a problem. The debt is extremely high, and the economy is faltering from the declining and aging population. A declining population makes economic growth extremely difficult to obtain and can affect housing prices with extra supply (essentially the same problem as the United States faced but without the benefit of population growth which can eventually fix problems of over supply), while the aging population puts more stress on government programs and on younger taxpayers.

Aflac does most of its business in Japan and holds a considerable portion of its assets in Japanese debt. The extreme case of a Japanese default would be extremely damaging to Aflac. Quantitatively, about 40% of Aflac’s $100 billion+ investment portfolio is held in Japanese Government Bonds. That’s the portion that’s at risk if there were to ever be a government default, and additional risk would likely come from a reduction of premiums even in moderate scenarios without a default but with a debt/economic crisis.

Conclusion and Valuation

Wow, what a run. I published a report on Aflac 14 months ago suggesting that the price of under $46 at the time was appealing, even using an aggressive 12% discount rate, and the stock is now up to nearly $63. With dividends added, that’s a nearly 40% rate of return on paper in 14 months.

Dividend investors, however, are interested in long-term growth. The forward-looking question is whether the stock price remains attractively priced, or whether this run-up has taken the attractiveness out of the stock. To be sure, the current low P/E ratio of under 9 is very low, and lower than the historical average of the company. This makes their share buybacks particularly effective at boosting EPS. So, the share price increase has not been from an increase in valuation, but rather from an increase in reported earnings and a flat valuation on those increasing earnings, which translated into a substantially increased stock price.

To estimate Aflac’s fair value, we can do a two stage Dividend Discount Model. If the company grows EPS by an average of 9% going forward, which is below historical growth, then the dividend can increase at a rate of 12% per year over the next ten years to increase the payout ratio to only 30% at the tenth year. After that, the dividend could be assumed to grow at the same rate as EPS. Applying an aggressive 12% discount rate (the target rate of return), the calculated fair price is nearly $65/share, compared to the current actual price of under $63/share. In reality, EPS growth is not going to be smooth and it’s impossible to say what level management will want the payout ratio to be in ten years even assuming slowing of EPS growth. The point is, even assuming a slowing of growth, the company can be calculated to be at an attractive value for a 12% rate of return.

In a more conservative scenario, if the company grows the dividend by only 10% per year over the next 10 years followed by 7% thereafter, which is considerably below what has been typical for the company, and a less aggressive 10% discount rate (target rate of return) is used, then the calculated fair price is just under $64, which is comparable to the current price of about $63.

So, in a variety of scenarios, if Aflac continues operating normally, the stock is noticeably undervalued. The combination of dividend yield and dividend growth, with 30 years of consecutive annual dividend growth, is one of the better combinations you’ll find on the market.

Clearly, this undervalued status is due to very real concerns about the Japanese economy. If Japan has a default or otherwise has a severe economic contraction, all bets are off. EPS growth, and consequently dividend growth, will run into walls if Japan defaults or enters a more tangible economic crisis, and the portfolio value will be at risk. Aflac is considered a short opportunity for those that are bearish on the Japanese default risk, with some predictions of the stock price being cut in half over the next year.

For this reason, I continue to view Aflac as a dividend investment that has an above average risk profile and above average potential returns if those risks don’t unfold. Most investor portfolios do not have substantial direct exposure to Japan, so holding Aflac stock may be a way to diversify into a concerned region if you’re not as bearish on the economy of Japan as some are. Aflac at this time does not appear to be a good candidate for a core holding if you’re concerned about the Japanese economic risk, but should provide above average returns if the more bullish or optimistic views of Japan end up being correct.

Full Disclosure: As of this writing, I have no position in AFL.

You can see my stock portfolio here.

Strategic Dividend Stock Newsletter:

Sign up for the free dividend and income investing newsletter to get market updates, attractively priced stock ideas, resources, investing tips, and exclusive investing strategies:

What do you think of IBM, which is trading at a 52W low?

I think it’s a strong pick right now, and I own IBM stock. The dividend yield is fairly low at 2.11%, so it’s not a good candidate for current dividend income, but I think it’s a strong pick for tech diversification with dividend growth and capital appreciation.

AFLAC’s underwriting profit is about twice it’s investment income. http://seekingalpha.com/article/1032911-aflacs-hidden-source-of-value

Underwriting profit, however, is not net profit. That linked article discussed 2011 numbers so I’ll reference those. Premiums were about $20.3 billion, claims were about $13.7 billion. So that’s around $6.6 billion in underwriting profit. But then there are expenses, such as $1.1 billion in policy acquisition, $4.1 billion in selling, general, and administrative expenses, and nearly $0.5 billion in other expenses, leaving almost nothing left. That same year, total company net profit was reported to be $1.964 billion, and investment income was $3.280 billion. In normal years without large capital losses, Aflac makes a tiny profit on its actual underwriting, and then the bulk of net income consists of the investment income.

So, like other insurers, Aflac makes its real money from investments- the insurance just gives it the float it needs to make that investment money.

If Aflac dips below $56, I am going to add to my position in this dividend growth insurer. If it manages to expand US operations, this could only add to the streak of consecutive dividend increases.

I don’t necessarily disagree that afl is undervalued, the problem for me is their current yield is not very attractive compared to historical yield (only last year), making me reluctant to start a position at this point. I would love to own some though.

I think many dividend investors are initially turned off of Aflac because of its lower current dividend yield than what they look for. But investors must not forget that Aflac has a payout ratio of around only 20% so plenty of room to grow that dividend which they have been doing in past years.

I’m long AFL and would be still adding to my position at current levels if it wasn’t already my largest holding. Gotta love the duck!