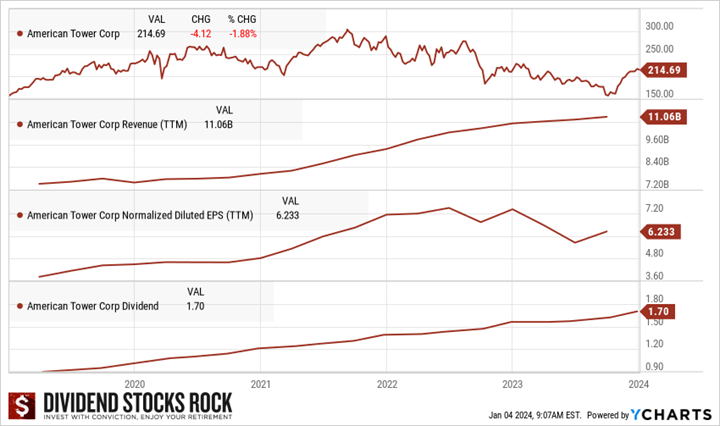

American Tower is still a buy list stock in February 2024. Who would have thought that cell tower REIT could bounce back that fast? After mostly a bad year in 2023, it only took two months! AMT also resumed its generous dividend increases.

OK, we lack great timing—we should have selected AMT in October rather than January 2023—but it’s always easy to play Monday morning quarterback. Missed our buy list stock for January? Find out about here.

American Tower Business Model

A holding company, American Tower Corporation runs a real estate investment trust (REIT) that owns, operates, and develops multitenant communications real estate. It has property segments for the U.S. & Canada, Asia-Pacific, Africa, Europe, and Latin America, as well as segments for Data Centers and Services. Its primary business is leasing space on multitenant communications sites to wireless service providers, radio and television broadcast companies, wireless data providers, government agencies and municipalities and tenants in other industries.

A holding company, American Tower Corporation runs a real estate investment trust (REIT) that owns, operates, and develops multitenant communications real estate. It has property segments for the U.S. & Canada, Asia-Pacific, Africa, Europe, and Latin America, as well as segments for Data Centers and Services. Its primary business is leasing space on multitenant communications sites to wireless service providers, radio and television broadcast companies, wireless data providers, government agencies and municipalities and tenants in other industries.

The Data Centers segment includes data center facilities and related assets that the Company owns and runs in the U.S. Its Services segment offers tower-related services in the U.S., including AZP, structural analysis and construction management, which primarily support its site leasing business, including the addition of new tenants and equipment on its communications sites.

Want more stock ideas, download our top stocks for 2024 booklet.

AMT Investment Thesis

AMT belongs to a very select group of three major Telco REITs, alongside Crown Castle and SBA. In the U.S., data usage tends to double every two years due to the rise in video content and Internet of Things applications. With 5G technology, telecoms have no choice but to invest in their networks continuously. AMT has a strong international presence. With many developing countries such as India roughly 10 years behind the U.S. in network development, this is a promising growth opportunity. We are optimistic about demand driven by mobile video growth, unlimited data plans, and spectrum build outs in the 2.5 GHz and 600 MHz bands.

The CoreSite acquisition was a bit surprising since it’s outside AMT’s core business. Still, it’s an interesting growth vector to pursue as demand remains robust for data centers. In April, AMT saw accelerated organic growth in tenant billings and another record quarter of new business signed at CoreSite.

The CoreSite acquisition was a bit surprising since it’s outside AMT’s core business. Still, it’s an interesting growth vector to pursue as demand remains robust for data centers. In April, AMT saw accelerated organic growth in tenant billings and another record quarter of new business signed at CoreSite.

AMT Last Quarter and Recent Activities

AMT had a strong third quarter 2023 with AFFO per unit up 9% and revenue up 6%. American Tower boosted its guidance for 2023 adjusted funds from operations as Q3 top and bottom lines came in stronger than expected. AMT now expects 2023 AFFO per share of $9.72-$9.85, which would mean 0.3% year-over-year growth at the midpoint. The average analyst estimate is $9.75. Not bad for a stock that was free-falling! Management mentions that AMT should continue to surf on stronger data consumption driven by the 5G network.

The company is expected to report its full year earnings for 2023 on February 27th.

Want more stock ideas, download our top stocks for 2024 booklet.

Potential Risks for American Tower

Although AMT has a strong portfolio of assets, technology advancements might force it to evolve further. 5G technology requires more small cells as network structures rather than massive towers; therefore, AMT’s large towers might not be as appealing in 5 years if the technology doesn’t need them. The consolidation of telecom firms also poses a risk with a reduction in the number of redundant networks; AMT could see its tenant base reduced.

AMT could grow through emerging markets, but there is no sign currently that the middle-class will grow fast enough to consume data at the same pace as North Americans. With perspectives of weaker growth, AMT’s stock price fell sharply in the fall of 2023 but has since bounced back nicely. After a miniscule dividend increase of 0.6% in July, ($0.01/share), the two subsequent quarters are reassuring as AMT increased the dividend by 3% and then almost 5%,

AMT Dividend Growth Perspective

AMT’s dividend growth history is quite impressive. In 2014, the company paid $0.29/share, and today it pays $1.70/share. Most of 2023 was a bad for AMT, yet it managed to increase its dividend by 8.9%, and its stock price bounced back within two months, all very encouraging. The stock has slowed down since the beginning of 2024, but there is no news about it; it’s just market volatility. AMT’s fundamentals are strong.

Final Thoughts on American Tower

The need for data transferred through cell towers will continue to rise in the coming years. AMT supplies what has become an essential service these days. I like its geographic diversification and its sticky business model. My investment thesis hasn’t changed throughout the year, so its remains a buy list stock. This is a good example of when you should not judge a stock by its performance but rather by its fundamentals.