Interest rate cuts are coming. We’ve been hearing that since the fall of 2023. Hasn’t happened. How come? More worrying for investors is what will happen, and how to prepare.

In the fall 2023, with inflation easing and the economy in general seemingly under control, it made sense for the Federal Reserve and economists to anticipate interest rate cuts for the new year. With all this optimism, many investors who had shied away from the stock market, preferring bonds or certificates of deposits—which offered their most decent returns in years—or who were on the sidelines, went on a shopping spree. They flocked to the market, bought a lot of stock, a stock prices went up.

Learn how to create a recession-proof portfolio. Download our free workbook.

Why no interest rate cuts yet?

What happened next is that inflation went back up a bit rather than continuing to abate. The monthly inflation rate in the U.S. went from 3.1 in January 2024, to 3.2 in February, then to 3.5% in March. While much better than the above 6% figures we were seeing a year ago, and better than the average of 4.1% for 2023, the Fed thought, “Hm, we need a bit more time before we cut interest rates.” And here we are.

What’s happening now?

Unemployment rates have started to increase in fall 2023 but only slightly. There are no alarming signs of consumers feeling squeezed enough to stop discretionary spending altogether. The U.S. economy is more resilient than anticipated. That is a good thing because it reduces the odds of a deep recession.

However, there are signs of a slowdown. We see them in quarterly corporate earnings. Corporate earnings are available more quickly than economic data published by the Fed and government departments, which always lag behind due to the time required to gather and compile the data. The impact of a slowdown is more immediate for corporations. They see their sales growth slowing down or sales falling. Their margins suffer, as do their profits and the free cash flow they have on hand.

However, there are signs of a slowdown. We see them in quarterly corporate earnings. Corporate earnings are available more quickly than economic data published by the Fed and government departments, which always lag behind due to the time required to gather and compile the data. The impact of a slowdown is more immediate for corporations. They see their sales growth slowing down or sales falling. Their margins suffer, as do their profits and the free cash flow they have on hand.

What I expect will happen

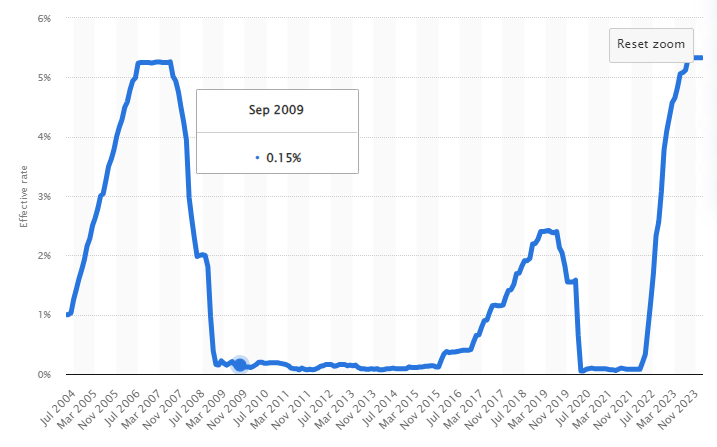

In these conditions—inflation easing gradually and signs of a slowdown—I have no doubt interest rate cuts are coming later in 2024. However, I can’t see us going back to the historic lows we enjoyed from 2009 to 2017 or to the below 2.5% rates of 2018 to 2022. The cuts will be small, come slowly and steadily.

Moderate interest rate cuts will provide some relief to homeowners having to renew their mortgages. Many of them still enjoy the super low rates of pre-2022 and will renew from 2024-2026. They will do so at rates that will be lower than they are now, but higher than what they had. So, while their payments might not double, they will nonetheless go up. A few hundred dollars more per month on a mortgage payment means a few hundred fewer dollars spent on restaurants, new cars, and travel.

We are already seeing companies in the consumer discretionary sector with weaker results and that will continue. Companies in other sectors are also feeling the slowdown.

Preparing for what’s coming next

As an investor, I don’t trade for fear of short-term economic events, slowdowns, or even recessions. What I do is dutifully review my holdings, as we should all do quarterly. I review my sector allocation and individual stock weight and adjust if needed. I review each holding to ensure that they had healthy growth trends over the last five years, that the dividend is safe, and that my investment thesis for holding them is still valid. See Quarterly Review of Your Stocks Made Easy.

I’ll also identify which stocks will be the most affected by a downturn. Knowing that, when my portfolio goes down, I understand it and I don’t fret. For example, I know my consumer discretionary holdings will hurt, if they don’t already. I don’t expect them to perform very well for the next 12 to 18 months. But I’ll review them to ensure they are in a strong position to weather the storm and come out of it swinging.

Be ready, create a recession-proof portfolio. Download our free workbook.

Summary

We are seeing the market slowing down with returns below expectations, in large part because the market expected interest rate cuts sooner. We might have to wait until May or June to see cuts.

On the upside, we have a resilient economy; yes, that means we’ll likely see only moderate interest rate cuts, but also, we probably won’t have a deep recession. Avoiding a huge recession means the stock market should not crash. This is what I expect, and what I hope, but we never know what the future holds.

The best way to protect your portfolio against whatever happens is to ensure that you have very strong businesses with solid metrics. Review all your stocks, looking at the dividend triangle; ensure they show trends of growing sales, profits, and dividends, and have the business model and growth vectors to continue doing so. You might also want to review the composition of your portfolio.

If the worst happens, knowing the strengths of your holdings will prevent you from panic-selling at a loss for no reason, and make you a patient investor.