You have loser stocks in your portfolio. Maybe the stock price has been down for a while, or it dropped fairly recently, but seems to be on downward trend. I know the feeling. Sell or keep them, quite the dilemma. There are hidden costs to holding on to loser stocks.

Many investors will keep the stock and wait for its price to go up again. At times that is the right thing to do, as long as the company has a solid business model, growth vectors, strong fundamentals, a safe dividend, and the stock decline can be attributed to a downward trend of the market or sector, or a one-time event for that company. On the flip side…

Never keep you losers simply because you are losing money

In other words, waiting for a stock to bounce back so that you break even, or even make money is usually a bad decision.

Selling a loser can feel like a failure, and no one likes that. To avoid that unpleasantness, you might deny the problem and keep your losers. Facing a hit with a 40%+ loss in our portfolio, keeping the stock for a while is tempting for many of us. “I’ll keep my shares until I recover a good part of my losses.” Bad decision. Let’s dig into this fairy tale of bouncing back to break even

The fairytale of breaking even

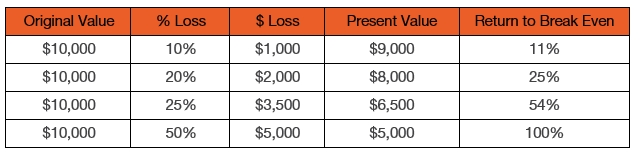

This table shows you how much of a return you need from an investment that suffered a great loss to break even.

Notice that the more you lose in %, the higher the rate of return you need to break even, and it climbs exponentially!

What are the odds of that stock bouncing back that strongly in the next 5 years? Well, it depends on the company and the situation, but generally, chances aren’t that strong.

Hidden costs of holding on to loser stocks

Often, you hold onto your big losers for years until you finally throw in the towel and move on. Some of the costs of waiting are insidious. Holding on to loser stocks too long hurts you more than you know. Here’s why:

- It starts with you losing money on a bad investment. Not a good feeling.

- Then, you take the risk of waiting for the share price to bounce back to break even or reduce your loss, only to lose even more. An even worse feeling.

- As if this wasn’t enough, by keeping your dead weight investments, instead of investing your monies in a profitable stock, you fail to make gains, losing even more money. Ouch!

Avoid Losers, Focus on Quality

Holding on to loser stocks sucks. They hurt your portfolio, they could cut their dividends and they cripple your retirement. You may be stuck in “analysis by paralysis”, but it doesn’t have to be this way. You can choose quality over high yield.

The Dividend Rock Stars list is a selection of companies showing both income and growth. The list is updated monthly based on companies growing their revenue, earnings per share and dividend over the past 5 years.

Holding on to loser stocks too long, an example

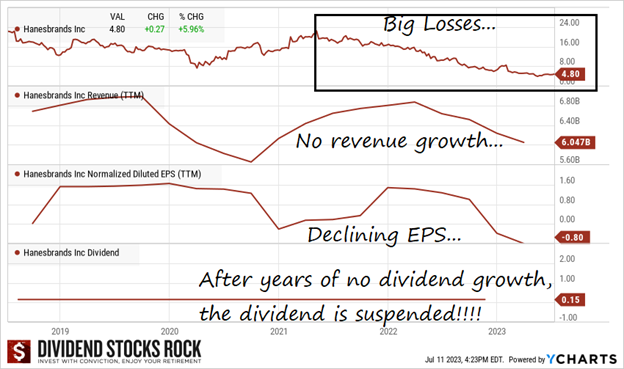

Early May 2021 – HanesBrands (HBI), an apparel manufacturing company, has a stock price of $21.30, which soon begins a slow and steady downward trend.

Later in 2021, two investors holding HBI stocks, bought at $15.00, notice this trend, “Hmm, well, we are still in the pandemic. It will go back up.”

June 3, 2022 – The HBI stock price has dropped to $11.79. Both investors are down 21.4%. They need a return of 27.2% to break even on HBI.

- Investor A chooses to keep the stock, not wanting to take the 21.4% loss and still thinking it will bounce back.

- Investor B looks at HBI’s dividend triangle and notices that revenue is declining, never having returned to pre-pandemic level, that the EPS is declining after a short-lived bump, and that there hasn’t been any dividend increase since 2016! Investor B promptly sells HBI.

Later in June, Investor B buys shares of Oxford Industries (OXM), another apparel manufacturing company that shows revenue and EPS growth, with levels exceeding pre-pandemic levels, and steady dividend growth except in the early part of the pandemic in 2020. Investor B pays $88.51/share.

September 30, 2022 – HBI stock price has declined to $6.96.

- Investor A, who held on to HBI, is now down 53.6% and would need the price to go up 215% to break even.

- Investor B’s OXM stock is now worth $103.90/share, an increase of 17.4%!

July 7, 2023 – HBI is at $4.28, and dividend payment was stopped 9 months ago.

- Investor A needs 350% return to break even with HBI.

- Investor B’s OXM stock is trading at $99.63, having declined a bit, but still showing a 12.6% return. It paid a quarterly dividend, and the dividend increased by 18.2%!

Investor A is down 71.5%, and missed out on opportunities for increasing stock price and dividend that Investor B enjoys. Clearly, the hidden costs of holding on to loser stocks hurt us more than we think.

Moving on: Replacement List

A good tool to have on-hand when you are assessing whether to sell a loser stock, or when you have decided to sell, is a list of replacement. Make a list of the stocks you’d like to have but don’t have money to invest it at the moment. Choose companies that have good growth potential and a strong dividend triangle in various sectors.

Not sure where to start? Download our Dividend Rock Stars list! The list is a selection of companies showing both income and growth. You guessed it; we prefer a combination of dividend growth and dividend yield.

After all, what better way to get over the sting of selling a loser stock than to buy yourself something nice?