How should you build your dividend portfolio? How can you ensure your holdings can weather all kind of markets? What happens if we hit a recession?

Fear is a powerful emotion and not easily dismissed. It’s often the reason for low confidence. A rational response is to seek more information. Your brain asks you to validate that your opinions, beliefs, investment thesis are correct. Unfortunately, the more articles you read, the more people you talk to, and the more analysis you do, the less likely you are to act. Words are fun, but meaningless if they don’t prompt action. This is how you suffer from “paralysis by analysis”.

This article will be a great help if you recognize yourself in any of the following statements:

- One of my stocks dropped 30%, I wonder if I should sell.

- I have cash ready, but I won’t invest yet.

- I don’t think adding money to my portfolio is wise right now.

- I’m thinking of selling 30% of my holdings to protect my capital.

- I’ll wait until things settle down before I invest.

- I’m losing money right now; I don’t like it.

- The market is down today. What if it’s the beginning of the next crash?

- I’m paralyzed in front of my computer; I just can’t click on the buy or sell buttons.

This article explains a simple technique to select the sectors and the best dividend stocks with which to build your dividend portfolio. At Dividend Stocks Rock (DSR), we use technique successfully to build several dividend portfolios.

Download our Recession-Proof Portfolio Workbook for detailed information and tools for building your portfolio!

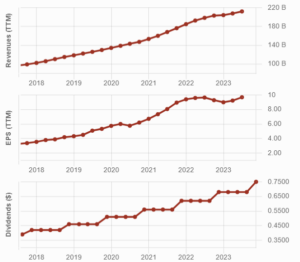

Stock Selection Made Simple: the Dividend Triangle

When we left in our small RV to drive to Costa Rica, we lived the adventure of a lifetime. It was a wonderful experience because we had a clear strategy. We knew where we were going, why we were doing it, and we had ways to handle challenging days. The market will keep throwing curve balls; let’s make sure you don’t whiff on them.

At DSR, we also have a clear strategy: we focus on dividend growing stocks. We handpick companies showing a strong dividend triangle (e.g., revenue, earnings, and dividend growth potential) and verify we understand their business model. It can be frustrating to follow this clear, but strict strategy. At times, we have to ignore great investing opportunities because they don’t fit in our model. Since our model is easy to understand and we know why we’re using it, we don’t doubt ourselves.

Let’s go over each of the dividend triangle’s metrics: revenue, earnings per share (EPS), and dividends.

Revenues

A business isn’t a business without revenues. What’s the difference between a company making increasing revenues and one showing stagnant results? Growth! We look for businesses with multiple growth vectors that will ensure consistent sales increases year after year.

Earnings per share (EPS)

You cannot pay dividends if you don’t earn money. If earnings don’t grow strongly, the dividend payment cannot increase indefinitely.

EPS is based on accounting principles (GAAP), which include non-cash charges and irregular items unlikely to recur, such as a product recall. Consequently, EPS is flawed and can be misleading. To make up for this, it’s best to review the EPS trend over 3, 5, and even 10 years. Also, review the Adjusted EPS, which disregards irregular items, thus reflecting more accurately the recurring profit from the company’s operations.

Dividends

Dividend payments are the *obvious* backbone of any dividend growth investing strategy. But I don’t mind the real dollar amounts or the yield, I focus solely on dividend growth. Dividend growers show confidence in their business model. Increasing the dividend is a statement that the company has enough money to both grow their business and reward shareholders, and that it can pay off its financial obligations and invest in new projects (CAPEX). No responsible management team increases the dividend if they lack the cash to run their business.

Companies losing market share due to their lack of competitive advantages see that story unfold through their revenue trends. It’s very rare to see any business report growing revenues year after year if it’s losing market share. There are justifiable reasons for weaker results; the end of a cycle, a change in the business model, or simply the economy slowing down. However, if this persists for several years and management can’t find growth vectors, raise a red flag!

The same logic applies to earnings. If for several years a company cannot generate growing EPS, odds are dividend growth won’t happen either. Because of the flaws of the EPS, it’s good to also review cash flow metrics to see what’s really going on.

Keep in mind dividends aren’t magic; they’re the result of strong free cash flows, not the cause of good free cash flows.

What happens with companies generating strong free cash flows? They tend to have a rising stock price over the long haul, a reliable dividend growth policy, and make you a richer investor.

Stock and Dividend Classification

At DSR we classify stocks and dividends in five categories. You don’t need to be a DSR member to rate all your holdings. To classify stocks and dividends, our methodology uses the rating and score defined below.

The DSR PRO Rating

- 5 = Exceptional Buy– Everything is there: strong business model, several growth vectors, and an undervalued price.

- 4 = Buy– It’s a good company, the short-term upside is good but not flabbergasting.

- 3 = Hold– A classic “right company at the right price”.

- 2 = Sell– If we were you, we would seriously consider getting rid of this one.

- 1 = Screaming Sell– Enough said.

The DSR Dividend Safety Score

This score, from 1 to 5, tells you which kind of dividend policy you can expect.

- 5 = Stellar dividend– Past, present, and future dividend growth perspectives are marvelous.

- 4 = Good dividend– The company shows sustainable dividend growth perspectives.

- 3 = Decent dividend– Don’t expect much than a 3-5% dividend growth.

- 2 = Dividend is safe but– Not likely to increase this year. May suffer from a dividend cut.

- 1 = Dividend Trash– It has been cut or is this situation is not sustainable.

When reviewing your portfolio, you can easily rate all your holdings using a similar methodology. While we do it for you at DSR, you can do it yourself with more research. You must seriously justify to yourself why you should keep any “1” and “2” in your portfolio. If you can’t come up with a strong investment thesis, chances are you should sell them… not eventually, but now.

Remember, the best time to make changes to your portfolio is now. What’s lost is lost. However, you can reallocate your money in a better way going forward.

Manage Stocks with the Dividend Safety Score

Here’s how we manage stocks according to our dividend safety score.

Dividend trash (1)

Dividend trash (score of 1) are companies that are about to cut their dividend or have done so within the past 12 months. They’re usually a lost cause, and you should get rid of them right away. There are exceptions, for example, extraordinary circumstances like the COVID-19 pandemic. During that time, some companies suspended their dividend temporarily. Pretty hard to make money when your business is closed. It was acceptable to keep such stocks if they had a strong dividend triangle prior to 2020, to give them time to resume their dividend growth policy when the situation improved.

Dividend is safe but (2)

A score of 2 is for companies without dividend growth for a while. An absence of dividend growth is the first step toward a dividend cut. On rare occasions, companies decide to use all their money to acquire new businesses. In such situations, you might want to hold on to a 2. Still, we prefer companies that can do both: make acquisitions and increase their dividend.

Decent dividend (3)

A score of 3 is for companies with a decent dividend in that it offers modest dividend growth, probably enough to beat inflation. You must review these quarterly to make sure the situation doesn’t worsen. We often see that score in income sectors where yields tend to be higher. If a REIT increases its dividend by 2-3% yearly, I’m good with that. However, I keep an eye on them and check that management keeps its promise.

Good dividend (4) and Stellar dividend (5)

Stocks with scores of 4 and 5 offer great dividend growth perspectives. They usually show a strong dividend history and payout ratios under control. The dividend safety isn’t only about the past; it’s also about the company’s ability to maintain its dividend growth in the future. The stronger the dividend triangle is, the stronger the score is.

When selecting new holdings as you build your dividend portfolio, I’d recommend choosing only companies with a score of 4 or 5. They won’t let you down should the market turn rocky for a while. You can count on those payments to smooth the path leading you to retirement.

The Secret: Sector Allocation

If you’ve ever read any “investing 101” books, they all say that your asset allocation is the main factor that determines your investment returns. If you were afraid of a recession in early 2020 and put most of your money in consumer staples and gold, you outperformed the market by a wide margin. If you were an oil & gas investor… well, very sorry to hear that.

As you build your dividend portfolio, I believe you should never invest more than 20% of your money in a single sector. The more you exceed 20% in a sector, the more volatile your portfolio might be. When the market drops, it affects all sectors. However, each crisis is most damaging for a subset of industries, but we never know which will suffer the most. It could be tech stocks (1999 tech bubble), banks (2008 financial crisis), oil & gas businesses (2015 oil bust, 2020 COVID-19) or entertainment, travel, leisure and retailers (2020 COVID-19). The key is to hold some of the best companies from each sector.

As you build your dividend portfolio, I believe you should never invest more than 20% of your money in a single sector. The more you exceed 20% in a sector, the more volatile your portfolio might be. When the market drops, it affects all sectors. However, each crisis is most damaging for a subset of industries, but we never know which will suffer the most. It could be tech stocks (1999 tech bubble), banks (2008 financial crisis), oil & gas businesses (2015 oil bust, 2020 COVID-19) or entertainment, travel, leisure and retailers (2020 COVID-19). The key is to hold some of the best companies from each sector.

Here’s my view on how each sector can help you build a stress-free retirement portfolio.

For more in-depth look at sectors, and much more, download our Recession-Proof Portfolio Workbook.

Core sectors

Companies in core sectors are the ones to consider first. Not to say all of them must in your portfolio, but rather that they are likely to be less affected by a global recession. Each core sector has unique characteristics.

Technology

Dividend growers in this sector are usually “old techs” that are dominant in their industry. They sit on significant cash and cash flows. Retirees ignore them because of their low yields. Interestingly, they went through the COVID-19 pandemic without a breaking a sweat. Cash is king during most recessions, and old tech stocks like Microsoft (MSFT), Apple (AAPL), Cisco (CSCO), and Texas Instruments (TXN) are generating plenty of cash.

Even if you’re retired and looking for income, tech stocks can bring solid growth to your portfolio; you can always sell a few shares as needed to generate the income you want.

Financial services

Banks are at the center of our capitalistic system. They can get too greedy (2008 anyone?), but in general, they offer a good source of dividends. You can find great companies among large banks, JP Morgan (JPM) for example, large asset managers, such as BlackRock (BLK), and payment processors Visa (V) and Mastercard (MA), often elements of successful portfolios.

Consumer defensive (or staples)

These classic and boring companies fly under the radar during economic booms, but they suddenly become market favorites during recessions. Why? Because they help in reducing volatility. After all, we all need to eat, brush our teeth, and clean our house. Personally, I don’t invest much in this sector because I don’t mind my portfolio value going down during crisis.

Procter & Gamble (PG), Coca-Cola (KO), Colgate-Palmolive (CL), don’t need introduction for most investors and you may value their stability.

Healthcare

I’m not a huge fan of the healthcare sector because it’s mostly big pharma spending billions in R&D. Their drug pipeline is crucial and consumes most of their cash flow. This makes it hard to maintain a dividend growth policy while developing new medicines. Nonetheless, you can find solid dividend growers in this category (Johnson & Johnson (JNJ), AbbVie (ABBV), Pfizer (PFE)).

You can also find great businesses in the medical device sub-sector, such as Lemaitre Vascular (LMAT), Abbott Laboratories (ABT), Stryker (SYK). Healthcare businesses have one thing in common; no matter how the recession hits, our health remains crucial. Therefore, recessions should be less harsh on them.

Growth sectors

While you can find growing businesses in all sectors, some industries offer you stronger growth potential. Many investors put the technology sector in this category, but I prefer to classify it as core assets.

Consumer cyclicals (or discretionary)

The name says it all; when the economy booms, consumer cyclicals follow. We can look to the automobile industry where you find auto parts makers such as Gentex (GNTX), Genuine Parts (GPC)). Classic restaurant chains such as McDonald’s (MCD), Starbucks (SBUX) also do well when consumers are hungry. Sporting goods and apparels such as Nike (NKE), and home improvement companies like Home Depot (HD) can be of interest. This is a rare sector where you can go over 20% and still have wide diversification. The buying process for a new car isn’t the same as for a burger or a t-shirt.

Being cyclical, they can hurt during economic slowdowns and recessions, and when inflation and rising interest rates squeeze consumers leaving them with less discretionary spending room.

Industrials

The second growth sector is industrials. Like consumer cyclicals, the industrial sector offers a wide variety of completely unrelated industries. Since each industry follows a different cycle, you can often pick stocks at a cheap price while clouds are gathering. A classic example is railroads. Companies such as Union Pacific (UNP) and CSX (CSX) were selling at a great discount during the 2015-2016 oil bust. You’ll also find long term dividend growers like Lockheed Martin (LMT) and Waste Connections (WCN) offering a great opportunity from time to time. You just must be patient and you’ll be able to buy several great businesses during their downcycle. We cover many of them at DSR.

Income sectors

Ah! The section you’ve been waiting for… every retiree’s dream: live off your dividends without touching your capital!

This strategy is difficult to achieve because many high yielding stocks get crushed during recessions. By chasing yield, you endanger your entire retirement. When a company cuts its dividend, its share price inevitably declines; you not only lose income, but also suffer a capital loss. Fortunately, there are sectors offering decent yields and some peace of mind.

REITs

The tax structure behind REITs calls for them to distribute most of their profit to shareholders (unit holders). For many, Real Estate is the definition of stability in the investing world. However, rising interest rates can hinder REITs’ expansion plans as debt costs more, and they can also hit their revenue if tenants become unable to pay the rent. It’s important to be careful about the type of REIT you choose.

The tax structure behind REITs calls for them to distribute most of their profit to shareholders (unit holders). For many, Real Estate is the definition of stability in the investing world. However, rising interest rates can hinder REITs’ expansion plans as debt costs more, and they can also hit their revenue if tenants become unable to pay the rent. It’s important to be careful about the type of REIT you choose.

With working from home’s popularity since the pandemic, REITS owning office towers will continue to deal with lower occupancy rates as tenants renew leases for much less square footage, or not at all. Industrial REITs own warehouses, distribution centers, data centers and cell towers; they are more likely to do well as they are supported by ecommerce and the internet.

Since you can achieve great diversification within the various REIT sub-sectors (Industrial, Residential, Commercial, etc.), this is a sector where you can easily invest 30% of your portfolio if it fits with your goals. This sounds like a sound plan for income seeking investors.

Utilities

Another haven for investors during crises is the utilities sector. We need power and water. I lean towards clean energy utilities such as NextEra Energy (NEE) and Xcel Energy (XEL). Since they carry a lot of debt due to their sizeable capital expenditures, utilities benefit from low interest rates, and feel it when they rise. Don’t expect much growth as the economy slows down, but the dividends should remain safe.

Telecoms & communications

Except for the telecom industry, this communication services sector is not strong on dividend growth and is not suited to income-seeking investors. And even then, things haven’t been going all that great for telecom companies for a while. Companies like Verizon (VZ) AT&T (T). They suffer from poor revenue growth and higher interest charges due to their capital-intensive business model. While they have a high dividend yield, their dividend trend isn’t as strong as it used to be. Until they find growth vectors and pay down their debt, I’d say proceed with caution; monitor your holdings quarterly.

Sectors to ignore

I’ll get straight to the point: I really dislike the energy and basic materials sectors, because they both depend on commodity prices to be profitable. Since they have no control over those prices, their cash flow is often volatile. This makes them marginal dividend growers. I understand you can occasionally make a great investment in those sectors, but more people get burnt than get rich. It’s a risk I’m not willing to take.

Want a bit more help to find good stocks, see Finding Low Yield, High Growth Stocks.

It’s hard it is to invest when stocks don’t seem to trade at their fair value

Don’t you hate not knowing when to buy or sell stocks? There are too many investing articles contradicting one another, which leads to confusion. This might give you the impression you won’t reach financial independence. It doesn’t have to be this way. I’ve built a free recession-proof portfolio workbook which gives you the actionable tools you need to invest with confidence and reach financial freedom.

Download the workbook now!

This workbook is a guide to help you achieve three things:

- Invest with conviction and address directly your buy/sell questions.

- Build your dividend portfolio and manage it through difficult times.

- Enjoy your retirement.