Why look at the 5 most popular U.S. stocks with members of DSR Pro? To get ideas! You have your own process to select stocks, but seeing other investor’s favorites can open the door for new opportunities. It’s a great starting point for your research. I also do it out of curiosity 😉.

I surveyed the DSR database to pull out the 25 most popular U.S. stocks, not looking at individual portfolios, but rather the number of times each stock appears across the 2,289 DSR PRO members’ portfolios. This is not based on value; I don’t know how much is invested in each stock.

This week, we have a fairly detailed look at the top 5 stocks, what I like and don’t like about each one and the roles they can play in a portfolio. We’ll see the remaining 20 in a later article.

Never let a list like this replace your investment process. Don’t load up on these stocks without the conviction that they fit with your strategy. It’s a good list to start a research project, but that’s just the beginning. There’s more digging required before pulling the trigger…

Sign up for our upcoming webinar: Most Popular Dividend Stocks – Best Protection and Better Returns

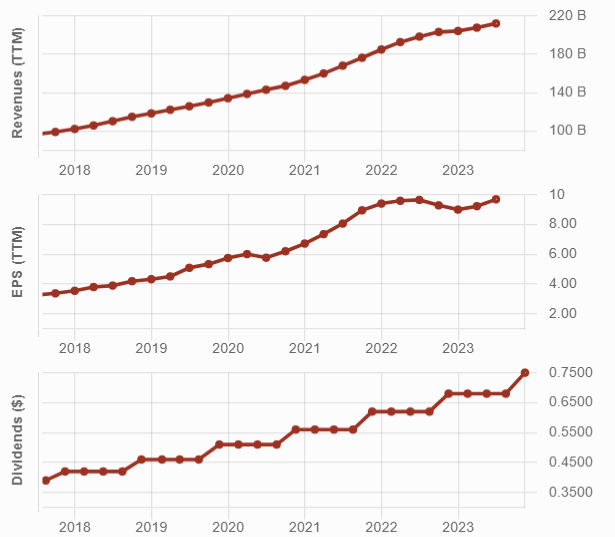

MICROSOFT (MSFT)

1st place – 773 members

Microsoft has built an impressive portfolio of products through organic development and acquisitions. With strong ties to corporate America, it now plays a major role in the cloud business. Its near-perfect dividend triangle shows double-digit revenue and earnings growth, and the dividend’s annualized increase is currently 10%.

The shift to a subscription-based model for many products was pure genius. We all pay for Microsoft Office Suite licenses annually. MSFT enjoys multiple growth vectors including gaming (even better since acquiring ActivisionBlizzard), cloud, and artificial intelligence, acquiring Nuance in 2022 and investing in Open AI, creator of the famous ChatGPT.

When a stock climbs continuously, you wonder when the party will end. MSFT is trading at a rich valuation; the average 5-year PE ratio is 31.4 while the stock trades over 36 times its earnings. It’s condemned to deliver double-digit growth, otherwise the stock will trade lower.

I put Microsoft in the “growth and defense” category. Such a strong company goes through recessions and continues to perform. Its only flaws are its low yield and rich valuation.

APPLE (AAPL)

2nd place – 710 members

Apple generates ~50% of its revenue from its iPhone. It was once seen as a one-trick pony, but Apple has developed several other business lines that complete its ecosystem. Its services business now accounts for 20% of sales and growing. About 10% of sales come from wearables, 10% from Mac systems, and 10% from iPads. Apple can gradually increase its prices in the services business to offset any slowdown in iPhone sales.

The iPhone looks like an infinite fountain of cash flow. Apple can afford to be second, third, even 10th when entering a new market because when it does, it does so with such flourish and the backing of enthusiastic fans eagerly awaiting the next product. It’s how Apple achieved double-digit growth in the service business for several years now. Apple’s strong and innovative culture should propel its business forward indefinitely. It generates impressive cash flow quarter after quarter with management using it wisely it to keep Apple on top.

Apple stock looks as expensive as its products. Quality has a price, but over 30 times forward earnings is a bit steep, especially when a recession looms. While Apple proved again and again it can battle against any other tech stock, there are new, innovative companies rising in this market. Just as the iPhone killed the Blackberry, it could be knocked off its pedestal. The market remains focused on short-term iPhone sales, which won’t be great. Therefore, AAPL could go sideways for a while. But you know the story; next time there’s a surprise sales story around phones, AAPL will surge again.

Forget about its P/E ratio and yield, go for Apple’s growth. Interestingly, I also see Apple as a great defensive stock. With such a strong quality brand, Apple will find its customers receptive to its new products even during tough economic times.

Sign up for our upcoming webinar: Most Popular Dividend Stocks – Best Protection and Better Returns

ABBVIE (ABBV)

3rd place – 576 members

I’m surprised to find a pharmaceutical firm as the third most popular stock. While AbbVie deserves a place in the top 10, I thought its volatility would have cooled off the interest of some investors. AbbVie products are in various therapeutic categories, in short, specialty drugs and aesthetics.

With one of the most promising drug pipelines in the industry combined with aesthetics products, ABBV is set to generate many blockbusters. Also fueling growth is its hematologic oncology portfolio; its psoriasis and rheumatoid arthritis drugs are also promising. Management seems confident, paying generous dividend increases over the past 5 years.

My concerns are patent expirations and large debt. Humira is AbbVie’s largest blockbuster ever, contributing over 50% of its profits. The Humira patent expired in 2023 for the U.S., which had an important impact on ABBV’s results this year. The company is losing the race to replace Humira within its pipeline. ABBV stock shows its fair share of volatility, so be ready to ride the roller coaster. While I like the acquisition of Allergan, it has pushed its debt even higher. Let’s hope for success!

AbbVie provides a solid yield (4%) that also comes with headaches; a highly volatile stock price that moves easily in double-digits on news of consequence. You’ve been warned.

JOHNSON & JOHNSON (JNJ)

4th place (up from 5th) – 508 members

Many investors picture JNJ as the maker of Tylenol; they believe consumer staple products are the bulk of its business. It’s not and I’m glad JNJ spun off its staple products into Kenvue (KVUE) this year. JNJ is now a big pharma company with medical devices as a side gig. Having settled its legal issues, JNJ is now ready to move on.

Johnson & Johnson is the world’s largest and most diverse healthcare firm, subject to patent expiry. Fortunately, JNJ specializes in complex drugs that are hard and costly to replicate. Consequently, they generate solid sales even after patent expiry. I like how JNJ can rely on other segments for reliable and consistent cash flow. JNJ is one of the few Dividend Kings, meaning it has over 50 years of consistent dividend increases. Another sign of a company that survives, even thrives, during any kind of recession.

With most revenue coming from pharmaceuticals, JNJ’s growth is somewhat tied to its drug pipeline. If the company can’t come up with new blockbuster drugs, selling medical devices won’t be enough to create continued and growing value for shareholders. Like 3M, JNJ can be in a delicate situation due to lawsuits. It happens occasionally and hurts the stock price.

JNJ is a strong defensive play that occasionally provides capital appreciation. It’s a stock that can go “dormant” before exploding on good news.

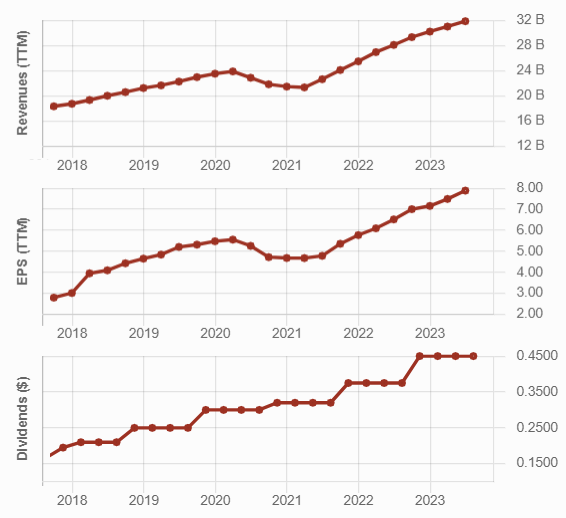

VISA (V)

5th place (up from 7th) – 498 members

Want a low yield, high growth stock to boost your portfolio performance? Visa’s been on a roll since its IPO. I regret not buying it 10 years ago! The largest kid in a playground requiring size and scale to succeed, Visa will keep surfing on international money transfers and ecommerce expansion. Its ability to follow (and create) trends in money transfer are crucial going forward. If you thought Visa was expensive last year…

Visa’s dividend triangle is nearly perfect: 5-year revenue growth of 9.65%, EPS of 11.75%, and dividend growth of 16.90%.

It built the widest and most secure network for the transfer of funds, and partners with major financial institutions across the world. The clear trend favoring electronic payments is a strong tailwind for Visa’s established its network.

It doesn’t carry significant debt on its balance sheet. Visa focuses on the quality of its payment network, leaving the consumer debt to financial institutions and making money on transactions, whether the consumer pays at the end of the month or not.

Visa seems to always trade at a rich valuation, often the case with low-yield, high-growth stocks. The current PE is at 30, with an average of 36 over 5 years! That might stop you from pulling the trigger if you’re worried about buying at the “wrong” price. I hesitated several years before I bought it in 2017. While Visa has a sticky business model, merchants could go rogue and try to negotiate fees with Visa one day. There’s only so much you can squeeze from merchants, especially if they find alternatives!

Visa’s definitely a play on growth. It’ll get hurt during recessions when consumers spend and travel less.