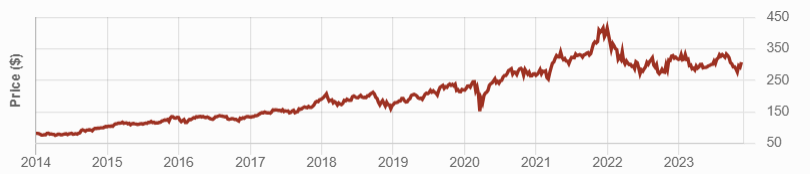

Still my number one buy list stock for November is Home Depot (HD). It should be a rough fall and winter for Home Depot as the market slowly, but surely realizes we’re heading towards a recession, well that’s my guess anyway! But short-term fluctuations create great long-term opportunities.

HD entered the maintenance, repair, and operations sector by acquiring Interline Brands in 2015, rebranding it The Home Depot Pro. With its do-it-yourself and professional customers and highly rated online platform, HD has built a semi-bulletproof business model, able to compete with anyone.

Want more stock ideas? Download our Rock Stars list, updated monthly.

Home Depot Business Model

Home Depot is a home improvement retailer offering building materials, and products for home improvement, lawn and garden, decor, and for facilities maintenance, repair, and operations. It also provides home improvement installation services and tool and equipment rental.

Home Depot is a home improvement retailer offering building materials, and products for home improvement, lawn and garden, decor, and for facilities maintenance, repair, and operations. It also provides home improvement installation services and tool and equipment rental.

HD operates over 2,322 stores located throughout the United States, Puerto Rico, the United States Virgin Islands, Guam, Canada, and Mexico.

It serves two primary customer groups: do-it-yourself (DIY) customers and professionals (Pros). DIY customers include homeowners who purchase products and complete their own projects and installations. Pros include renovators, general and building service contractors, maintenance professionals, handymen, property managers, and tradespeople, e.g., electricians, plumbers, and painters.

HD Investment Thesis

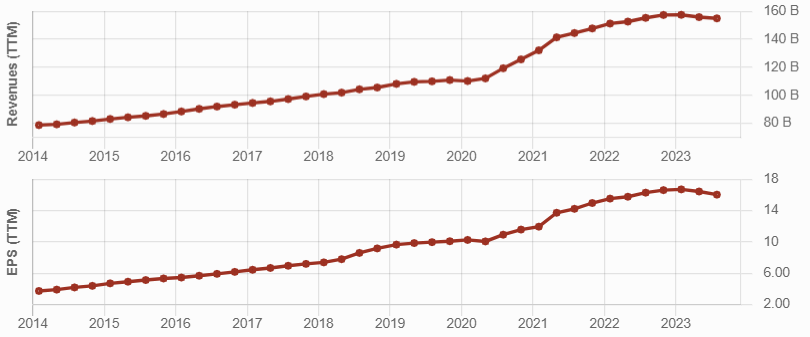

HD is the world’s largest home improvement retailer, with more than $150B in sales. HD has built a strong relationship with Pro builders by making everything they need available when they need it. HD gained from the surge in the home improvement market with a high single-digit annualized revenue growth over the past 5 yrs. HD enjoyed the “stay-at-home” tailwind created by the pandemic and the rising popularity of DIY projects caused by housing shortages and higher interest rates.

A key element in its success was double-digit growth in the online segment over the past 5 years. Its website is among the largest platforms in the world.

HD Last Quarter and Recent Activities

Home Depot did better in the third quarter of 2023 than expected despite weaker revenue (-3%) and earnings (-10.1%). Comparable sales fell 3.1% and customer transactions were down 2.7%. The average transaction ticket fell 0.3%, due in part to deflation from core commodity categories. For example, framing lumber was approximately $420 dollars per thousand board feet compared to $545 dollars in the third quarter of 2022, a decrease of over 20%.

Pro sales outperformed sales to DIY sales, as DIY customers. Increasing pressure from high-interest rates made DIY customer scale back their projects. Big-ticket transactions, i.e., those over $1,000, were down 5.2% compared to a year ago. Demand softened for big ticket discretionary categories like flooring, countertops, and cabinets. However, there was big-ticket strength in Pro heavy categories like roofing, insulation, and portable power.

Pro sales outperformed sales to DIY sales, as DIY customers. Increasing pressure from high-interest rates made DIY customer scale back their projects. Big-ticket transactions, i.e., those over $1,000, were down 5.2% compared to a year ago. Demand softened for big ticket discretionary categories like flooring, countertops, and cabinets. However, there was big-ticket strength in Pro heavy categories like roofing, insulation, and portable power.

HD is pursuing growth in the Pro segment, including new offerings for the Complex Professionals. These are Pros working on complex projects who want to reserve product, use trade credit, and receive deliveries at their jobsite in a staged manner.

HD lowered its 2023 full-year guidance due to its recent results and the current economic conditions.

Want more stock ideas? Download our Rock Stars list, updated monthly.

Potential Risks for Home Depot

HD has limited room to grow on its own, with limited new store openings each year. It still posts revenue growth year after year but might have to look internationally for future growth. The housing shortage was supporting sales growth, but a long-term economic slowdown has started to affect results. With higher interest rates, new housing starts will keep slowing down.

Supply chain challenges remain a worry, particularly with lumber. The PRO segment is seeing some competition that could erode HD’s market share in the mid to long-term. Finally, Amazon is growing quickly across several segments and could affect HD’s sales in some categories.

HD Dividend Growth Perspective

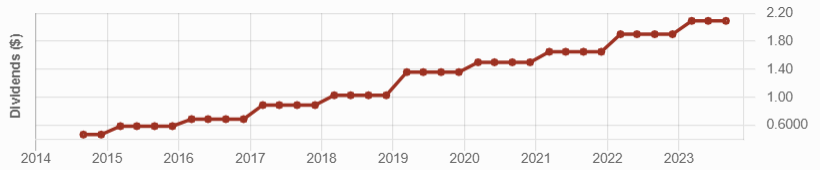

HD has increased its dividend payout since 2010. While it’s still a relatively young player in its market, its impressive dividend triangle should put HD on the radar of dividend growth investors.

With low payout and cash payout ratios, HD has faced numerous challenges but kept its dividend growth policy alive. Going forward, we can expect a mid-single to high-single-digit dividend growth rate with a few more generous surprises; we sure hope an increase is on its way to start off 2024.

Why it’s a Buy List Stock

Home Depot is a perfect fit for a dividend growth portfolio as it possesses a strong dividend triangle. It will face multiple headwinds for several months due to the economic climate. Continued investments in its online platform and in the Pro segment combined with its past resilience, make it a strong candidate buy list stock.

After the highs of 2022, HD stock currently trades at a lower PE vs. its 5-year average (19.95 vs 21.75). It also offers a higher dividend yield vs. its 5-year average (2.70% vs. 2.20%), despite growing it double-digits for the past 5 years. Could be an opportunity…though be on the lookout for a dividend increase announcement.

See where it lands in popularity among DSR member in 25 Most Popular U.S. Stocks at DSR.