Finding low yield, high growth stocks! After hearing me sing the praises of low-yield high-growth stocks, a DSR member asked how to find them. Great question! I thought I should probably share this with all of you.

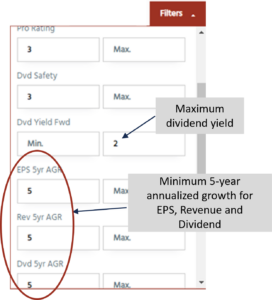

The first step is to use a stock screener to start the search with filters and values explained next. I’ll refer to the DSR stock screener occasionally as an example.

You can also listen to my podcast How to Find Low Yield High Growth Stocks.

Search filters

To find low-yield, high-growth stocks, you must cap the dividend yield to 2% in the stock screener. This ensures you only look at stocks from which the market expects strong growth. A stock that isn’t priced to offer a low yield, signals that, in general, the market doesn’t expect much growth from it.

Next in your search filter are the metrics to identify growth. These are the metrics that make up the dividend triangle: revenue growth, earnings per share (EPS) growth, and dividend growth

Narrow your research to companies with a strong dividend triangle; this means a minimum of 5% for 5-year annualized growth for revenue, EPS, and dividends. This trio of filters puts the emphasis on businesses that have been thriving over the past 5 years.

This search with these values in DSR shows roughly 9% of all stocks we follow (at the time of writing, it brought up 109 stocks out of 1,216 in our database). It’s still a lot of companies to look at, but it’s a good start to your search.

Here is a recap the search filters and values to use

| Filter | Value |

| Dividend Yield | Maximum: 2% |

| Revenue 5-year AGR | Minimum 5% |

| Earnings per share (EPS) 5-year AGR | Minimum 5% |

| Dividend 5-year AGR | Minimum 5% |

If using the DSR stock screener, also filter for our Pro rating and Dividend Safety Score. Specify a minimum value of 3 for each one, to ensure you are looking at quality stocks. Including 3s is best because it’s possible our team has missed a few great stocks, assigning them a 3 rather than a 4 (remember, ratings are useful, but never 100% accurate).

Narrow down by sector

Chances are you’re not looking to add stocks from all sectors in your portfolio. You can restrict your search to companies in specific sectors. By selecting one sector, you’ll likely reduce the results to around 10 stocks.

The results in DSR in October showed most sectors had 16 or fewer candidates. The industrial sector was the champion with 37 candidates.

Get in-depth information on how low yield stocks contribute to dividend income. Download our Dividend Income for Life guide.

Review each business model

Now that you have a more manageable number of companies to choose from, you must take a deep dive into each one.

You want to identify what made each of these companies thrive over the past 5 years. Discovering the key elements that made these businesses so successful puts you in a better position to determine if that will continue. Then, review their business model and the economic environment to determine the likelihood of their repeating that performance level over the next 5+ years.

For example, Visa (V) is one company that would end up in your search results for the financials sector. Low yield, robust growth. So, the stats are on our side for Visa. Why? And, can it keep it going?

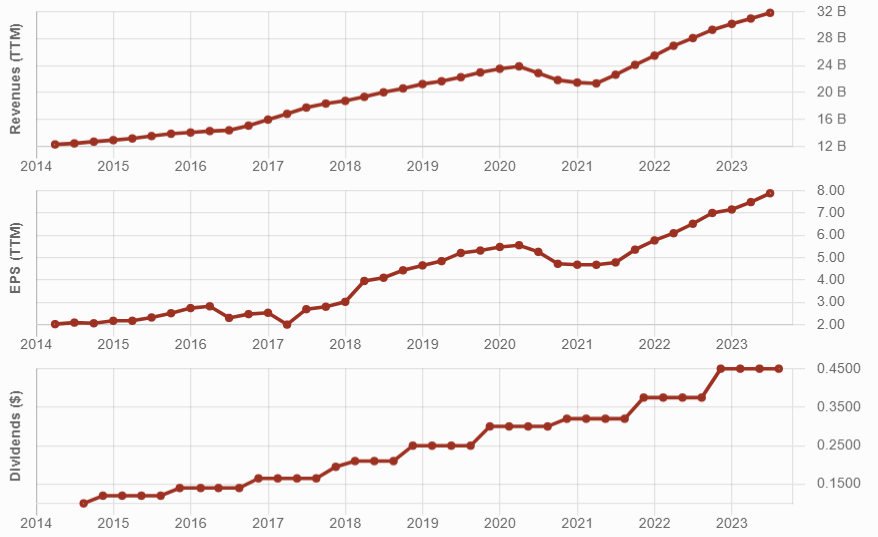

Visa’s Dividend Triangle

Visa shows a robust dividend triangle for the past 5 years, except for the minor dip experienced at the onset of the pandemic in 2020-2021. Its revenue and dividend growth has been strong for at least 10 years, and its EPS growth strong for the last 6 years.

V’s key to success was building the largest and most secure electronic payment network. Visa partners with major financial institutions across the world, and customers pay a commission for each transaction.

However, past performance is no guarantee for the future. At one point, low-yield, high-growth stocks either become mature businesses or find other growth vectors to bring them back to the fast track. With its established network and balanced exposure to payment categories, Visa benefits from strong tailwinds as there’s a clear trend favoring electronic payments. The likelihood of seeing a strong triangle over the next 5 years is pretty good.

Visa’s recently made acquisitions in Europe, including a cross-border payments platform, and entered into crypto. This demonstrates it’s ready to adapt to changes in the industry and pursue its growth model for a while longer.

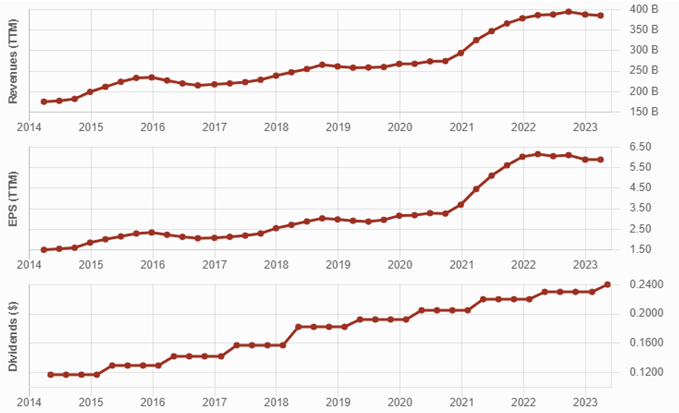

Apple’s Dividend Triangle

A quick look at Apple’s dividend triangle shows that the economic slowdown is weighing on its results:

Since 2022, Apple shows a slowdown in revenue and EPS; even its dividend hasn’t increased significantly. Should you be worried? Here’s when the deep dive becomes important. Looking at Apple’s business model, you see it regularly reaches a plateau where growth slows down. It’s typical of the technology sector. A few years ago, Microsoft reported 90-100% growth each quarter for its cloud business (Azure). Today, this segment still shows strong growth (25-30%), but not doubling year-over-year anymore.

Apple faces an important challenge with its iPhone business; many people see a limit to how much better the next version can be. I’ll continue to bet on Apple based on its expertise and track record in building and integrating new products/technology to their ecosystem. However, that’s narrative, not data. Therefore, monitoring even such a giant beauty like Apple is important.

Get in-depth information on how low yield stocks contribute to dividend income. Download our Dividend Income for Life guide.

Conclusion

Identifying low-yield, high-growth stocks (or high-yield, low-growth stocks) is relatively easy when you look at the past. A simple search in a stock screener provides you with a list of companies and their performance over the past 5 years. It’s a good starting point for a search (or to identify red flags in your portfolio), but the deep dive into their business model is crucial in both cases.

Analyzing the dividend triangle and understanding the business model is just as crucial for your high yielders as it is for your high growth low yielders. Why? To ensure they continue to be safe investments; that their dividend is safe and that it will grow at least 2-3% per year—a minimum level of growth and protection against inflation. Central banks like modest inflation (2-3%); it means the economy is healthy and growing. You should be happy to see modest growth from your high yielders as well; in the absence of growth however, you might be nearing a dividend cut.

Now that you know how to find the stocks, learn how to build your income portfolio.