You don’t need a book to understand how a sector works. What you need is a clear analysis guideline that will tell you what is important to know and how to make the best investment decisions. The consumer defensive sector is particularly interesting during these times of uncertainties. Let’s discuss its greatest strengths and weaknesses and how to get the best from it.

Iconic Brands and Constant Cash Flows

Consumer defensive stocks also have a second name: consumer staples. When we discuss consumer staples, we often describe it as all the products you can find in your house. Those are products you must buy no matter what happens in your life. These companies have built stellar brand portfolios supporting repeat purchases. Repeatable purchases lead to constant and predictable cash flows. Therefore, food, beverages and household products could be a great foundation to build a dividend growth portfolio. If you are concerned about the current state of the economy, add some consumer defensive stocks to your portfolio.

Sub-Sectors (Industries)

Greatest Strenghts

If you are looking for a place to stash your cash during tough times, forget about your mattress. Consumer defensive stocks are in fact defensive. When the market goes into panic mode, this part of the equity markets isn’t normally a source of worry. We clearly have seen how grocery and discount stores have done during the pandemic. Besides healthcare services, they were the first to be named as “essential businesses”.

On top of selling “essential goods” (we could discuss how alcoholic and tobacco products are considered as essential another time), this sector also shows another great characteristic. Most of its industries have built their business model around repetitive sales. What’s better for a dividend investor than to find a business that keeps selling the same products to the same consumers every week? This is what we can call a cash cow.

Throughout the years, many of these businesses have built iconic brands. You will even find companies managing portfolios of multibillion dollars brands. Such large brands come with economies of scale and a wide distribution network. This increases the barriers to entry up to a higher level. This also provides many investors a sentiment of calm as they can count on their dividend no matter what happens. Even better, when people lose their job, they will keep buying those brands!

Greates Weaknesses

Growth is often a matter of concern for this sector. When emerging markets came into play, they all rode the wave and discovered new playgrounds. As those markets are growing, local competitors arise. Smaller players can’t compete on price and scale. However, they are more flexible and know their customers better than those “gringos” coming from North America. Buy America or buy local is not just a slogan that we have here in our countries. It’s a movement trending around the world.

Speaking of competition, it now comes from everywhere. Beverage companies go after snacks and packaged foods industries while some discount stores first introduced packaged foods before transforming into full grocery stores. Such competition created first a shelf war where products had to compete against each other for top space in stores. This has now moved to the online world where shopping online has reached all industries.

Those “old” companies must adapt to e-commerce as well. Many of those companies face similar challenges that consumer cyclicals face when it comes down to dealing with digital sales. Even groceries must invest massively in their online platform to enable consumers to order their food and pick it up at the store.

How to Get The Best of It

It’s hard to determine a good time to buy consumer defensive stocks as they are rarely “on sale”. When everybody is making money in the market and growth stocks get most of the love, you have a shot at buying unloved consumer staples. This is the type of investment that will make you almost regret having made the investment during a bullish year. They will often lag and show minimal growth during boom times. On the other hand, when panic spreads, these companies will hold the fort and make sure your portfolio doesn’t go bust.

Most industries are best fit for income investors.

Favorite Picks

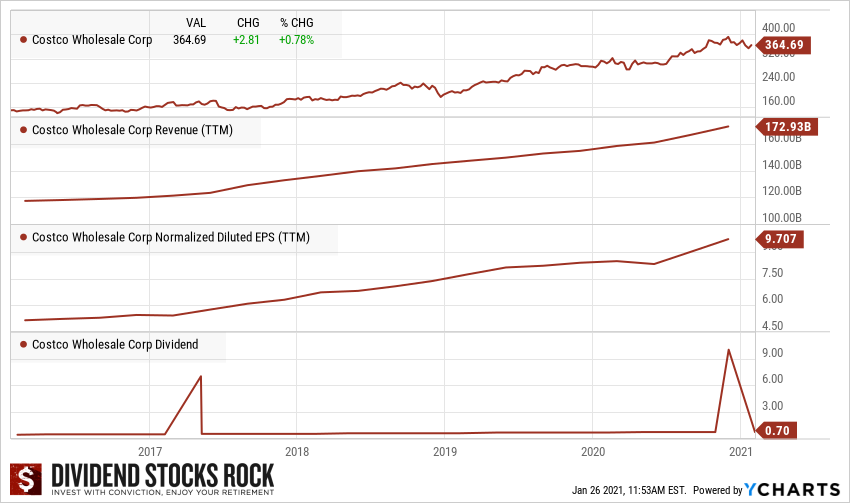

Costco (COST)

- Market cap: 160B

- Yield: 0.76%

- Revenue growth (5yr, annualized): 7.49%

- EPS growth rate (5yr, annualized): 10.93%

- Dividend growth rate (5yr, annualized): 12.33%

Business Model

The leading warehouse club, Costco has 795 stores worldwide at the end of fiscal 2020, and most sales are generated in the United States (73%) and Canada (13%). It sells memberships that allow customers to shop in its warehouses, which feature low prices on a limited product assortment. Costco mainly caters to individual shoppers, but roughly 20% of paid members carry business memberships. Food and sundries accounted for 42% of fiscal 2020 sales, with hardlines being 17%, ancillary businesses (such as fuel and pharmacy) nearly 17%, fresh food was14%, and soft lines at 10%.

Investment Thesis

Costco has a unique business model: members are convinced they made the best deal possible with their two baskets full of goods. It is convenient to do your grocery shopping, buy your TV for the Super Bowl, get your training shoes for your 10k and pick-up the medicine for your little one… all at the same place! Costco is the “all-you-can-eat” store. It is also one of the few retailers to claim that all is going well without it being a white lie. COST shows strong revenue growth for the decade. Its business model will provide continued growth, and as customers are also members, they tend to prioritize their purchasing at Costco. With over 90 million members and a renewal rate around 90%, COST is a stable pick for your portfolio.

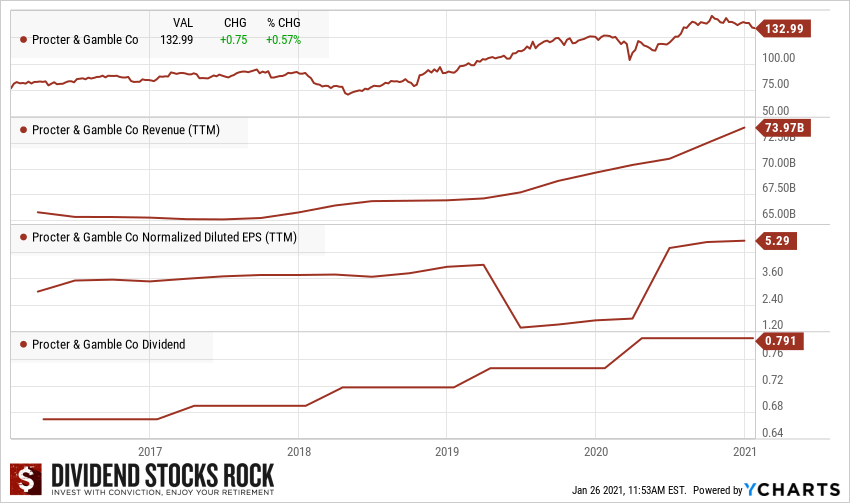

Procter & Gamble (PG)

- Market cap: 330B

- Yield: 2.30%

- Revenue growth (5yr, annualized): -2.46%

- EPS growth rate (5yr, annualized): -10.86%

- Dividend growth rate (5yr, annualized): 11.40%

Business Model

Since its founding in 1837, Procter & Gamble has become one of the world’s largest consumer product manufacturers, generating nearly $70 billion in annual sales. It operates with a lineup of leading brands, including 21 that generate more than $1 billion in annual global sales such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. P&G sold its last remaining food brand, Pringles, to Kellogg in 2012. Sales beyond its home turf represent around 55% of the firm’s consolidated total, with around one third coming from emerging markets.

Investment Thesis

If you buy shares of PG, your goal must be to earn a steady and increasing flow of income. Procter & Gamble is probably more stable than most bonds and pays a higher yield. There are no immediate threats around that will jeopardize its dividend in the future. PG is a strong core holding, no matter how much you pay for it. As the company is still about to get out of its brand portfolio transition, it may be good timing to enter a position. We can clearly see a trend developing since mid-2018. As the market goes through lots of fluctuation, PG is the kind of company that will continue paying its due without a worry. This is not a surprise to see such hype around the stock.

Webinar: Where to Invest in 2021?

2,000+ investors saw this webinar already.

- KM: “Amazing webinar! Thanks very much!”

- Cheryl: “With thanks, I’m impressed!”

- Harley: “Thank you for your passion Mike.”

- Roberta: “I’m such a huge fan of DSR! Well done, Mike.”