The digital economy runs on connectivity — not just between people, but between clouds, networks, and applications. That’s where this REIT shines. As businesses migrate to hybrid and multi-cloud strategies, demand for secure, low-latency, and globally connected infrastructure continues to soar. This company sits at the crossroads of that demand, enabling enterprises and tech giants alike to interconnect their digital operations at scale.

Building the World’s Most Connected Platform

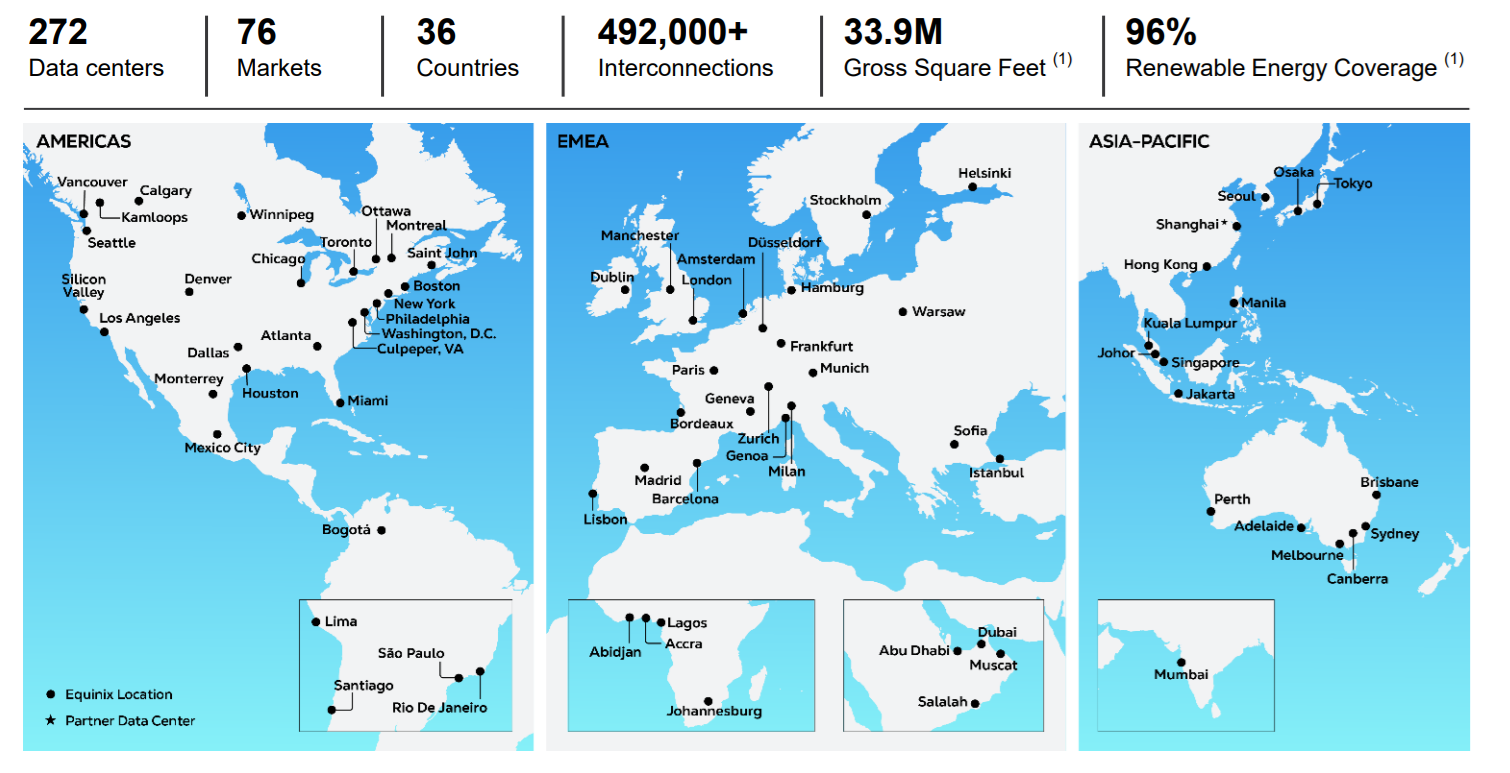

Equinix (EQIX) operates the largest global platform of interconnected data centers, with over 240 facilities spanning five continents. Its portfolio includes both International Business Exchange (IBX) and xScale data centers, catering to enterprises, hyperscale cloud providers, and network operators.

Revenue is primarily recurring, driven by:

-

Colocation services – housing the customer’s IT infrastructure.

-

Interconnection solutions – linking businesses, partners, and clouds within and between data centers.

-

Digital services – tools like Equinix Fabric, Cloud Router, and managed IT support.

Additional offerings, such as Equinix Smart Hands (on-site operational support) and Equinix Smart Build (turnkey infrastructure solutions), deepen customer relationships and create sticky, long-term contracts.

Why This REIT Stands Out: Bull & Bear Cases

Bull Case — Interconnection as a Growth Engine

Equinix’s strongest asset is its ability to create digital ecosystems — highly interconnected environments where enterprises, cloud providers, and networks converge. This creates massive switching costs; once a business is embedded in Equinix’s environment, moving elsewhere is costly, complex, and risky.

Playbook

Operating in 70+ metros, Equinix earns through recurring colocation and interconnection fees. Its platform supports mission-critical workloads for industries from finance to gaming to healthcare.

Growth Vectors

-

AI & Cloud Demand – Hyperscalers are racing to add capacity, and Equinix’s xScale portfolio caters specifically to this high-demand segment.

-

Edge Computing – With the acquisition of Packet, Equinix offers Equinix Metal, enabling rapid deployment of physical infrastructure at the network edge.

-

Global Expansion – Targeted builds and acquisitions in emerging markets increase reach and capacity.

-

Sustainability Leadership – The recent S$500M green bond issuance underscores its commitment to renewable energy and efficient operations.

Economic Moat

-

Largest global footprint in the sector.

-

Dense ecosystems of interconnected partners.

-

Multi-cloud and multi-network capabilities are unmatched by competitors.

Bear Case — Debt and Competition Loom

Equinix’s growth model is capital-intensive, and expansion has pushed total debt to ~$15.3B from $11.6B just five years ago. In a high-interest-rate environment, refinancing risk and interest expense could pressure Funds From Operations (FFO).

Business Vulnerabilities

-

Debt limits flexibility for opportunistic acquisitions or faster buildouts.

-

Heavy reliance on sustained high demand for data center capacity.

Industry & Market Threats

-

Competitors like Digital Realty Trust (DLR) and CyrusOne are expanding aggressively, potentially pressuring pricing.

-

Technological changes — from new cooling systems to alternative compute infrastructure — could alter competitive advantages.

Competitive Landscape

While Equinix remains the largest and most connected, rivals are investing to close the gap. Any slowdown in demand or shift in industry preference could reduce its premium positioning.

Get the Dividend Income for Life Guide

Want to retire on dividends? The Dividend Income for Life Guide shows you how to build sustainable income for decades—with clear steps, example portfolios, and smart rules to follow. Whether you’re near retirement or just starting, this guide helps you structure your finances around income, not speculation.

Download your free copy now »

What’s New: Another Strong Quarter

In Q2 2025, Equinix reported:

-

Revenue +5% YoY, driven by demand across multiple geographies and industries.

-

FFO per share +14%, fueled by better-than-expected bookings and sales execution.

-

Issuance of S$500M in green bonds to finance sustainable projects.

-

Full-year guidance raised: Revenue +5-6%, AFFO per share +7-9%.

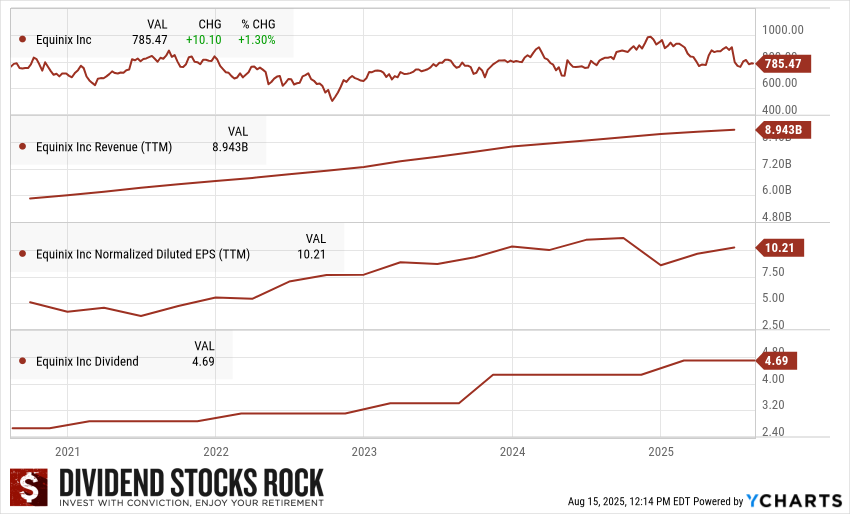

The Dividend Triangle in Action: Growth with Scale

Equinix has delivered a strong Dividend Triangle, with steady revenue, FFO, and dividend growth. Over the past five years:

-

Revenue: Climbing steadily with global expansion.

-

FFO: Consistent double-digit growth, supported by high renewal rates and new capacity.

-

Dividend: Increased regularly, with the current payout at $4.69 per share quarterly.

While the yield is modest, the growth rate more than compensates for income-focused investors looking for long-term compounding.

Build Your Dividend Income for Life

The Dividend Income for Life Guide shows you how to build a retirement-ready portfolio based on dividend growth rather than chasing high yields. Companies like Mastercard prove that even a modest yield can become a powerful income stream over time when paired with consistent dividend hikes. Learn how to spot these long-term winners and create an income you can rely on for decades.

Download your free guide today.

Final Thoughts: A Digital Tollbooth Worth Owning

Equinix isn’t just a landlord for servers; it’s a tollbooth for the digital economy. Its unique positioning in interconnection and global reach make it a cornerstone REIT for those seeking growth in a tech-driven world. While debt and competition are worth monitoring, the long-term demand drivers — cloud, AI, and digital transformation — remain firmly in its favor.

I love your brief on EQIX.

I’m going to look at tiptoeing in on a pullback.

For the time being, I’m investing in ORCL and CSCO.

Thanks for sharing your sharp insights on EQIX.