No, this isn’t a Batman adventure, but rather a post explaining the Brookfield companies. Brookfield Corporation is huge. With over 180,000 employees in 30+ countries, it manages more than $750B in assets invested in its various businesses. Brookfield companies operate in different industries, for example, asset management, renewable energy, reinsurance, and infrastructure (with tickers including BIP, BEP, BAM, etc.). They can be great investments, as long as you understand which is which!

Many investors have been excited about Brookfield’s diversification, its smart business model, and its ability to thrive for more than a century while paying generous dividends and providing excellent total returns. Others turned away due to Brookfield’s complex structure.

Get great dividend stock ideas with our Rock Stars list, updated monthly!

Why so complex?

Starting as the San Paolo Tramway, Light and Power Company in 1899, the company has diversified into new activities. Along the way, it spun off these new business segments as separate companies. The mothership, the parent company now called Brookfield Corporation, owns part of or all of these Brookfield family companies. Investors can buy stock in any of the Brookfield companies that are publicly traded, or buy shares of the parent, Brookfield Corporation, which itself owns a piece of all the others.

What Brookfield does

Brookfield Corp. (BN) is an alternative asset manager. It focuses on what’s called alternative assets rather than classic assets such as equities (stocks), fixed income (bonds, preferred shares), or cash (money market funds). Alternative assets are long-life, high-quality assets including hydroelectricity plants, wind and solar farms, toll roads, pipelines, railroads, data centers, healthcare facilities, etc.

Brookfield expertise

Investing and managing alternative assets requires unique expertise. While each Brookfield company operates in different industries, they all share many characteristics. Most of their projects and investments:

- Are large and complex.

- Require patient money, i.e., money must remain invested for decades to generate substantial cash flow.

- Perform well over time.

- Relate to assets not considered liquid, meaning that they cannot be sold quickly and easily.

- Are not greatly affected by economic cycles. They tend to be recession resistant.

Diversification

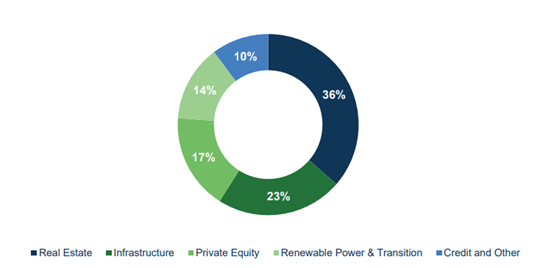

Brookfield assets are managed through different companies owned or partly owned by Brookfield Corp. The profits BN makes come from different types of assets as shown below.

With asset types having different risk profiles and strategies, each one contributes to overall diversification and reduced volatility.

What’s in it for investors?

Investing in alternative assets is a great way to diversify a portfolio. Usually, the returns on such investments aren’t determined by what’s happening on the stock market. You can expect them to generate about 5-7% above inflation over long periods.

The problem for a retail investor is quite simple: it’s virtually impossible to buy a piece of a bridge or a railroad. This is where Brookfield comes into play. Investing in Brookfield Corp. (BN) is like investing in your own “alternative asset fund”.

The Brookfield companies

Brookfield manages assets through seven companies in the Brookfield family and one standalone business.

Brookfield Asset Management (BAM)

BAM is an asset-light alternative asset manager. It doesn’t have many assets but rather manages funds coming from pension plans and other institutional and retail investors. BAM manages the funds and establishes strategies. It makes money by charging fees on its assets under management (AUM). The more money it raises for investments, the more its earnings grow.

Brookfield Corporation (BN)

As the parent company, BN owns part of the other Brookfield companies. It’s also a heavy-asset manager; it not only does the asset-light manager’s job (strategy + earning fees on AUM), but also contributes with its own assets. BN can benefit from its own strategies, sell those assets for a profit in the future, and reallocate the proceeds into new projects or undervalued assets. This is known as asset recycling.

BN has $60B invested in public holdings (BEP, BIP, BBU, BAM, BNRE) and $78B invested in private holdings.

Brookfield Renewable (BEP)

BEP operates one of the world’s largest publicly traded renewable power platforms. Its portfolio consists of approximately 33000 MW of capacity and over 7,000 generating facilities in North America, South America, Europe, and Asia. The company is an experienced global owner and operator of hydroelectric, wind, solar, distributed generation, and storage facilities. Been concerned about renewable energy companies not getting a lot of love lately? See What’s happening with renewables?

Brookfield Infrastructure (BIP)

BPI is one of the largest owners and operators of critical and diverse global infrastructure networks. It operates four segments:

- Utilities: electricity and gas connections

- Transport: rail operations, toll roads, terminals, and export facilities

- Midstream: pipelines, processing, storage

- Data infrastructure: multi-purpose towers, fiber optic cable, data centers

BIP is well diversified with operations in the Americas (69% of assets), Asia Pacific (14%), and Europe (17%).

Get great dividend stock ideas with our Rock Stars list, updated monthly!

Brookfield Business Partners (BBU)

BBU is a global business services and industrial company focused on owning and operating high-quality providers of essential products and services. Their operations are diversified across the industrial, infrastructure services, and business services sectors.

This is the smallest of the Brookfield kids and potentially the least interesting in my opinion, in part because of its lack of dividend growth. BBU goes after public businesses and acquires them to convert them into private companies.

Brookfield Reinsurance Ltd (BNRE)

Brookfield Reinsurance offers a broad range of insurance products and services to individuals and institutions, including life insurance and annuities, health, personal and commercial property, and casualty insurance. It’s expanding in the U.S. with the announcement of a $1.1B acquisition of Argo Group International Holdings in February 2023. BNRE is a young company. It will take to analyze how it evolves.

Brookfield Property Group (Private)

This private company has a portfolio of $276B in assets invested in housing, logistics (industrial), hospitality, science & innovation, offices, and retail. The portfolio is diversified across many industries and spread across five continents.

In addition to these companies, Brookfield acquired a majority interest in Oaktree, which continues to operate as a standalone business. Brookfield and Oaktree managed a credit portfolio worth $157B with a contrarian, value-oriented and risk-managed approach to protecting capital.

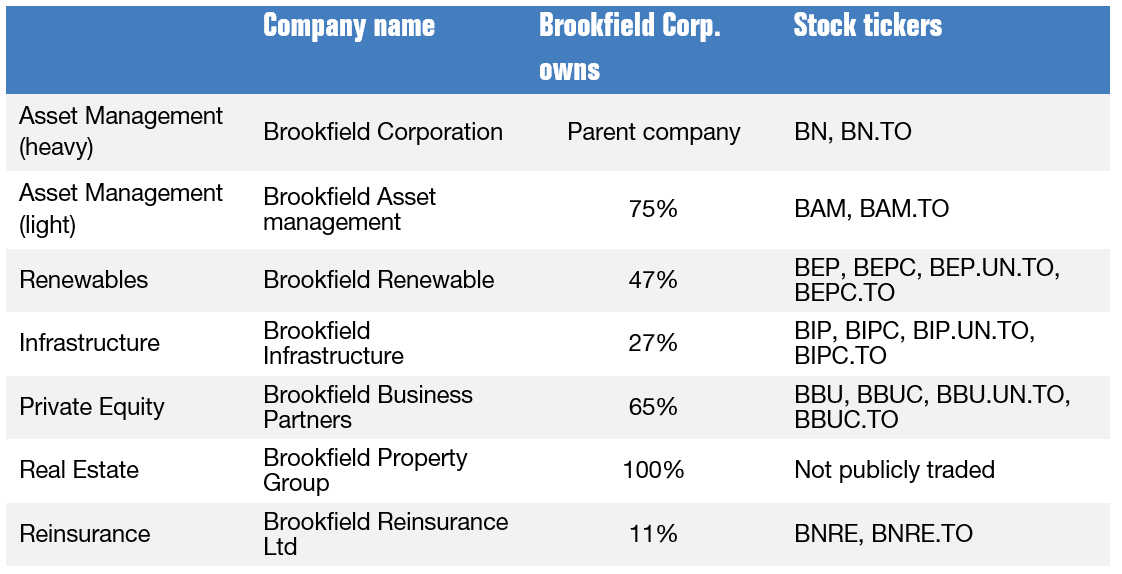

Ownership and stock symbols

Below, you see the asset types, the Brookfield company that manages them, the percentage of ownership the parent BN company has in each company, and the different stock symbols for each company.

In closing

Brookfield has a complex structure and opaque business models that make it hard to understand. Some of its companies (BN, BIP, and BEP) have sizeable debt but with their cash and assets on hand, debt repayment hasn’t been a problem. In my opinion, the most interesting investments today are BN, BAM, BIP, and BEP. Listen to the following podcasts for recent results:

If something major happens to BN, it likely affects BAM, BIP, and BEP so holding all of them isn’t advisable. Since BN, the parent, has a stake in many industries, investing in it is like a mini-ETF.

Some companies in the chemical and specialty chemical industries offer products that are bought no matter what is happening in the economy. Companies that produce those stable products enjoy stronger pricing power, are less dependent on commodity prices, and could become good dividend growers.

Some companies in the chemical and specialty chemical industries offer products that are bought no matter what is happening in the economy. Companies that produce those stable products enjoy stronger pricing power, are less dependent on commodity prices, and could become good dividend growers. On top of their cyclical nature, most basic materials companies need a lot of capital to operate. This often leaves little room for dividend growth, particularly during economic downturns. This is also why these companies are likely to cut their dividend temporarily to assist the business in weathering challenging times. Management’s goal is not to fill shareholders’ pockets with distributions, but rather to improve their production abilities and lower their cost of operations.

On top of their cyclical nature, most basic materials companies need a lot of capital to operate. This often leaves little room for dividend growth, particularly during economic downturns. This is also why these companies are likely to cut their dividend temporarily to assist the business in weathering challenging times. Management’s goal is not to fill shareholders’ pockets with distributions, but rather to improve their production abilities and lower their cost of operations. However, if you want to make speculative plays, this is one of the best sectors to play. Whenever there is a bottom, you can pick some leaders in the industry by looking at their balance sheets and ability to generate cash flow, and you can often make great trades. However, you won’t see me overly excited about any materials company.

However, if you want to make speculative plays, this is one of the best sectors to play. Whenever there is a bottom, you can pick some leaders in the industry by looking at their balance sheets and ability to generate cash flow, and you can often make great trades. However, you won’t see me overly excited about any materials company.

I feel that as investors, we often overlook industrials. There’s nothing sexy about industrial companies. They don’t create much hype on the stock market. Even worse, the sector is not seen as a source of high dividend yields.

I feel that as investors, we often overlook industrials. There’s nothing sexy about industrial companies. They don’t create much hype on the stock market. Even worse, the sector is not seen as a source of high dividend yields. Many industrial companies are 50 years old or more. It’s one of the few sectors where you can find many companies that have survived through a whole century. Many of these old companies are of the “GDP+” type of businesses, meaning they normally generate a bit more in returns than the economic growth of the market where they operate (a country or, for the bigger ones, the world). Due to their long-standing existence, they have built solid core businesses and commensurate brand recognition. Those who survived the passage of time and found ways to evolve often make solid dividend payers.

Many industrial companies are 50 years old or more. It’s one of the few sectors where you can find many companies that have survived through a whole century. Many of these old companies are of the “GDP+” type of businesses, meaning they normally generate a bit more in returns than the economic growth of the market where they operate (a country or, for the bigger ones, the world). Due to their long-standing existence, they have built solid core businesses and commensurate brand recognition. Those who survived the passage of time and found ways to evolve often make solid dividend payers. Barriers to entry are legion in most industries in this sector. It’s quite difficult for a new, inexperienced business to secure military contracts or build railways. Most industrials spend massively in research and development and operate enormous facilities around the world. Since many are old companies, you can often pick a business that has survived the last three recessions while keeping its dividend alive. Surviving and thriving in such challenging periods in the market is proof of timelessness and sustainability.

Barriers to entry are legion in most industries in this sector. It’s quite difficult for a new, inexperienced business to secure military contracts or build railways. Most industrials spend massively in research and development and operate enormous facilities around the world. Since many are old companies, you can often pick a business that has survived the last three recessions while keeping its dividend alive. Surviving and thriving in such challenging periods in the market is proof of timelessness and sustainability. A problem with industrial companies is that they often become too large to be managed effectively. Many remember the multiple problems at General Electric (GE), which had to cut its dividend twice between 2008 and 2018. When facing legal issues, 3M decided to spin off a portion of its activities to “simplify” its business, and hopefully mitigate legal ramifications. In other words, the longevity of a company is not necessarily an accurate predictor of its likelihood of paying or increasing its dividend in the future.

A problem with industrial companies is that they often become too large to be managed effectively. Many remember the multiple problems at General Electric (GE), which had to cut its dividend twice between 2008 and 2018. When facing legal issues, 3M decided to spin off a portion of its activities to “simplify” its business, and hopefully mitigate legal ramifications. In other words, the longevity of a company is not necessarily an accurate predictor of its likelihood of paying or increasing its dividend in the future. Most industrials follow cycles. Railroads, construction equipment companies, and truck manufacturing are busy during economic booms but suffer during recessions. If you follow a specific industry closely, you’ll be able to catch great businesses when their stock price is devalued by the market.

Most industrials follow cycles. Railroads, construction equipment companies, and truck manufacturing are busy during economic booms but suffer during recessions. If you follow a specific industry closely, you’ll be able to catch great businesses when their stock price is devalued by the market.

FPL segment is a rate-regulated electric utility that generates, transmits, distributes, and sells electricity in Florida. It has approximately 33,276 megawatts (MW) of net generating capacity, approximately 90,000 circuit miles of transmission and distribution lines, and 883 substations.

FPL segment is a rate-regulated electric utility that generates, transmits, distributes, and sells electricity in Florida. It has approximately 33,276 megawatts (MW) of net generating capacity, approximately 90,000 circuit miles of transmission and distribution lines, and 883 substations.

Some of these industries have amazing dividend growers. The key for these companies is to build a strong brand that serves them well over time. Brands like Nike, Home Depot, McDonald’s, and Starbucks in the U.S. and Ski-Doo, Tim Horton’s, Dollarama, and Canadian Tires in Canada are iconic brands. While such companies do better when the economy booms, they are also resilient during recessions. The cyclical aspect of this sector can also propel your returns if you buy during economic downturns.

Some of these industries have amazing dividend growers. The key for these companies is to build a strong brand that serves them well over time. Brands like Nike, Home Depot, McDonald’s, and Starbucks in the U.S. and Ski-Doo, Tim Horton’s, Dollarama, and Canadian Tires in Canada are iconic brands. While such companies do better when the economy booms, they are also resilient during recessions. The cyclical aspect of this sector can also propel your returns if you buy during economic downturns. E-commerce has been a great disruptor to this sector’s retailers, many of them going bust, which is a continuing trend. Direct-to-consumer (DTC) sales, e.g., Nike selling you shoes directly through your computer or phone, have become a vital element of their business model. Retailers who resist will fail. Brick & mortar retail isn’t dead, but it must expand into the digital sales space for overall company success.

E-commerce has been a great disruptor to this sector’s retailers, many of them going bust, which is a continuing trend. Direct-to-consumer (DTC) sales, e.g., Nike selling you shoes directly through your computer or phone, have become a vital element of their business model. Retailers who resist will fail. Brick & mortar retail isn’t dead, but it must expand into the digital sales space for overall company success.

Medical instruments & supplies: basic instruments, e.g., surgical, stethoscopes, blood pressure cuffs; consumables, e.g., gloves, syringes, test tubes; infection control products including disinfectant, sterilization equipment, personal protection equipment, etc.

Medical instruments & supplies: basic instruments, e.g., surgical, stethoscopes, blood pressure cuffs; consumables, e.g., gloves, syringes, test tubes; infection control products including disinfectant, sterilization equipment, personal protection equipment, etc. The advantage of this sector for dividend investors is the wide selection of large and well-established companies. Companies with strong distribution networks, large drug portfolios, or pipelines full of new products tend to be the top performers in the sector.

The advantage of this sector for dividend investors is the wide selection of large and well-established companies. Companies with strong distribution networks, large drug portfolios, or pipelines full of new products tend to be the top performers in the sector. Big pharmaceuticals often come with massive stock price fluctuations. A patent expiry, a new drug, or a major acquisition can all give Mr. Market mood swings. They can also give investors opportunities to pick up a solid dividend grower at a reduced price. I bought shares of Johnson & Johnson (JNJ) during their quality control issues in 2012-2013 and benefited greatly. Pfizer (PFE) has been going through a rough time since the sales of its Covid vaccine have dwindled; could be a good entry point for this massive pharma.

Big pharmaceuticals often come with massive stock price fluctuations. A patent expiry, a new drug, or a major acquisition can all give Mr. Market mood swings. They can also give investors opportunities to pick up a solid dividend grower at a reduced price. I bought shares of Johnson & Johnson (JNJ) during their quality control issues in 2012-2013 and benefited greatly. Pfizer (PFE) has been going through a rough time since the sales of its Covid vaccine have dwindled; could be a good entry point for this massive pharma.