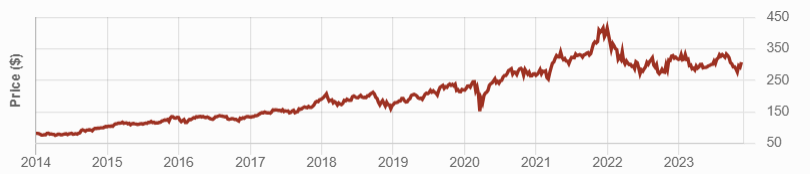

A buy list stock for March 2024 is NextEra Energy (NEE). I see this as a falling knife, i.e. a speculative play on a company whose stock fell quite a bit but that has very good chances to go up again.

Missed our buy list stock for last month? Learn about it here.

NextEra Energy Business Model

NextEra Energy, Inc. is an electric power and energy infrastructure company. It operates through its wholly owned subsidiaries, NextEra Energy Resources, LLC and NextEra Energy Transmission, LLC—collectively known as NEER—and Florida Power & Light Company (FPL).

FPL segment is a rate-regulated electric utility that generates, transmits, distributes, and sells electricity in Florida. It has approximately 33,276 megawatts (MW) of net generating capacity, approximately 90,000 circuit miles of transmission and distribution lines, and 883 substations.

FPL segment is a rate-regulated electric utility that generates, transmits, distributes, and sells electricity in Florida. It has approximately 33,276 megawatts (MW) of net generating capacity, approximately 90,000 circuit miles of transmission and distribution lines, and 883 substations.

The NEER segment owns, develops, constructs, manages, and operates electric generation facilities in wholesale energy markets in the United States and Canada. It also has assets and investments in other businesses with a focus on clean energy, such as battery storage and renewable fuels. It owns, develops, constructs, and operates rate-regulated transmission facilities in North America.

Don’t miss anything! Get the latest delivered weekly by subscribing to our newsletter, right here.

NEE Investment Thesis

The bulk of NEE’s income comes from the booming state of Florida through its subsidiary Florida Power & Light (FPL). This steady growth is set to continue. Florida has quick and cooperative regulators and low customer rates. The company benefits from a territorial monopoly and enjoys significant economies of scale. NEE also counts on investments in clean and renewable energy via its wind and solar power plants, energy sources of the future. President Biden’s $2 trillion renewable energy investment plans should create a tailwind for the company.

The company also grows through acquisitions. In 2019, NEE purchased two utilities and two power plants in Florida for $6.5B, which contributed to earnings in 2021. In 2021, NEE acquired FPL and Gulf Power for $4.44B, while assuming $1.3B of debt.

NEE Last Quarter and Recent Activities

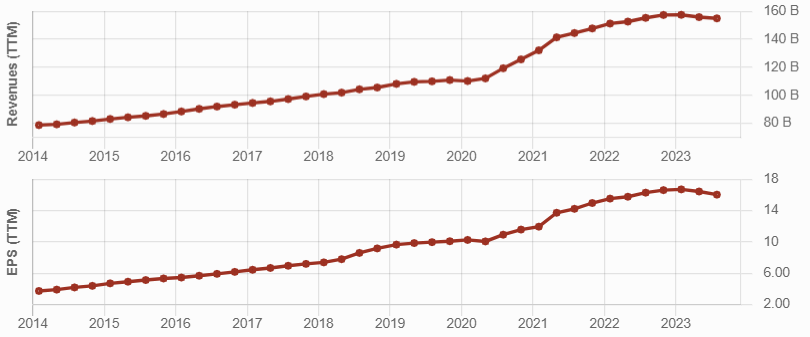

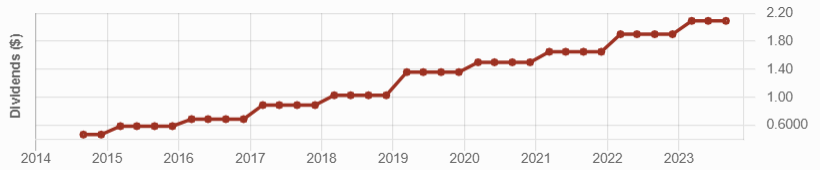

NextEra Energy reported a good quarter with revenue up 12% and EPS up 2%, beating analysts’ expectations. Management also pleased investors when it mentioned it expects to grow adjusted EPS by 6%-8% annually through 2026 from 2024 levels. The company’s Florida Power & Light regulated utilities unit increased its average number of customers by nearly 81,000 over the year-ago quarter, despite a 1.8% drop in retail sales in the period. For the following two years, the company’s 6%-8% EPS growth forecast translates to a range of $3.45-$3.70 for 2025 and $3.63-$4.00 for 2026.

For the full year 2023, NEE saw adjusted earnings per share by more than 9% over 2022. Due to strong operational and financial performance at both FPL and NextEra Energy Resources, it exceeded the high end of its adjusted EPS expectations range.

Potential Risks for NextEra Energy (NEE)

NEE faces a challenge that is common to all utility companies: increasing debt level to invest in future growth projects. The company must invest large sums of money in its power plants to make wind and solar energy a larger share of its generation assets. Therefore, increasing debt with higher interest rates will undoubtedly affect margins and profitability.

NextEra is currently deploying a massive growth plan. This could backfire if the economy slows down or if interest rates increase. NEE is known for its many M&A attempts, which pose an inherent risk. Despite recession risks, NEE hasn’t changes the raised 2022-2026 EPS guidance from June during Q2 earnings. It reaffirmed its growth expectations through 2026 in Q3 2023. This demonstrates management’s confidence…or is it naiveté? To date, it seems to be confidence as results remain strong. In January of 2024, management reaffirmed its guidance through 2026.

Don’t miss anything! Get the latest delivered weekly by subscribing to our newsletter, right here.

NEE Dividend Growth Perspective

NextEra has increased its dividend every year since 1995. Most utilities are known to distribute a good part of their earnings, but we’d like to see a cash payout ratio below 100% going forward. At this time, the dividend payment is not at risk, and management expects strong dividend growth in the coming years because earnings should grow at a 6-8% rate through 2026.

For a higher yield, an investor may want to consider NEE’s YieldCo, NextEra Energy Partners LP (NEP). Keep in mind that we are not talking about the same business. NEP is a YieldCo, much smaller than NEE. Its current yield is a generous 12.3%. However, NEP has reduced its dividend growth target to 6% from 12%-15% for the next few years. This came after some difficulties due to higher interest rates, which are explained in more detail in What’s happening with renewables?

Final Thoughts on NextEra Energy (NEE)

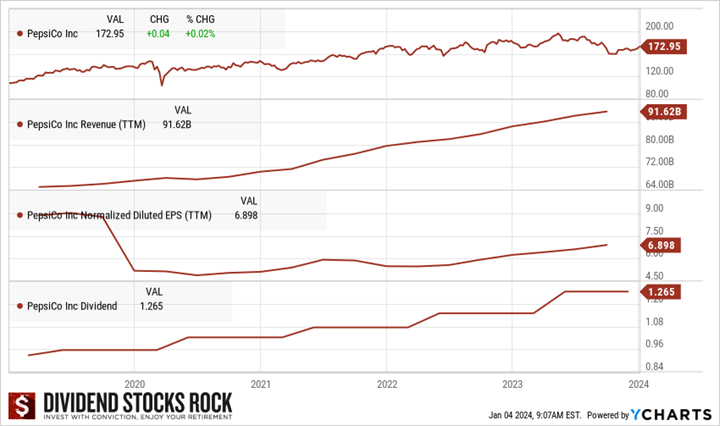

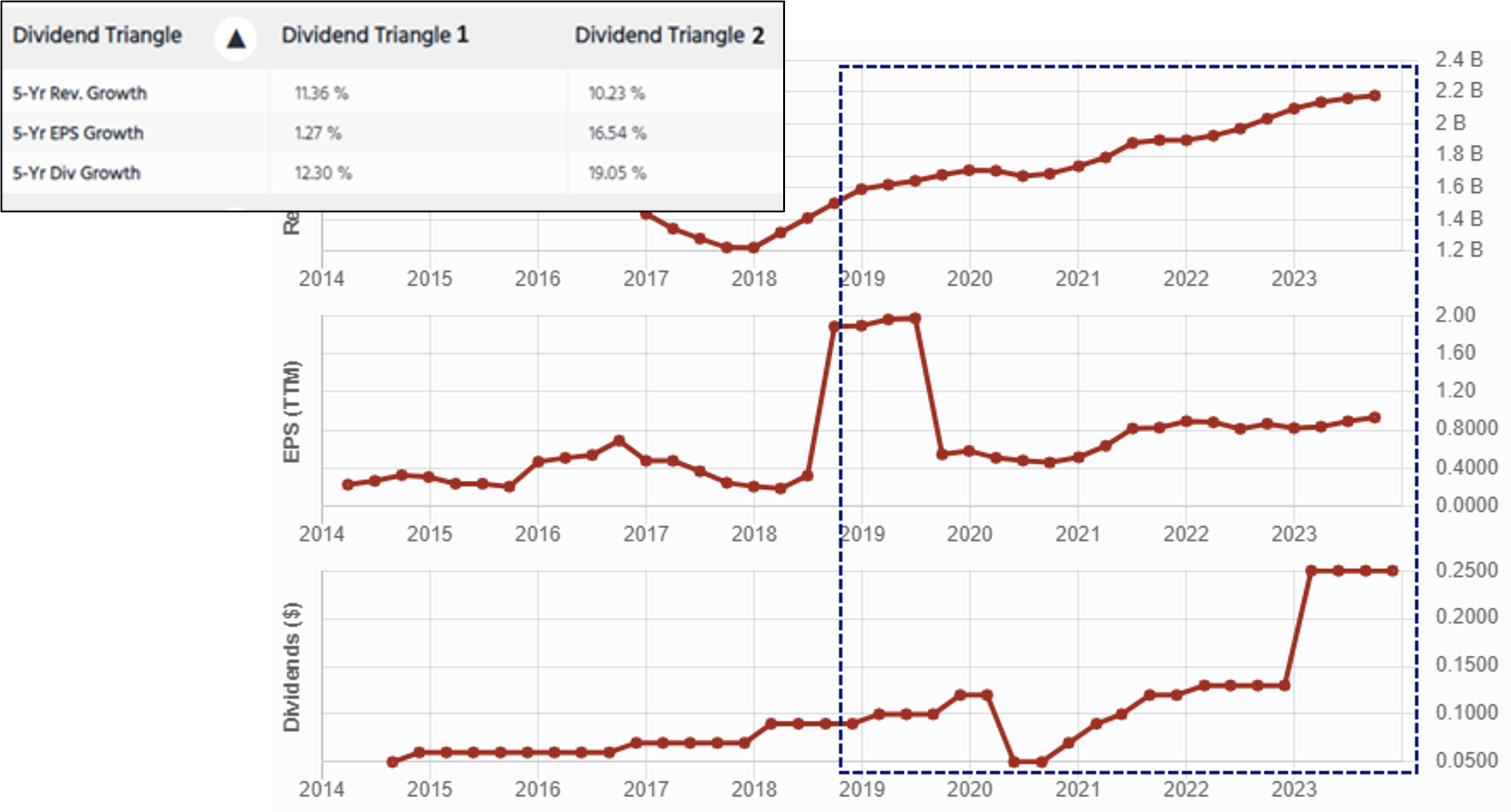

NEE stock has lost quite a bit of its value from close to $80 in the first half of 2023 to about $55.50 in early 2024. Its dividend triangle is pretty strong—showing growth and steady dividend increases—and management is confident.

After a good quarter reported in January, NextEra Energy came back in the news in February, this time to announce a 10% dividend increase (from $0.468/share to $0.515). While many are concerned about the utility sector growth perspectives, NEE management is showing strong signs of confidence.

The board also approved an updated dividend policy beyond 2024. This is expected to translate to a growth rate in dividends of roughly 10% per year through at least 2026 off a 2024 base, estimated to be $2.06 per share.

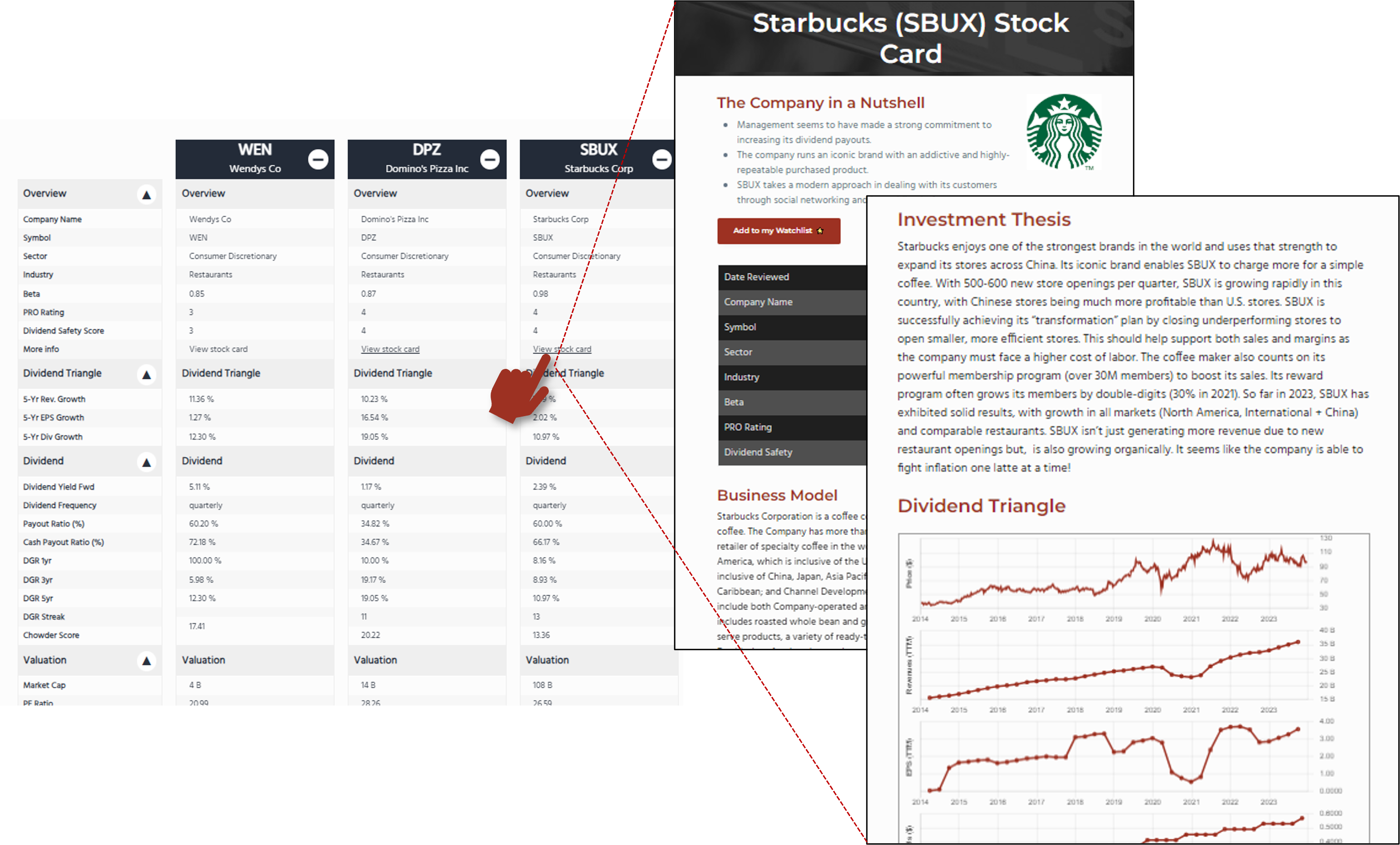

Some of these industries have amazing dividend growers. The key for these companies is to build a strong brand that serves them well over time. Brands like Nike, Home Depot, McDonald’s, and Starbucks in the U.S. and Ski-Doo, Tim Horton’s, Dollarama, and Canadian Tires in Canada are iconic brands. While such companies do better when the economy booms, they are also resilient during recessions. The cyclical aspect of this sector can also propel your returns if you buy during economic downturns.

Some of these industries have amazing dividend growers. The key for these companies is to build a strong brand that serves them well over time. Brands like Nike, Home Depot, McDonald’s, and Starbucks in the U.S. and Ski-Doo, Tim Horton’s, Dollarama, and Canadian Tires in Canada are iconic brands. While such companies do better when the economy booms, they are also resilient during recessions. The cyclical aspect of this sector can also propel your returns if you buy during economic downturns. E-commerce has been a great disruptor to this sector’s retailers, many of them going bust, which is a continuing trend. Direct-to-consumer (DTC) sales, e.g., Nike selling you shoes directly through your computer or phone, have become a vital element of their business model. Retailers who resist will fail. Brick & mortar retail isn’t dead, but it must expand into the digital sales space for overall company success.

E-commerce has been a great disruptor to this sector’s retailers, many of them going bust, which is a continuing trend. Direct-to-consumer (DTC) sales, e.g., Nike selling you shoes directly through your computer or phone, have become a vital element of their business model. Retailers who resist will fail. Brick & mortar retail isn’t dead, but it must expand into the digital sales space for overall company success.

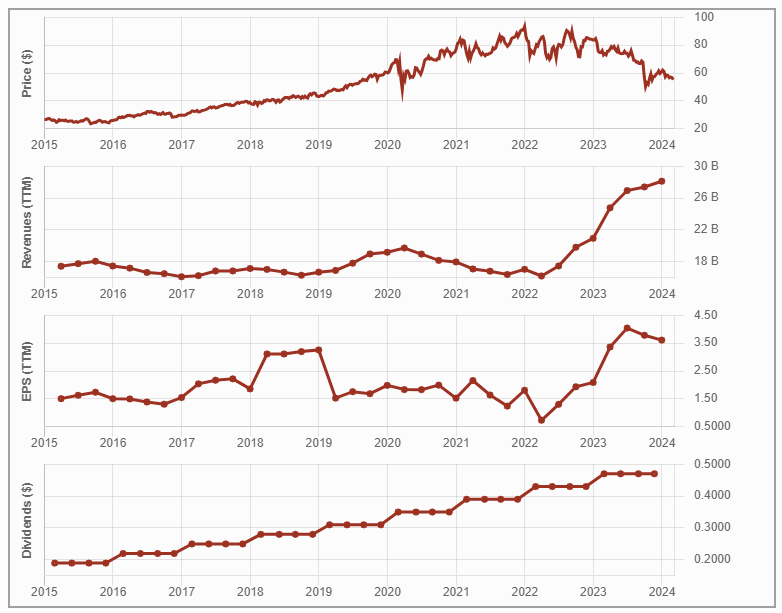

Home Depot is a home improvement retailer offering building materials, and products for home improvement, lawn and garden, decor, and for facilities maintenance, repair, and operations. It also provides home improvement installation services and tool and equipment rental.

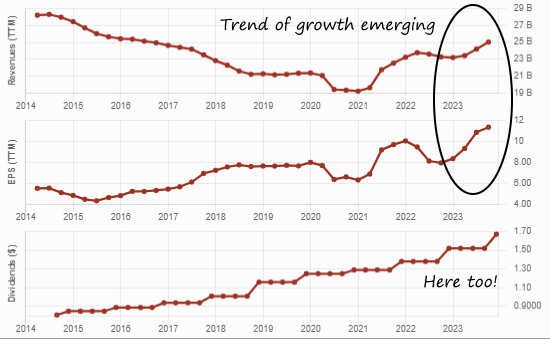

Home Depot is a home improvement retailer offering building materials, and products for home improvement, lawn and garden, decor, and for facilities maintenance, repair, and operations. It also provides home improvement installation services and tool and equipment rental. Pro sales outperformed sales to DIY sales, as DIY customers. Increasing pressure from high-interest rates made DIY customer scale back their projects. Big-ticket transactions, i.e., those over $1,000, were down 5.2% compared to a year ago. Demand softened for big ticket discretionary categories like flooring, countertops, and cabinets. However, there was big-ticket strength in Pro heavy categories like roofing, insulation, and portable power.

Pro sales outperformed sales to DIY sales, as DIY customers. Increasing pressure from high-interest rates made DIY customer scale back their projects. Big-ticket transactions, i.e., those over $1,000, were down 5.2% compared to a year ago. Demand softened for big ticket discretionary categories like flooring, countertops, and cabinets. However, there was big-ticket strength in Pro heavy categories like roofing, insulation, and portable power.